Swedish venture capital firm BeHold Ventures has successfully closed its first fund, raising $58.2 million (550 million SEK) to invest in early-stage European gaming startups.

Led by founder and managing partner Karl Magnus Troedsson, a veteran of AAA development, the fund began raising in 2021, officially launching in 2022, and now supports a growing portfolio across the Nordics and the UK. At $58M, BeHold is among Europe’s most significant game-specific funds.

“After a lot of hard work, I’m happy to announce we’ve closed our first fund, oversubscribed on an otherwise tough market. Team effort from Sigurlína Ingvarsdóttir, Magnus Kenneby, Binni Erlingsson.

Karl Magnus Troedsson, Founding Partner at Behold Ventures

It’s Behold Ventures firm belief that games are the medium of our century with the power to both entertain, educate, and bring people together. From this position, we will stay the course, keep investing in early-stage startups and the bold entrepreneurs of tomorrow.”

Diverse Investor Base and Capital Deployment

Troedsson shared numbers for the capital resources:

- Regional distribution: 54% Europe, 44% Asia, 2% North America

- Investor types: 42% institutional, 43% strategic, 10% family offices/high-net-worth, and 5% general partners

- Current activity: $21M deployed across 18 startups, targeting more than 25 investments

Focus Areas and Investment Thesis

BeHold prioritizes early-stage European studios—especially those in the Nordic region—emphasizing franchises, dev tools, and game‑adjacent tech.

The firm shows an active interest in companies targeting Gen Z and Gen Alpha audiences, including those leveraging user-generated content platforms like Roblox. Troedsson highlighted that projects with smaller teams can be more efficient and nimble, aligning with current market pressures.

Speaking to GamesBeat, Troedsson said:

“We basically started with the money that we invested ourselves as general partners, and the fundraising went well at that time.

We’ve been shoeing a running horse when it comes to raising a fund and doing investments at the same time.

We’re also staying true to the fact that we want to build a portfolio that consists of a majority of game developers, but also some tools, tech and infrastructure, when we find something that is suitable, if it’s connected to the games industry.”

Karl Magnus Troedsson, Founding Partner at Behold Ventures

Portfolio Highlights

Fund participants so far include:

- Dead Astronauts, Seven Stars (Finland), Red Rover

- Contribution to a $7 M funding round for Blue Scarab Entertainment, which is developing an MMO with a broader audience focus

Industry Outlook & Rationale

Troedsson cites macroeconomic slowdowns, stagnating demand since COVID, and reconsidered AAA budgets. Still, he believes games will remain central to entertainment, education, and socializing, especially among younger demographics who blend gameplay and social interaction

BeHold expects a resurgence in interest from both traditional VCs and private equity for mid-stage game investments. Its strategy emphasizes lean, proof-of-market startups before scaling, with smaller initial teams bolstered after traction is shown.

“You can see it clearly when you’re watching the Roblox space and the developers there.

Overall budgets are very much under pressure in our industry right now. People are questioning the smartness on the risk balancing of investing very high budgets against single content development studios, even if the founders are super experienced. But the young developers, they don’t need as much money to do a lot more. I would say many of them are very frugal with money.”

Karl Magnus Troedsson, Founding Partner at Behold Ventures

Team and Expertise

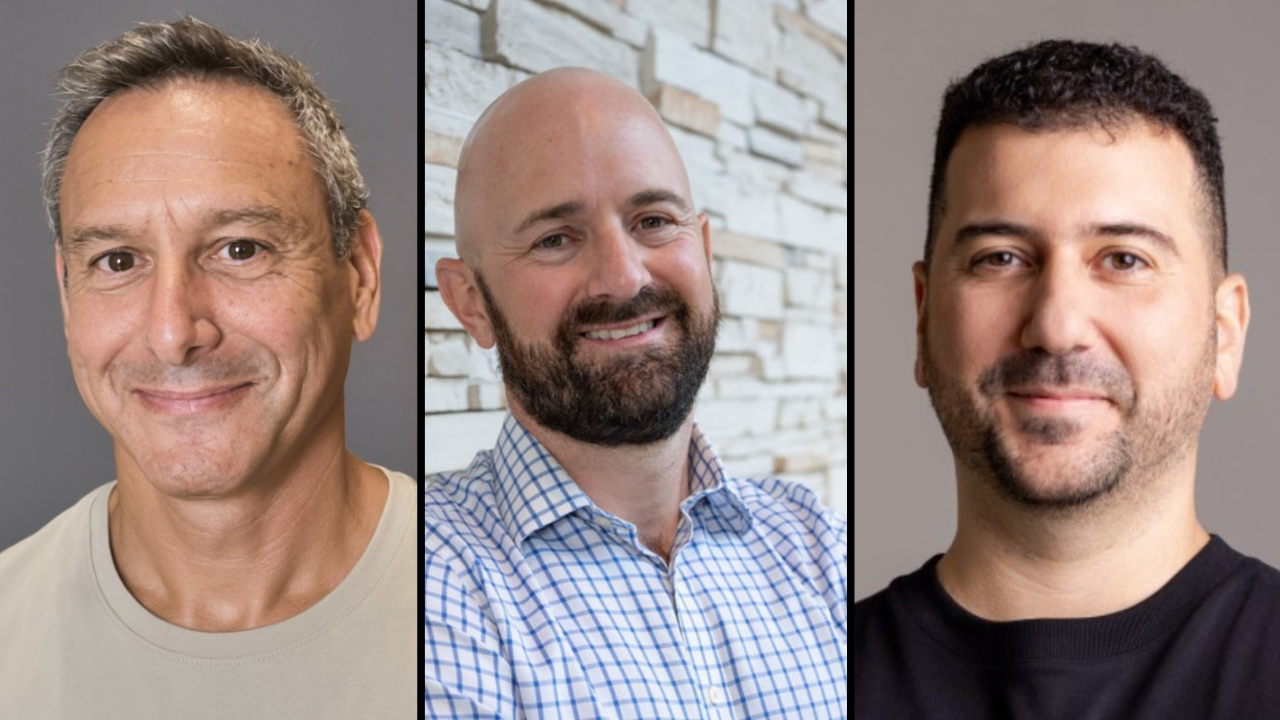

Founders include:

- Brynjólfur Erlingsson – principal (formerly of Mojang, specializing in analytics

- Karl Magnus Troedsson – ex-DICE lead, founder and managing partner

- Sigurlína Ingvarsdóttir – Founding Partner

- Magnus Kenneby – Founding Partner