With global financial digitalization accelerating, competition in the financial app market is intensifying. Marketing strategies are evolving rapidly and have become essential for user acquisition and market expansion.

To help industry professionals stay ahead, SocialPeta analyzed 2025 global financial app marketing data and released the report “2025 Financial App Marketing Trends Observation,” providing detailed insights into emerging market patterns and strategic, data-backed recommendations to support more effective decision-making.

Overview of Global Financial App Advertising

In 2025, the overall trend for global financial app advertising shows a slight decrease in the number of advertisers but an increase in the volume of advertising creatives. Marketing strategies vary significantly across different regions and dimensions, reflecting the diverse needs of the global financial market.

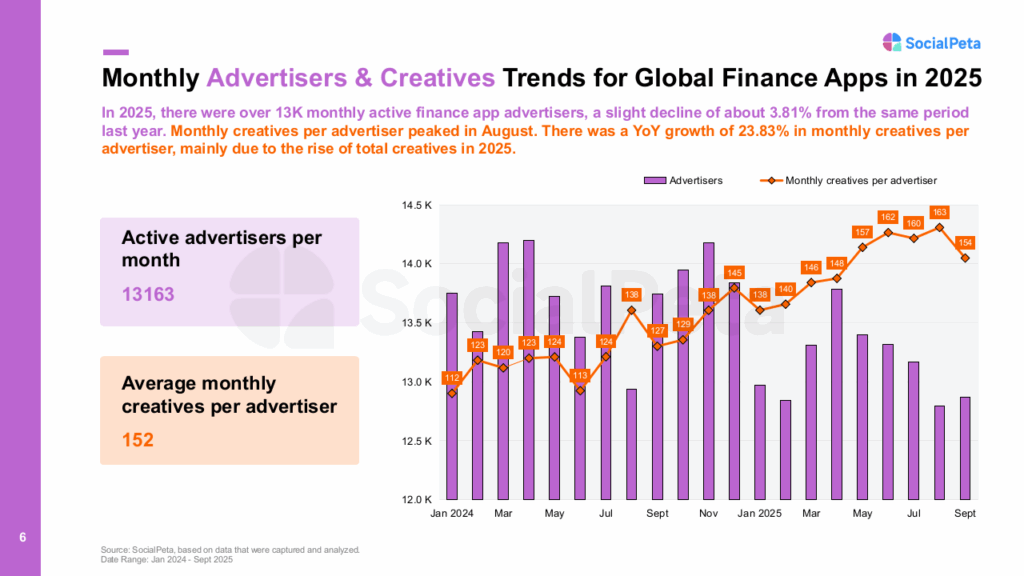

1. Slight decrease in the number of advertisers, increased investment in advertising creatives

In 2025, the average monthly number of active financial app advertisers worldwide exceeded 13,000, down 3.81% YoY, indicating a more rational market as rising compliance costs and tighter budgets pushed some small and mid-sized advertisers to scale back.

In contrast, the average number of creatives per advertiser rose 23.83% YoY, peaking in August, as leading platforms increased creative investment to strengthen brand visibility and defend market share.

Meanwhile, rapid product evolution—driven by AI features and deeper scenario integration—has further increased demand for diverse creatives to clearly communicate new value propositions and attract target users.

2. Regional Advertising Differences: North America has the highest concentration of advertisers, while Southeast Asia leads in the volume of creatives.

From a regional distribution perspective, global financial app advertising shows distinct characteristics:

- Number of Advertisers: North America is the core market with the highest number of active advertisers, attracting payment and brokerage apps due to mature consumer behavior and a well-regulated financial environment. In contrast, Hong Kong, Macau, and Taiwan have the fewest advertisers, reflecting market saturation and intense local competition.

- Average Number of Creatives: Southeast Asia leads globally in average creative volume, signaling the strongest growth potential as rising adoption of mobile financial services drives high-frequency creative deployment. Europe and Africa follow as complementary markets, supported by Europe’s stable user base and Africa’s expanding opportunities in emerging markets.

3. Copywriting Strategy: English as the Mainstream, Core Message Focused on “Free” and “Convenient”

In 2025, global financial app copywriting shows clear language and content preferences:

- Language Selection: English remains the dominant language, accounting for 46.3% of creatives and covering major markets such as the United States and Europe. It is followed by Spanish (19.6%), French (7.7%), and German (4.7%), primarily serving audiences in Latin America and Europe. Minority languages—including Hindi, Japanese, and Vietnamese—each represent less than 2%, reflecting targeted investment in emerging markets.

- Core Message: High-frequency copy highlights free transfers, real-time exchange rates, and operational convenience, directly addressing users’ demand for low-cost, efficient financial services. In terms of tone, emojis (23%), numbers (22%), and exclamations (20%) are most commonly used, boosting click-through rates with more vivid and impactful messaging.

