In this interview, Nikita Matsokin, Executive Director at MY.GAMES Venture Capital reflects on MGVC Publishing’s first year and the operating playbook behind Fable Town’s momentum.

He explains how rapid early scaling and coordinated store featuring created a hybrid UA flywheel that lifted organic visibility, why launching with ads enabled more efficient acquisition without undermining payer conversion, and how the team is pushing into web-store D2C to improve margins.

Matsokin also outlines MGVC’s 2026 focus areas, from monetization and live-ops iteration powered by advanced analytics to faster content production supported by GenAI.

Can you give us a review of MGVC Publishing’s first year? What were the standouts, and what are the main focus areas for growth and improvement in 2026?

2025 was an intense and highly transformative year for MGVC Publishing and our team.

Firstly, it’s worth highlighting Fable Town as the project that delivered the strongest growth in our portfolio, both in revenue and installs.

In 2025, the game experienced significant audience growth, with around 100,000 players engaging daily. Over the past year, Fable Town generated more than $11 million in revenue and exceeded $1 million in monthly revenue for several consecutive months.

This performance was driven by coordinated efforts across product development, publishing strategy, and marketing, which I’ll elaborate on in more detail below.

Looking at our publishing portfolio as a whole, several major achievements stand out. In particular, we:

- Improved the efficiency of in-game rewarded ads monetization across our projects through the implementation of innovative ad placement design solutions, alongside a series of enhancements to our ad mediation system setup;

- Expanded DTC revenue solutions and actively promoted web shops to improve product margins;

- Identified new marketing growth opportunities through incentivized traffic and adROAS-driven optimization across several traffic sources.

In addition, throughout 2025, we strengthened our team with new talent and established two important unannounced partnerships.

Fable Town saw a nearly twofold increase in organic traffic. Beyond the product improvements, what specific marketing strategies successfully drove this high-quality, low-cost user acquisition?

First, we scaled extremely quickly at launch. During the first few months, we consistently generated over 300’000 installs per month. This volume pushed the game high in the store rankings, which in turn drove a strong uplift in organic visibility and search traffic.

Second, we closely coordinated our global launch with the platforms, securing prominent feature placements on both stores. Combined with our paid UA push, these placements created a flywheel effect: paid traffic improved rankings, featuring amplified visibility, and together they drove significant organic installs at very low marginal cost.

Third, we deliberately launched with in-game ads to support a hybrid UA strategy. While many competitors in our genre avoid ads, implementing an ad stack from day one allowed us to run hybrid bidding across major networks. This substantially reduced our CPI, enabling us to acquire significantly more users with the same budget while strengthening our chart position.

At the same time, Fable Town maintained strong payer conversion in our core markets, meaning that even with ad-optimized campaigns, we preserved a high IAP share and built a large base of paying users.

Together, these three factors – rapid scale, coordinated platform features, and efficient hybrid UA – generated high-quality, low-cost user acquisition and a significant surge in organic traffic.

The game achieved a 2.5x uplift in rewarded ad revenue alongside improved IAP, while maintaining exceptional stickiness (21.6% DAU/MAU). Can you tell us how Reef Games achieved this?

Throughout the year, we worked closely with Reef Games Studio on the ongoing development of the project, with a strong focus on delivering a steady stream of diverse content to players in order to increase average playtime.

Among the most important engagement-driven updates, we introduced a comprehensive set of live-ops features aimed at improving long-term stickiness. This included monthly quest lines, a collectible photo album system, and new hero mechanics, all designed to deepen player engagement and retention.

For highly engaged players, we expanded our hybrid monetization approach by integrating a range of native rewarded ad placements that allow players to accelerate progression and unlock new content. In addition, we introduced a special in-game economy configuration focused on rewarded advertising. On top of this, we added an offerwall and refined it through multiple iterations.

On top of these initiatives, we leveraged MY.GAMES’ best practices and proprietary know-how in rewarded ads mediation significantly expanded our marketing scale in 2025. Combined with the product improvements, this created a strong cumulative effect, driving substantial growth in rewarded ad revenue.

You anticipated the D2C boom in 2025. Can you tell us how Fable Town has leveraged the D2C market?

We expected a strong shift towards D2C revenue in mobile games in 2025, and that expectation was clearly confirmed by the end of the year. Two key factors drove this trend.

The first was the development of web hubs for games, which combine community-facing content – such as wikis and project-specific information – with the ability to purchase in-game items directly. Over the course of the year, publishers also expanded and refined their playbooks for driving in-game audiences to these web hubs.

The second factor was the evolving regulatory landscape in the U.S., shaped by the ongoing legal process involving Epic Games, Google, and Apple. During this period, a judge temporarily allowed developers to use external payment solutions to collect revenue from U.S. players without additional fees or commissions.

That said, the impact of this broader shift varies significantly by project and audience. For Fable Town, we launched a web store last year and have been systematically promoting it within our global player community.

Over the past year, we reached our first D2C revenue plateau through the web store, while still seeing significant room for further growth. Based on our market research and benchmarking, D2C revenue for a number of peer projects and publishers typically accounts for between 15% and 35% of total revenue, while Fable Town currently remains below that range.

Our analysis also shows that the casual audience tends to be more skeptical about external payment solutions and D2C compared to players in mid-core and hardcore games, who are highly motivated to seek additional value that they can clearly perceive when purchasing game content through web hubs.

The industry has moved from manual decisions to automated systems. How has MGVC’s advanced Business Intelligence framework enabled the team to automate the dynamic optimization of Fable Town’s content and monetization offers at scale?

