SocialPeta has partnered with industry leader AdChampagne to publish the 2026 Global Mobile App Marketing Trends White Paper. The report is enriched with exclusive insights from industry leaders, including PlayableMaker, AppNava, YouAppi, App Masters, Alison.ai, MAF, TMUG Club, web2wave and Spiral.

The white paper offers an in-depth view of the latest global mobile app marketing trends, uncovering several critical shifts:

- A More Concentrated and Competitive Market: top players increase creative output despite a shrinking advertiser base.

- AI as a core capability: leading AI apps scale through volume and quality, while weaker products exit.

- Sector divergence: finance prioritizes trust and lifetime value; other verticals favor established, patient players.

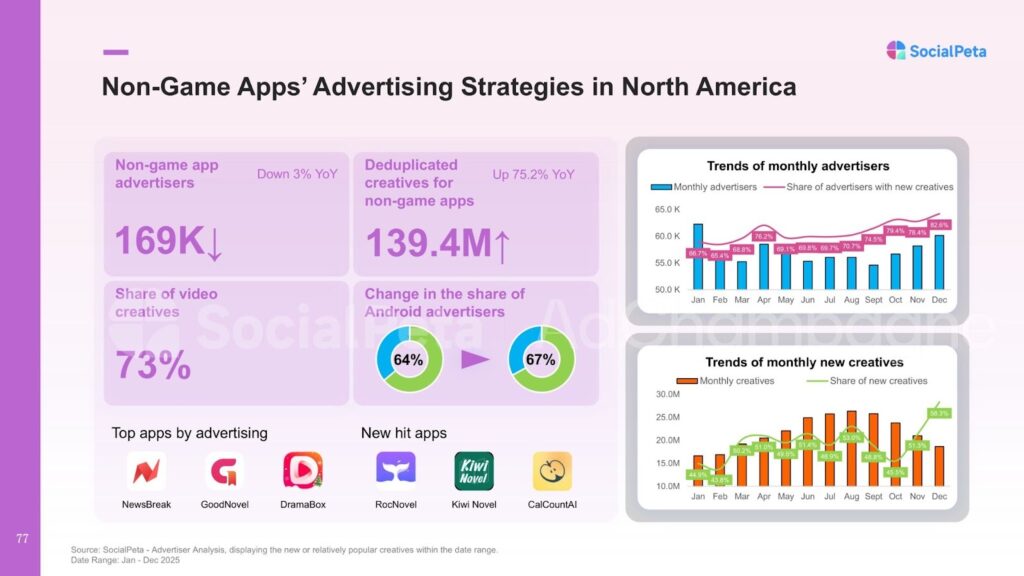

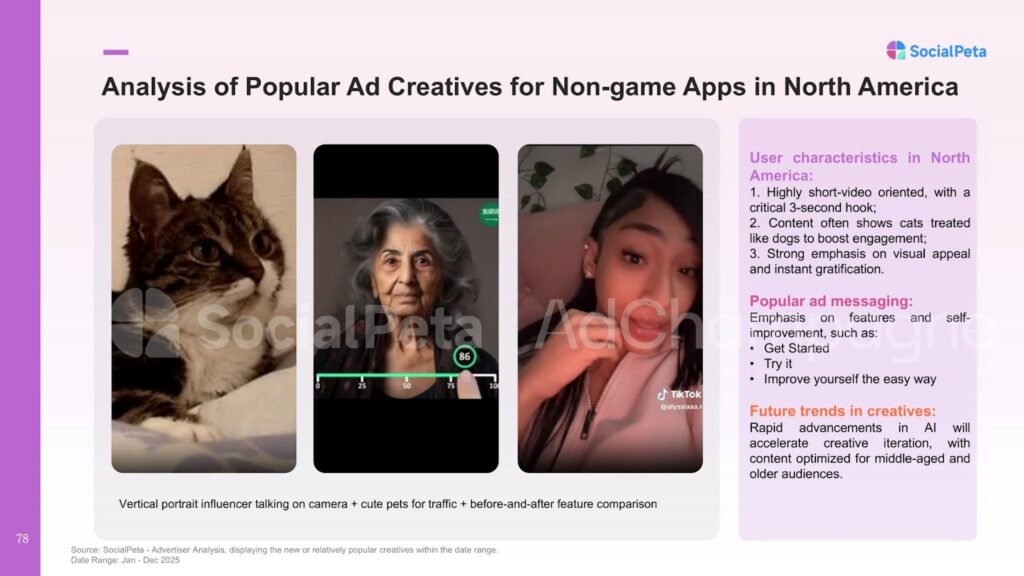

- North America as a touchstone: rational users and strict standards test scalable models.

- From traffic to capabilities: success now depends on content quality, production systems, AI integration, and long-term growth.

