As Mobidictum Conference 2025 approaches, we are excited to showcase the leading voices and visionaries in the gaming industry who will attend and contribute. These investors are pivotal to shaping the future of gaming, supporting your projects, and fostering growth within the industry.

By attending, you’ll have the chance to meet these investors and experience the future of gaming firsthand. Whether you are an entrepreneur looking for funding or a company seeking partnerships, Mobidictum Conference 2025 is the perfect stage for collaboration and growth in the gaming ecosystem.

Key investors attending Mobidictum Conference 2025, listed alphabetically:

Arcadia Gaming Partners

Arcadia Gaming Partners is a London-based venture capital firm launched in 2025 with a $100 million fund dedicated to mobile game companies. Positioned as a “founder-first” partner, Arcadia’s approach goes beyond capital by offering hands-on support in user acquisition, monetization, and team building. The firm was co-founded by industry veterans, including former Tripledot Studios leadership, and is already drawing attention as a serious new player in mobile gaming investments.

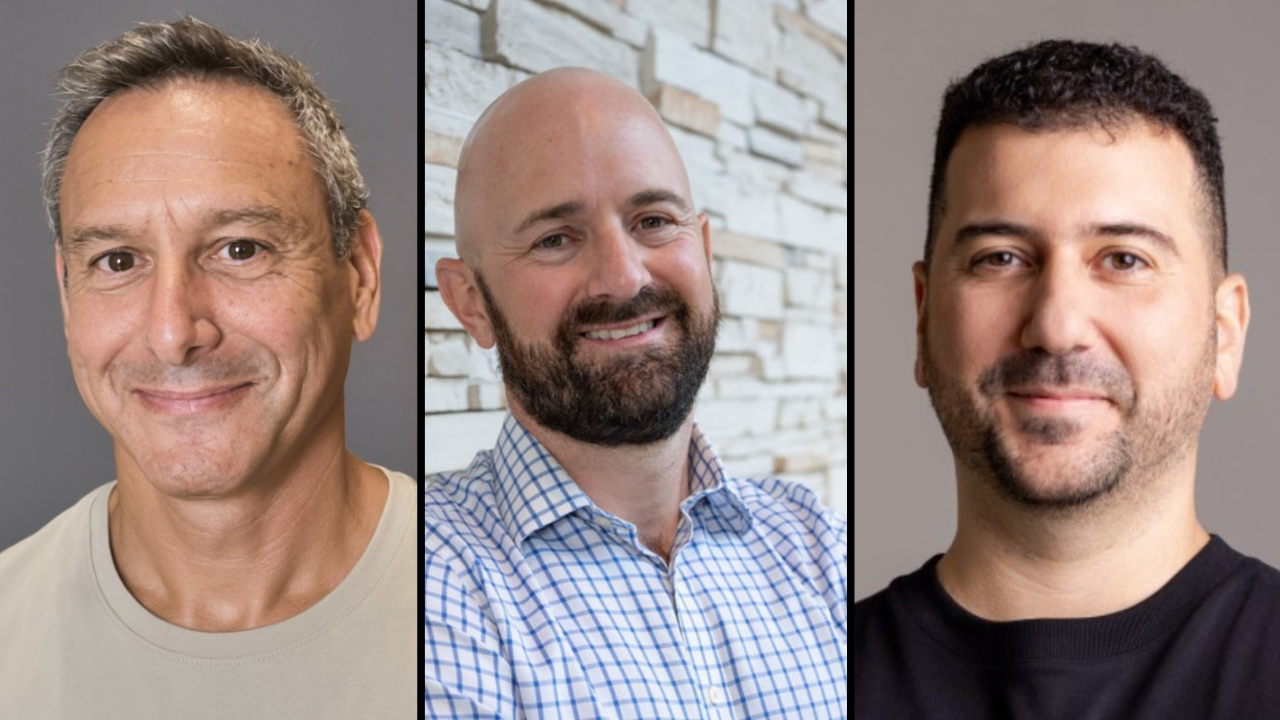

Attending the conference is Akın Babayiğit, co-founder of Arcadia. Before establishing the fund, Babayiğit co-founded Tripledot Studios, where he served as president before moving into investment. His career also spans advisory roles and investments in several Turkish gaming unicorns, including Spyke and Dream Games. With a Harvard Business School background, Babayiğit brings both entrepreneurial and investor perspectives to the Mobidictum Conference 2025.

