France-based Voodoo quickly became a prominent player in the industry after stepping into the field of mobile games. Its growth is recognized throughout the industry, and as one of the interesting French unicorns, it’s far from the startup it once was. It’s a company that creates ripples when it moves, so we covered its moves and what motivates those moves.

A brief look at Voodoo’s history

Voodoo SAS, commonly known as Voodoo.io, was established in 2013 by Alexandre Yazdi and Laurent Ritter. Initially establishing itself as a services company for websites and mobile applications under the moniker Studio Cadet in 2012, Yazdi and Ritter transitioned their focus to gaming with the founding of Voodoo the following year. The company’s early years were marked by experimentation and evolution, culminating in a strategic pivot that would redefine its trajectory.

Utilizing data accumulated from previous endeavors, Voodoo revamped its business strategy, leveraging insights to design games tailored to captivate a broader audience. Armed with the Unity game engine, the company embarked on a spree of game development, introducing a new title nearly every week. This strategy bore fruit with the release of Paper.io in 2016, marking a significant milestone in Voodoo’s journey.

The company’s exponential growth saw its workforce expand rapidly, quadrupling in size to 80 employees by 2017 and projecting further expansion to 150 by 2018. The same year, Goldman Sachs invested $200 million into Voodoo through its West Street Capital Partners VII fund.

After the newly acquired funds, Voodoo expanded beyond its Parisian roots, establishing offices in Montpellier, Strasbourg, and Berlin. By September 2019, the company boasted a workforce of 220 individuals.

Voodoo has a vast portfolio of hyper-casual games, which have garnered over 6 billion downloads as of February 2022. Today it surpasses 7.3 billion according to AppMagic data. Titles such as Helix Jump, Baseball Boy, and Hole.io have a significant share in this success and were recognized for their addictive gameplay and intuitive design.

Despite its achievements, Voodoo has faced criticism for its approach to game development, with accusations of cloning other games. While the company acknowledges similarities between its titles and existing indie games, it maintains that its creations offer unique gameplay experiences tailored to contemporary audiences.

After years of aggressively pushing its boundaries and extending its reach, Voodoo shows no signs of slowing down, with strategic acquisitions and partnerships positioning the company for further expansion.

List of Voodoo’s acquisitions and investments

Voodoo’s list of investments and involvements is not limited to the list below, but these are the ones we considered the most relevant to the article.

- OHM Games

- Beach Bum Games

- Gumbug games

- Bidshake

- Tarboosh Games

- Fabrika Games

- EVA

- Volt Games

- Fomo Games

A look into the companies that Voodoo has acquired or invested in

After getting familiar with Voodoo’s history, let’s take a look at Voodoo’s acquisitions and the companies that Voodoo has acquired.

OHM Games (Acquisition)

OHM Games is a mobile video game studio founded in 2018 and based in Paris. With over 500 million downloads and reaching the top spot in more than 55 countries, OHM Games focuses on creating various game genres like action, arcade, puzzle, and adventure.

Starting with Smash Balls: Crazy Home Run in April 2018, OHM Games introduced engaging gameplay mechanics. They followed up with Paper Plane Planet in June 2018, an idle game that took players on a virtual world tour.

In August 2018, they released Wall Clean, a unique wall-cleaning game set in cities worldwide. Players enjoyed the game’s concept and gameplay.

OHM Games continued to expand its portfolio with successful titles like Knock Balls, Push’em All, and Shortcut Run. In February 2021, they launched Trivia Planet, an educational geography quiz, followed by Run Rich 3D in June 2021, which achieved millions of downloads.

Beach Bum Games (Acquisition)

Founded in 2015 by a team of mobile entertainment experts, Beach Bum Games is known for its focus on bringing classic multiplayer games to mobile and digital platforms. The company has gained recognition with popular titles like Lord of the Board, Spades Royale, Gin Rummy Stars, Domino Go, and Rummy Rush.

Headquartered in Ra’anana, Israel, it’s led by founder Uri Shahak, who also founded Playtika, the studio has established itself as a significant player in the game industry.