The report decodes the growth dynamics shaping AI-powered app categories and delivers a comprehensive analysis of marketing trends and regional strategies across key verticals, including finance, social, and health. Serving as an end-to-end guide to global expansion, it offers actionable insights spanning strategic planning through execution.

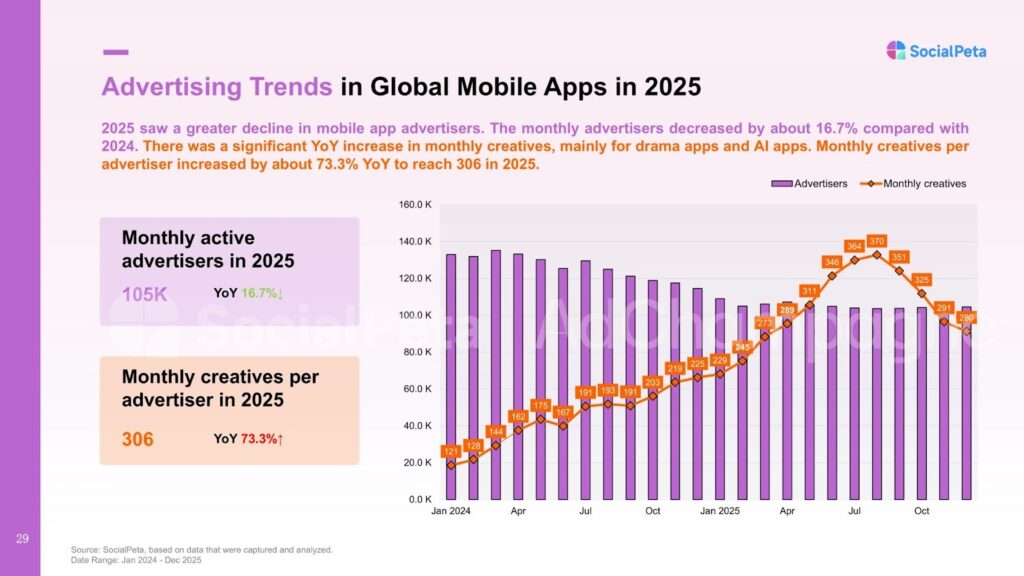

Mobile Apps in 2025: Fewer Advertisers, but Marketing Is Becoming “Heavier”

From an overall market perspective, mobile app marketing in 2025 shows a typical “scissor gap” phenomenon:

- The average monthly number of active advertisers decreased by approximately 16.7% year-over-year.

- Meanwhile, the average monthly volume of ad creatives per advertiser increased by 73.3% year-over-year.

What does this mean? The market is shifting from a phase where “everyone could participate” to one where “only those who sustain continuous investment can remain.” A decline in the number of advertisers does not indicate market contraction; rather, it reflects a significantly higher competitive threshold. Leading and mid-tier advertisers are competing for user attention through higher-frequency and more sophisticated creative testing.