At MY.GAMES, we have a proprietary analytics framework designed to track product cohorts and user flows, measure marketing effectiveness, and enable deep data analysis to identify growth opportunities and areas requiring attention.

This framework is integrated with studio-level tools and out-of-the-box solutions, allowing us to monitor the launch and ongoing performance of new content and offers, which we then iteratively refine based on incoming data.

For example, our framework allows us to deeply analyze the performance of new feature launches. Beyond the immediate revenue uplift, we evaluate the longer-term impact over time, as well as how user behavior and campaign structures adjust in response. This in-depth analysis helps us identify the most effective timing for live-ops launches, understand the impact of content composition – such as visuals, mechanics, and rewards – and plan these initiatives several months in advance.

The insights generated through this analysis feed directly into our product roadmap and planning process, guiding both the development of new features and the iteration on existing ones.

Elaborating on AI and automation, the studio is actively using GenAI solutions to generate concepts and validate hypotheses for in-game live-ops events, which significantly increases content production velocity.

As the Executive Director of MGVC, how do you assess the current state, challenges, and opportunities of the mobile gaming industry in Türkiye?

Türkiye is one of the most promising locations for the global mobile gaming industry going into 2026. A unique combination of strong creative talent, the presence of highly successful casual game companies – such as Peak, Gram, and Rollic – as sources of new founders, a well-developed local developer community, and the willingness of both European and Turkish VCs to fund Turkish startups has collectively driven very strong results.

This combination continues to fuel the emergence of new, high-performing studios with hit products. A strong example is Grand Games, which raised $3 million in 2024, followed by a $30 million round at the beginning of 2025, with its title Magic Sort! actively scaling throughout the second half of 2025.

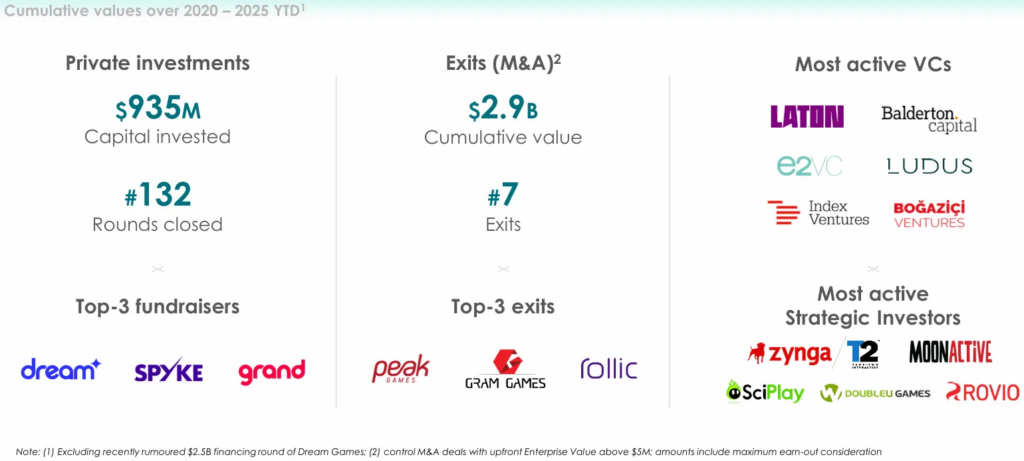

According to InvestGame report, over the past five years Turkish mobile studios have raised more than $935 million across 132+ investment rounds, while seven M&A exits have generated over $2.9 billion for founders and investors. These are strong results, and they do not yet account for a significant portion of deals that took place in 2025 after the report was published.

I’m confident that this positive trajectory for the Turkish gaming industry will continue into 2026.

At the same time, a key challenge – one that is shared globally – is the extremely intense competition for players’ attention. This competition comes not only from other games within the same genres but also from entertainment apps, particularly short-form video platforms such as TikTok, Instagram Reels, and YouTube Shorts, as well as increasing pressure from Chinese developers across many genres.

One of the most important opportunities, in my view, is the rise of AI-driven creatives. For publishers that are able to execute well in this area, AI creatives could unlock a new wave of growth and potentially reshuffle audience distribution within large, competitive genres.

What are your predictions for the next year in terms of investment, rising trends, and overall state of the mobile games industry?

Investment into the mobile gaming segment is expected to remain healthy but selective. Overall spending will continue to grow modestly as mobile stays the largest segment of global gaming, but investment discipline will persist.

Investors are prioritizing teams with proven execution, clear unit economics, and strong live-ops capabilities rather than betting on broad portfolios. At the same time, we’ll likely see more strategic M&A activity and publishing partnerships as established players look to secure IP and user-acquisition advantages.

In terms of trends, two forces will shape the market: AI-driven production and more efficient monetization models.

AI is already reducing development cycles, enabling faster content generation, and improving personalization, which strengthens retention.

Hybrid monetization – combining rewarded ads + in-app purchases, and subscriptions or battle passes – will continue to outperform, particularly as UA costs stay high. To counter rising acquisition costs, developers will also continue moving towards direct-to-consumer web stores to build strong communities and improve the unit economics.

Overall, the companies that succeed will be those that combine strong product craft with operational discipline: teams that use AI to move quickly, focus on meaningful progression and live-ops, and build diversified acquisition pipelines rather than relying solely on traditional paid UA.

The industry is maturing, but there’s still plenty of room for breakout hits, especially for studios that can deliver high-quality experiences while remaining lean and data-driven.

Executive Director, MY.GAMES Venture Capital (MGVC)