At the Mobidictum Conference 2025, Akın Babayiğit will bring his experience to the “The Billion-Dollar Blueprint: What Scalable Game Studios Get Right” session alongside e2vc’s Enis Hulli.

Alfa Games & Partners

Alfa Games & Partners is an investment banking firm based in İstanbul with a specialisation in mobile games and technology. They act as advisors on mergers & acquisitions, funding rounds, and exits in the gaming sector, and have been involved in several of Turkiye’s biggest gaming exits in recent years.

Their role often goes beyond just capital: Alfa provides support in structuring deals, legal advisory, and connecting creative studios with investors. This makes them a crucial bridge between game developers in Türkiye and the global investment ecosystem.

APY Ventures

APY Ventures is the publicly traded venture capital investment fund managed by Albaraka Asset Management in Turkiye. Their mandate is to support innovative technology startups from early stages, including gaming, by investing in high-potential companies and helping nurture a more mature ecosystem.

Atanova Ventures

Atanova Ventures is an early-stage investment firm focusing on gaming, artificial intelligence, and other technology sectors. They invest typically in pre-seed, seed, or late-seed startups (with check sizes in a moderate range), and prioritise ventures with bright ideas in marketplaces, fintech, gaming, health, education, etc.

Their strategy emphasizes partnership with founders, helping with incubation and long-term growth rather than just transactional deals.

Behold Ventures

Founded in 2021, Behold Ventures is a Swedish venture capital fund dedicated to early-stage gaming startups across Europe, with a particular focus on the Nordics. Its first fund closed oversubscribed at SEK 550 million (~$55–60 million) in 2025 and has already invested in nearly 20 companies, with a target of around 25 portfolio investments. Led by industry veterans, Behold combines capital with deep sector expertise to support Europe’s next generation of studios

At the helm is Karl Magnus Troedsson, Founder and Managing Partner. Best known for his leadership role at DICE, where he served as CEO and guided the Battlefield franchise to global prominence, Troedsson now channels his experience into supporting the next generation of European studios. His transition from leading one of the world’s biggest franchises to investing in new talent offers a unique perspective for founders attending Mobidictum Conference 2025.

At the Mobidictum Conference 2025, Karl Magnus Troedsson will bring his experience to the “Think Global, Invest Local: Why Regional Investors Matter in Gaming” session with Ludus Ventures’ Volkan Biçer.

BITKRAFT Ventures

BITKRAFT Ventures is a global investment platform founded by gaming-industry veterans. It invests in early- and mid-stage startups across gaming, interactive media, immersive/AR-VR/Web3 tech, and related areas.

The firm tends to back founders early (even when the idea is just forming), with a strong belief in the convergence of gaming and newer technologies.

e2vc

e2vc, formerly known as 500 Emerging Europe, is a seed-stage fund that backs globally ambitious startups from Central and Eastern Europe, including Turkiye. With a portfolio of over 60 companies — some of which have reached unicorn status — the fund has built a reputation for helping founders scale beyond local borders and secure significant follow-on funding.

General Partner Enis Hulli is one of the most recognizable VC figures in the region. A McGill graduate, he has built his career on enabling startups from underserved ecosystems to think globally from day one. Hulli will be joining the Red Stage discussions at Mobidictum Conference 2025, bringing valuable insights on how Turkish studios can position themselves for international growth.

At the Mobidictum Conference 2025, Enis Hulli will bring his experience to the “The Billion-Dollar Blueprint: What Scalable Game Studios Get Right” session alongside Arcadia’s Akın Bababiğit.

Griffin Gaming Partners

Griffin Gaming Partners is a dedicated VC fund focused exclusively on the games industry. Founded in 2019, it is one of the more prominent investors that looks only at gaming content, software infrastructure, and social/game platforms.

With ~US$1.5 billion under management, the firm targets early-stage investments globally, seeking to be the “definitive source of capital” for gaming ventures.

Hat-Trick Capital

Hat-Trick Capital is a Silicon Valley-based, family-office-backed VC fund with over US$100 million in assets under management. They primarily invest in pre-seed to Series A rounds (with check sizes between roughly US$500K-3M), focused on visionary founders, particularly immigrant founders, in sectors like AI/SaaS, robotics, and consumer technology.