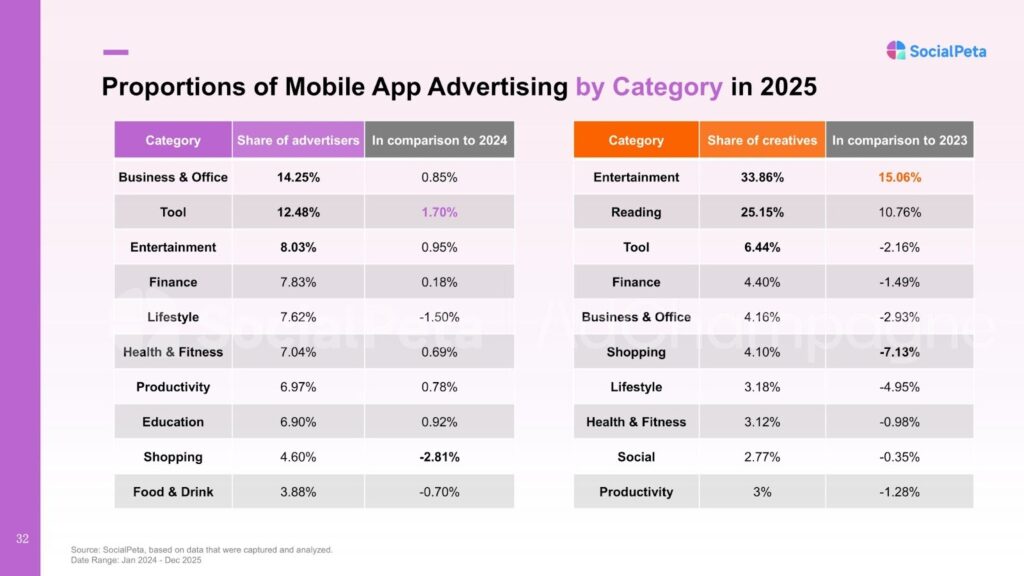

From a category perspective, business & productivity, utilities, entertainment, and finance continue to account for the largest shares of advertisers. From a creative volume standpoint, entertainment (short dramas), reading, and AI-related apps hold a dominant position.

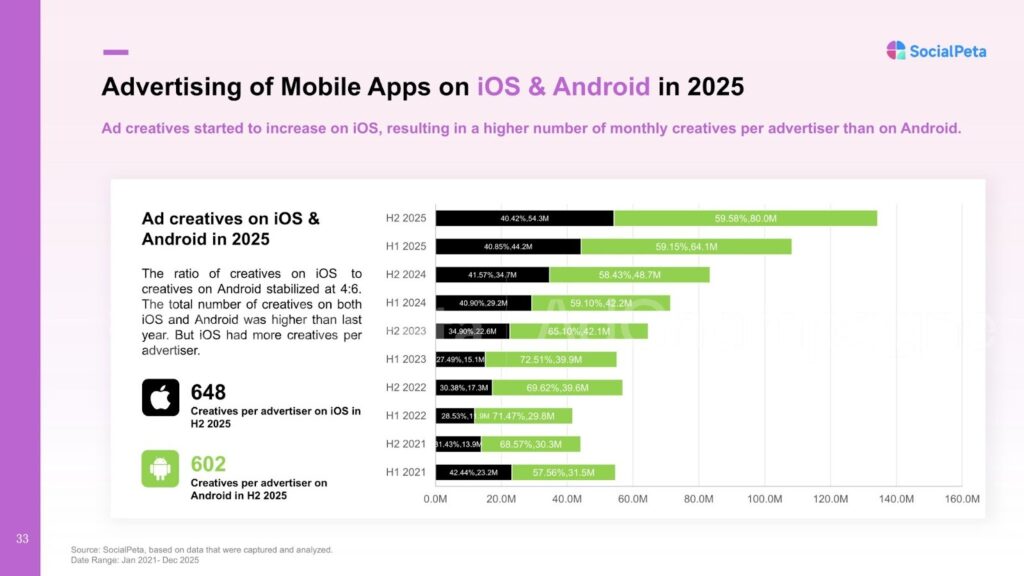

Another notable shift is at the system level: the advertising distribution ratio between iOS and Android has stabilized at 4:6. However, the average number of creatives per advertiser on iOS is significantly higher than on Android. This reflects the higher demand for refined content and high-quality creatives in high-paying markets.