Gumbug Games (Acquisition)

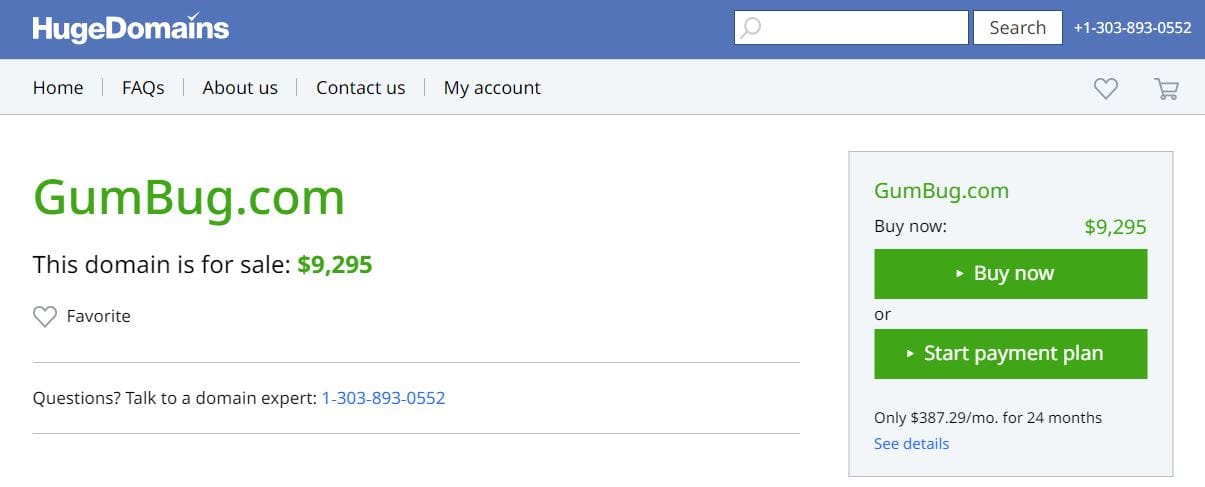

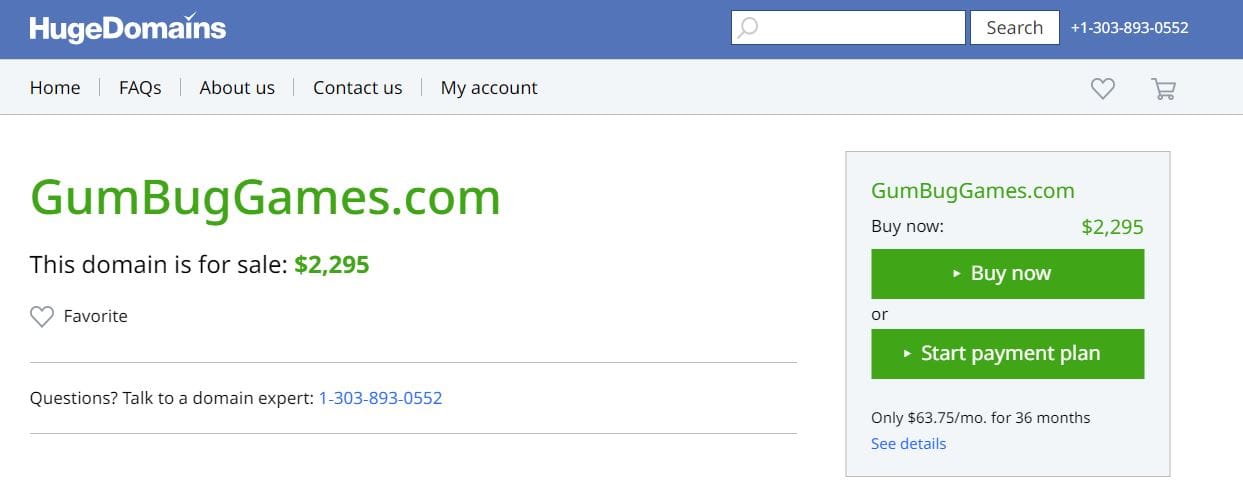

There isn’t much information about Gumbug Games except that it was established in 2013 and is a game development company in London, United Kingdom. The company specializes in action and adventure genres and focuses on Android and iOS platforms. One of its notable creations is Smash Supreme, a 3D mobile fighting game that has gained attention from gamers worldwide. As of December 31, 2021, the company had a team of eight. What’s interesting about the company is that we couldn’t even find its official website. We have reached two different domains as its official website through indirect means, but the domains seem to be on sale now. This leads us to believe that the company and its team have been assimilated into Voodoo.