Popular Financial App Marketing Cases

Across the three core sectors—payments, brokerage, and consumer finance—leading financial apps have adopted differentiated marketing strategies tailored to their positioning and regional needs, forming practical and replicable benchmarks.

1. Payment Apps: AI-Powered Upgrades and Ecosystem Cooperation to Expand Boundaries

Payment apps position convenience and global reach as core strengths. In 2025, they further reinforced these advantages through deeper AI integration and expanded ecosystem partnerships:

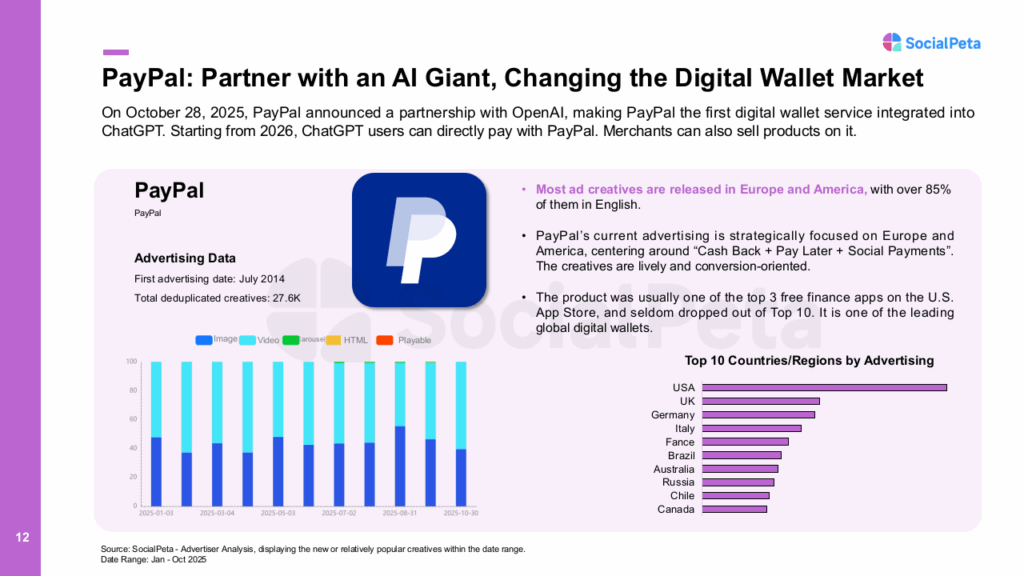

PayPal: As a leading global digital wallet, PayPal serves over 400 million active accounts, supports payments across 200+ countries and regions, and processes US$1.68 trillion in annual payment volume.

In 2025, its marketing centers on the “AI + payments” ecosystem, highlighted by a collaboration with OpenAI that will enable ChatGPT users to make payments via PayPal starting in 2026, seamlessly connecting user intent with transactions.

PayPal’s advertising focuses on Europe and North America, with English-language creatives accounting for over 85% of campaigns. Messaging revolves around three pillars—Cash Back, Pay Later, and Social Payments—while creative execution follows two main styles: minimalist product animations with concise copy, and celebrity-led campaigns that use humor to highlight key benefits. PayPal consistently ranks among the top three free finance apps on the U.S. App Store.

Brokerage Apps: Highlighting zero commission fees, with professional creatives designed to build user trust

Brokerage apps focus on low cost and high precision, establishing user trust through clear value propositions and professional marketing:

Webull: Webull launched zero-commission US stock trading and went public on Nasdaq via SPAC in April 2025 (BULL), with first-day trading up 10% and a market cap of ~$6.09B. The platform has 50M+ global downloads, 23M registered users, and 98% quarterly retention.

Marketing focuses on image-based creatives (54%), highlighting zero fees, low commissions, and deposit bonuses. Its style is professional and stable, using stock charts and feature-focused videos. Webull ranks consistently in the top 20 of the US App Store finance category.

Consumer Finance Apps: Focusing on Emerging Markets, Scene Integration Enhances User Loyalty

Consumer finance apps focus on “fast credit approval” and “localized services,” leveraging scene-based ecosystems to drive user conversion:

DiDi Finanzas offers revolving credit and credit cards, leveraging its ride-hailing ecosystem—11.96M daily rides—to promote vehicle loans to drivers and consumer credit to passengers. In Q2 2025, international GTV reached RMB 27.1B (+27.7% YoY).

Advertising targets Latin America, especially Mexico (10M+ users), with 71% of placements on Android. Creatives use micro-dramas depicting real financial scenarios and KOC influencer recommendations, with copy compliant with Mexico’s Consumer Protection Law.

This 24-page report offers a comprehensive overview of the 2025 global financial app marketing landscape, featuring case studies, data analyses, and future trend predictions, including scenario integration and deeper AI adoption.

It provides practical guidance on strategy, acquisition, and retention, helping marketers and industry professionals identify new growth opportunities. Download the full report for detailed insights.