From Traffic to Creativity: Video, Static, and Playable Ads in 2025

From data from AdChampagne, in 2025, total user acquisition (UA) spend reached $78 billion, representing a 13% year-over-year increase. Notably, this growth was driven almost entirely by iOS. Investment in Apple’s ecosystem surged by 35%, while Android budgets effectively stagnated, declining by approximately 1%. This divergence reflects advertisers’ increasing focus on platforms that deliver stronger monetization and higher-value users.

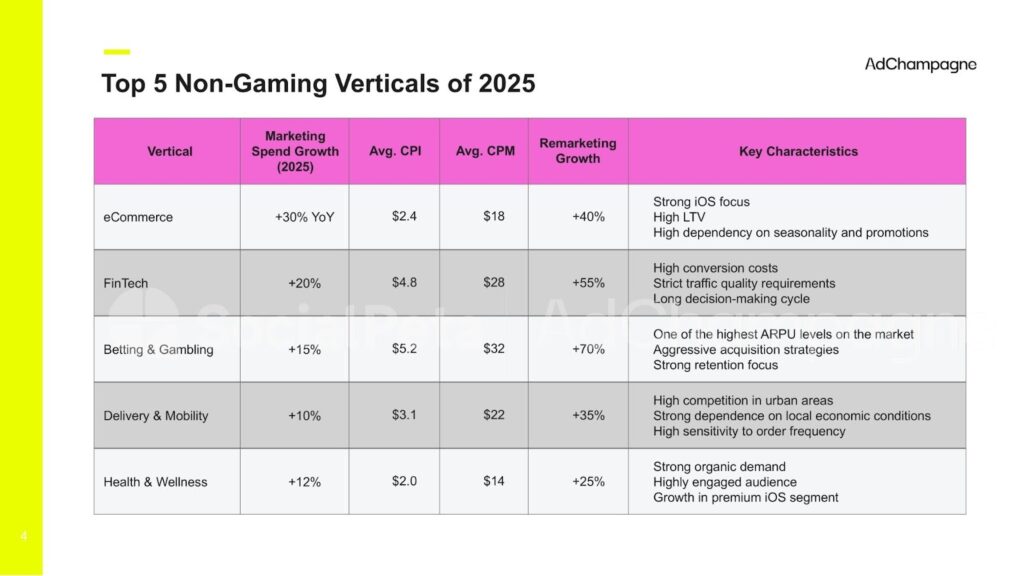

Non-gaming verticals emerged as the primary drivers of marketing spend growth. Sectors such as eCommerce, FinTech, and Betting continued to scale investment, underscoring how mature industries are prioritizing sustainable growth and long-term user value over short-term traffic expansion.

At the same time, performance marketing in 2025 is undergoing several structural shifts. AI-generated content has significantly reduced creative production costs, enabling brands to test a broader range of formats at scale.

Platform algorithms across Meta, TikTok, YouTube, and VK Ads are increasingly optimizing toward creative performance rather than audience targeting. Ad formats are becoming shorter, faster, and more native, with effective value delivery in the first two to three seconds now critical.

In this environment, Creative Rate of Efficiency (CRE) has emerged as a core KPI, measuring how quickly and cost-effectively individual creatives generate results.