The company also doesn’t have a strong presence in the AppMagic database. It has 44 games, 25 of which have no downloads. While most of the other 19 games have negligible downloads, their top game has slightly more than 150.000 downloads and an estimated revenue of little more than $17.000.

Bidshake (Acquisition)

Established in 2019 and headquartered in Paris, France, Bidshake offers a comprehensive multichannel campaign management and data centralization platform. Designed to simplify user acquisition (UA) processes, Bidshake’s platform automates optimization across various advertising channels, enabling data-driven decision-making and real-time updates. With over 20 data and campaign management API integrations, Bidshake offers a solution for managing and optimizing multichannel UA campaigns.

Tarboosh Games (Acquisition)

Based in EMEA with offices in Istanbul and Dubai, Tarboosh Games is an independent game studio founded by a team of passionate gamers aiming to establish a significant presence in the game industry. The team comprises individuals from diverse cultures and backgrounds, each bringing years of valuable experience in mobile and PC game development. Tarboosh Games has developed multiple games that have been published by Voodoo along with other publishers.

Fabrika Games (Investment)

Fabrika Games is a mobile game studio based in Istanbul and one of Voodoo’s interesting ventures. Voodoo’s relationship with Fabrika Games was cemented with an investment in 2020. We couldn’t find any trace of further development in this process. Still, today, Fabrika Games’ LinkedIn profile reads as “Voodoo Turkey,” which must have been “Turkiye,” and the company website has nothing more than the company logo, not even a link to Voodoo’s official site.

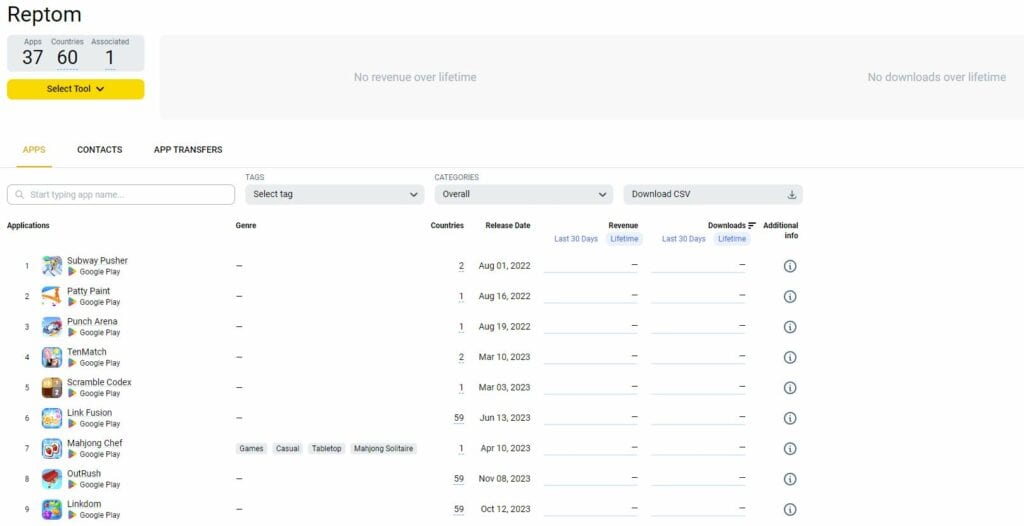

More interestingly though Voodoo launched a hyper-casual game studio, named Reptom in Turkiye, two years prior to investing in Fabrika Games. Whether the studio has been merged or dissolved into Fabrika Games as Voodoo’s Turkiye branch or anything about the studio’s fate, for that matter, is unknown to us. There is a Reptom in AppMagic database with 37 games, but no other data, even the location of the studio, is available. Therefore it cannot be concluded whether the one in the database is the same studio or it’s just a name resemblence.