Laton Ventures

Laton Ventures has quickly become one of the most notable investment funds with strong ties to Turkiye’s gaming ecosystem. Founded in 2023 with a $50 million fund, Laton focuses on early-stage investments in gaming and gaming-adjacent startups. Beyond capital, the firm provides operational guidance in areas such as user acquisition, monetization, and HR, aiming to position its portfolio companies for global growth

Under Görkem’s leadership, Laton has invested in five early-stage companies within its first year—two of which have since secured Series A funding, including Grand Games, which raised $30 million in under nine months . Laton has also quickly risen to rank among the global top 10 most active early-stage gaming VCs.

At the Mobidictum Conference 2025, Founding Partner Görkem Türk will bring his experience to the “More Than Money: How VCs Support Studios Today” panel alongside Pietari Päivänen and Mehmet Ecevit.

Ludus Ventures

Since its founding in 2021, Ludus Ventures has established itself as one of the most active gaming-focused VC funds in the region. With more than $60 million under management, a portfolio of 15 companies, and over $200 million in exits, Ludus has positioned itself as a “first-check” investor, supporting founders from the earliest stages.

Representing Ludus at Mobidictum Conference 2025 are Volkan Biçer and İsmet Gökşen. Biçer, Partner at Ludus, is well-known in the Turkish gaming ecosystem with over 15 years of entrepreneurial and investment experience, including being an early backer of Rollic Games.

Gökşen, General Partner and co-founder, plays a central role in shaping the firm’s strategy and fund deployment. Together, they represent one of the strongest investment teams in Turkiye’s growing venture scene.

At the Mobidictum Conference 2025, Volkan Biçer will bring his experience to the “Think Global, Invest Local: Why Regional Investors Matter in Gaming” session with Behold Ventures’ Karl Magnus Troedsson.

İsmet Gökşen will be on the panel “Turkiye’s Gaming Boom: Inside the Investment Engine of a Global Powerhouse” alongside Startups.watch’s Serkan Ünsal and InvestGame’s Anton Gorodetsky.

Leus

Leus Capital is a financial platform that supports mobile game and app developers with fast, collateral-free funding solutions. By leveraging performance-based metrics such as ROAS and LTV, Leus provides non-dilutive financing through products like KatAppult and ReLoad. Its mission is to empower studios to scale sustainably without giving up equity.

Halil İbrahim Özdemir is the Founder and Managing Director of Leus Capital, a financial platform that provides mobile game and app studios with fast, collateral-free funding. Leus helps studios scale without giving up equity, offering capital through products like KatAppult and ReLoad, based on performance metrics such as ROAS and LTV. Halil focuses on making the funding process faster and more accessible for developers, aiming to support sustainable growth across the mobile ecosystem.

At the Mobidictum Conference 2025, Halil İbrahim Özdemir will bring his experience to the “New Era of Funding: Let Your Data Talk” session with Yamy Studio’s Ahmet Ferhat Akben.

Revo Capital

Revo Capital is one of Turkiye’s pioneering and largest technology-focused venture capital funds. Founded in 2013, it has invested in early-stage B2B and B2C tech companies across Turkiye, Central & Eastern Europe, and the Baltics.

It closed its second fund at about €90 million, and is now raising its third fund, which has already reached a first close of US$86 million (with a target north of US$100 million), with a mission to support startups with Turkish roots achieving global impact.

Supercell Investments

Supercell Investments is the strategic investment arm of Supercell, one of the world’s most successful mobile game developers. The Helsinki-based studio, famous for hits like Clash of Clans and Brawl Stars, has extended its influence by investing in promising studios worldwide. Through its investment division, Supercell supports independent developers while preserving their creative autonomy — a philosophy aligned with its own culture.

Joining Mobidictum Conference 2025 is Pietari Päivänen, who works on Special Projects & Investments at Supercell. Päivänen is involved in scouting new opportunities and supporting portfolio studios, blending Supercell’s operational expertise with strategic capital. His participation gives Turkish developers direct insight into the thinking of one of the most influential names in mobile gaming.

At the Mobidictum Conference 2025, Pietari Päivänen will bring his experience to the “More Than Money: How VCs Support Studios Today” panel alongside Laton Ventures’ Görkem Türk and Mehmet Ecevit.

Join us at the Mobidictum Conference 2025!

Join us on October 21-22 and seize the opportunity to connect with these top-tier investors who are shaping the future of gaming at Mobidictum Conference 2025.