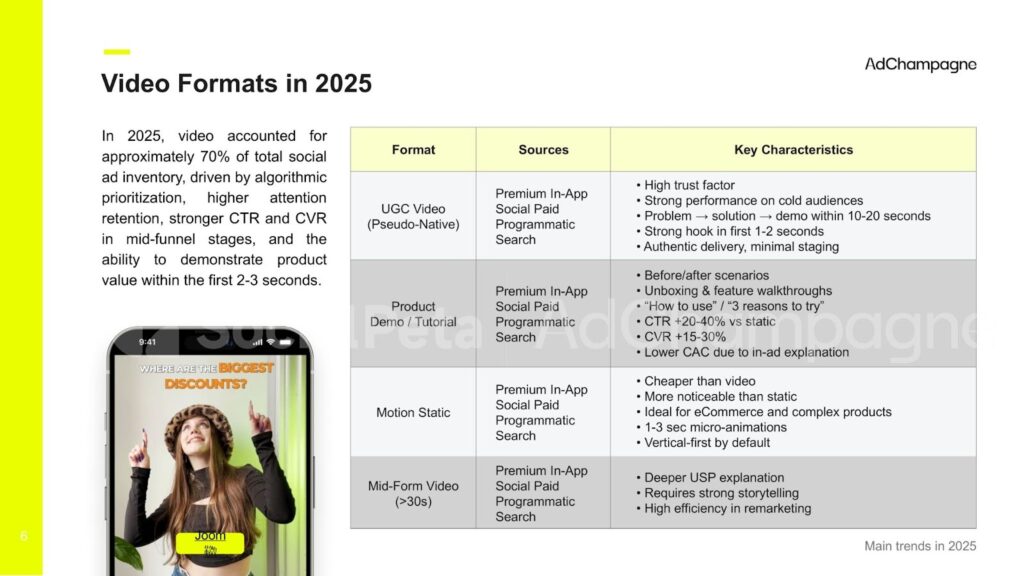

Across ad formats, video remains dominant in 2025, accounting for approximately 70% of total social ad inventory. Algorithmic prioritization, stronger attention retention, higher CTR and CVR in mid-funnel stages, and the ability to demonstrate product value within the opening seconds continue to drive video’s leadership.

Despite video’s dominance, static ads remain highly relevant, particularly during testing phases and for Android traffic. With the lowest production costs, static creatives enable rapid hypothesis validation, efficient A/B testing of offers and USPs, and strong performance in quick-conversion scenarios. They are especially effective for advertisers distributing through alternative app stores.

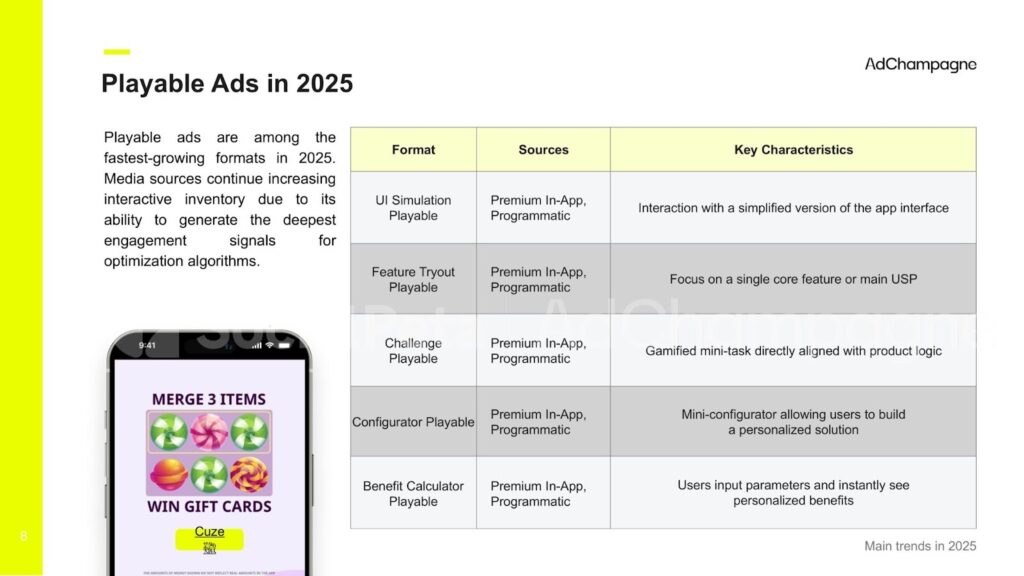

Meanwhile, playable ads are among the fastest-growing formats in 2025. Media platforms continue to expand interactive inventory due to playable ads’ ability to generate deeper engagement signals, which are increasingly critical for algorithmic optimization and user quality assessment.