EVA (Investment)

Founded in 2018, EVA (Esports Virtual Arenas) is a French startup focusing on the virtual reality esports industry. Operating on a franchise model, the company has experienced rapid growth due to its unique concept and technology. In EVA arenas, players compete by freely moving within a 500m² space, providing a distinctive gaming experience. These arenas also feature esports bars, enhancing the spectator experience. The company’s flagship game, After-H, was developed internally over three years.

Volt Games (Investment)

Based in Portugal, Volt Games was established in 2020 by Pedro Cabaço, Gonçalo Banha, João Albuquerque, and Pedro Dinis. Since then, the studio has expanded to a team of 10 individuals and has introduced six titles on iOS and Android platforms, including Perfect Fighter and Football Clash – Mobile Soccer. Collaborating with Voodoo since 2020, Volt has been involved in testing and launching games. At some point, the company announced its shift towards developing NFT and blockchain-based mobile games. The team then started working on their inaugural NFT mobile game, MetaStar Strikers, which revolves around football and employs a Score & Earn model. This game, built on Polygon, aimed to enable players to engage in online football matches to acquire NFTs.

Teskin Games (Investment)

Teskin Games is a mobile casual games developer and publisher based in Israel. Aside from the fact that there wasn’t much accessible information about the company, the company’s official website seems to be down, except for Jewel Quest’s Privacy Statement.

Fomo Games (Investment)

Fomo Games is a mobile game developer of mobile puzzle games. It was founded in 2019 and is headquartered in Istanbul, Turkiye.

The analysis of Voodoo’s acquisitions

Before analyzing Voodoo’s acquisition strategy, there’s an incident to remember. In January 2023, Voodoo’s Head of Publishing, Alex Shea, argued that the hyper-casual genre is dead. The statement itself wasn’t a shock to the industry, nor was it a big revelation. What was different is that other companies preferred a more moderate approach by adopting a transition strategy and focused on the transition aspect in their statements rather than slamming the whole genre. What Voodoo did differently was to express the reason behind its strategy very openly, and since then, Voodoo hasn’t been shy about its transition or progress.

This is why we think Voodoo’s acquisitions are different from other major players in the industry, for instance, Azur Games, which we have previously analyzed. Azur Games’ strategy looks more like an aggressive expansion, whereas Voodoo’s acquisitions look like preparations for evacuation. Evacuation from a genre completely.

The characteristics of the companies Voodoo acquired or invested in are diverse but have a pattern. They are mostly multiplayer, casual, or puzzle game developers. There is even an NFT game developer and a VR esports company.

The geographical distribution of the investments and acquisitions also has a pattern. Most of the companies that Voodoo acquired or invested in are in the EMEA region, with two located in Turkiye and Israel each. EMEA region has a vast untapped mobile games market potential, and these two countries have a unique place in the region. They have strong ties with the region, extensive experience working and collaborating with people and companies from the Western culture, and immense expertise in developing mobile games. Voodoo also has an office in Barcelona. These positions in major hubs spread around Europe and EMEA like a net, providing very good coverage.

Geographic location is ignorable in the mobile game industry in most cases. Still, as a developer, Voodoo needs geographic presence to a certain extent to get a foothold in its target markets. Therefore, dissolving Fabrika Games as Voodoo Turkiye can be interpreted as a move in this direction.

Voodoo is not a stranger to transitions. It’s the story of Voodoo Games’ (or Voodoo.io’s) inception, and it was never shy about its transition from the hyper-casual genre. Companies usually prefer to handle these transitions more softly, but apparently, Voodoo prefers a “burn the bridges” and never look back approach.

Voodoo’s actions imply a decision never to go back, but it doesn’t intend to limit its options. These acquisitions and investments should be the results of a desire to expand geographically while acquiring expertise and experience in different gaming genres, and the acquisition of a comprehensive multichannel campaign management and data centralization platform will probably help them to decide definitively on which route they will choose.

NEXT: Why did Apple’s new App Store policy create a backlash from the industry?