Performance marketing in 2025 has shifted from a competition for traffic scale to a competition driven by creative capability, system efficiency, and long-term value creation, with each ad format playing a more clearly defined role within the growth funnel.

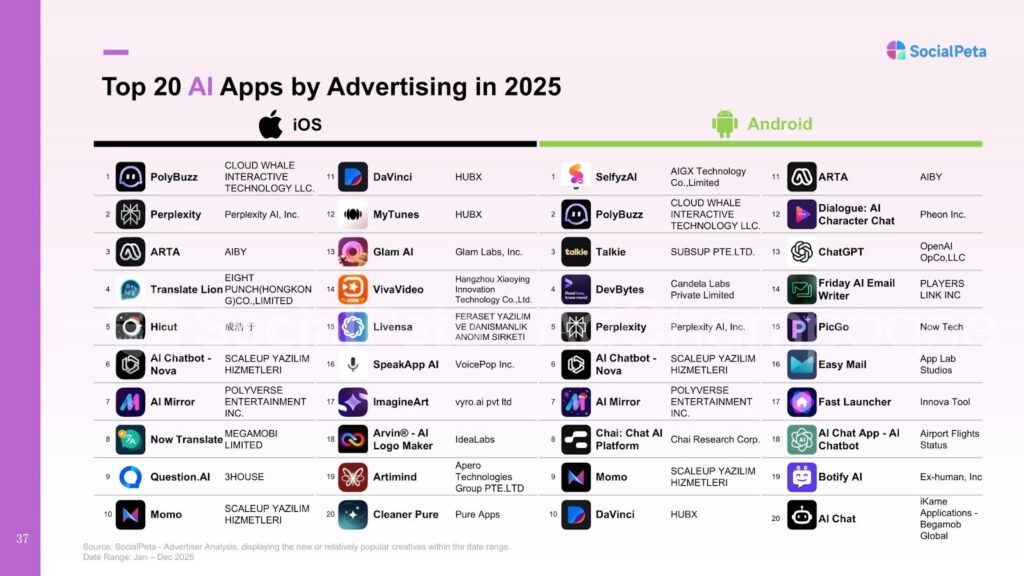

AI: The Most Certain Growth Curve

If short dramas capture attention, then AI apps address efficiency and trust. In 2025, one of the most prominent trends is that AI is no longer just a tool used in marketing — it is becoming a foundational capability of marketing itself. Across most utility app marketing copy, developers are increasingly, and almost implicitly, positioning their products with AI as the most prominent title or selling point.

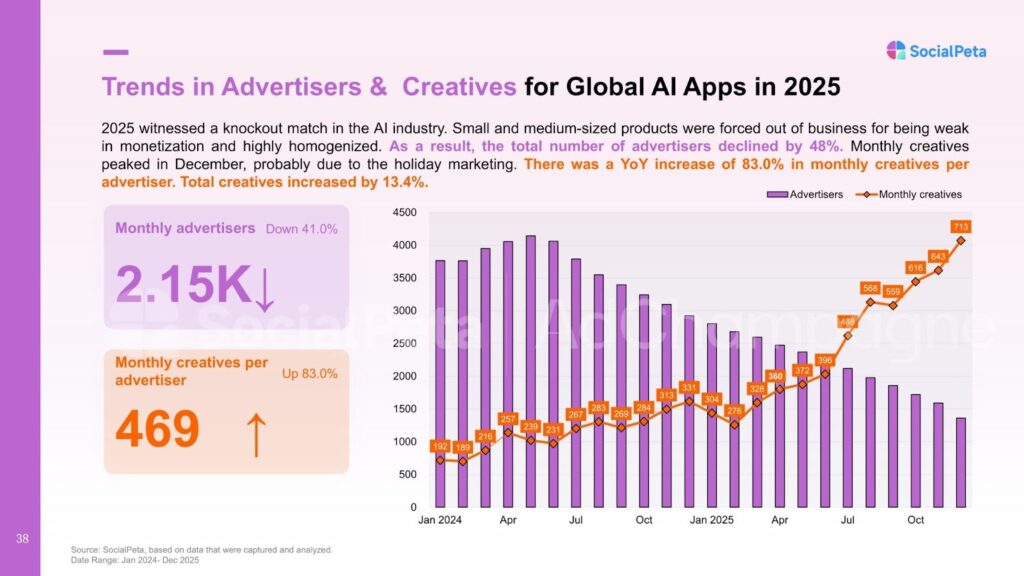

In 2025, the AI sector entered an elimination phase. Many small and mid-sized products exited the competition due to weak monetization capabilities and severe product homogeneity.

As a result, the total number of advertisers dropped by nearly half. However, leading companies continued to expand their efforts, attempting to capture greater market share through increased creative output.

With the arrival of year-end marketing campaigns, the average monthly creative volume also peaked in December.

Other Verticals: Finance Remains Stable, While Other Sectors Enter Structural Divergence

Among other verticals, financial apps have maintained a steady yet measured growth pace. This is not because finance is easier to operate; on the contrary, it is one of the sectors with the highest requirements for marketing systems and the lowest tolerance for error.

Marketing for financial apps in 2025 has clearly demonstrated several characteristics: rather than pursuing explosive traffic growth, advertisers are placing greater emphasis on user quality and lifetime value.

Creative messaging is becoming more rational, with deliberately sensational content significantly reduced.

Compliance, trust, and the cost of explanation have become prerequisites for marketing. This also means that marketing cycles for financial apps tend to be slower, but once a model proves successful, it delivers strong stability and compounding returns.

In this white paper, we also present detailed marketing case studies of overseas financial products such as Holafina, WeBull, and DiDi Finanzas. While each product’s ad creatives reflect its unique brand identity, their core messaging consistently reinforces the cognitive anchors of “security, transparency, and clarity.”

Compared with AI, the marketing approach pursued by financial apps is not focused on rapid bursts of growth, but rather on long-term trust building, which requires greater patience.

Meanwhile, other sectors such as utilities, education, and health have clearly entered a stage where strong players continue to strengthen their dominance. Opportunities still exist, but they increasingly favor companies with established foundations, strong teams, and long-term commitment.

Trends and representative case studies for these sectors have been analyzed in detail in the full version of the white paper, which we encourage readers to explore.

Regional Perspective: North America Remains the Ultimate Testing Ground

From a global perspective, North America remained the most important — and most selective — market for mobile app overseas expansion in 2025. It not only offers the highest user spending power but also imposes the strictest requirements on content quality, brand communication, and compliance standards.

Based on the earlier insights from our report, whether in AI or financial apps, the North American market has entered the phase of “moving away from gimmicks and focusing on value” earlier than other regions. Users tend to make more rational decisions, and conversion cycles are longer. However, once trust is established, lifetime value is significantly higher than in other markets.

For this reason, North America serves more like a touchstone — products that successfully establish scalable models here often possess the long-term capability to replicate their success in other markets. Conversely, models that rely solely on short-term traffic and media buying tactics will eventually encounter a growth ceiling in this market.

Looking back at mobile app marketing from the vantage point of 2026, a clear consensus is emerging: real competition has shifted from traffic acquisition to capability building. AI is no longer a conceptual enhancement, but a foundational capability deeply embedded in both production and marketing workflows. Meanwhile, sectors such as finance are demonstrating the value of steady, long-term growth through a long-term strategic approach.

Spanning 90 pages of in-depth analysis, the report delivers actionable insights to help mobile app marketers scale globally, refine performance strategies, and unlock long-term user value.

Download your copy to identify growth opportunities across global markets