Aream & Co., the largest independent investment bank focused exclusively on interactive entertainment and working with Founders, CEOs, and Boards, has shared its Q3 2025 report on the games industry.

The summary of the Q1 2025 report

The summary of the Q2 2025 report

Key Highlights in the gaming market environment:

- After a year of stagnation, mobile gaming in-app purchase (IAP) spend rebounded to $21 billion, driven primarily by Asian publishers. The report notes that companies from China, Singapore, and Türkiye were among the top revenue generators, with Turkish publishers contributing a 20% year-over-year increase.

- Top-performing publishers included Century Games, Supercell, Dream Games, and Garena, underscoring the continuing dominance of established players. Asian markets—especially China, Vietnam, and Hong Kong—also recorded double-digit growth in installations and active users.

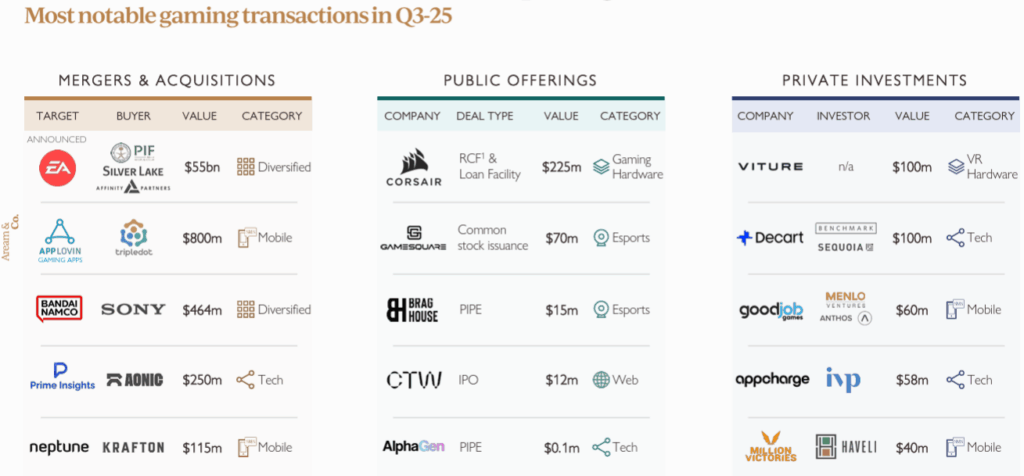

Key Highlights on the deals in the industry:

The M&A market held steady with 49 transactions totaling $56.9 billion, led by the $55 billion public takeover of Electronic Arts by a consortium of PIF, Silver Lake, and Affinity Partners — the largest all-cash sponsor-led leveraged buyout in gaming history. Other key moves included Bandai Namco’s minority stake sale to Sony and Prime Insights’ acquisition by Aonic.

The quarter marked the highest M&A deal value since Q4 2023, totaling $69.2 billion in announced and closed transactions. Institutional capital continued to flood into the sector, with private equity-backed gaming deals surpassing $77 billion year-to-date, reflecting a focus on scaled publishers and strong IP portfolios

Key Highlights in capital markets:

After a robust first half of 2025, public fundraising slowed dramatically. Total public market activity amounted to $0.3 billion in Q3, compared to $10.1 billion in H1 2025, with only one debt transaction recorded in the quarter.

The largest financings involved convertible senior notes and credit facilities, as companies sought liquidity through structured debt instruments rather than equity issuance

Private Investment: Early-Stage Funding Declines

Private investment volume continued to fall, totaling $0.6 billion across 82 deals in Q3 2025 — the lowest quarterly level in five years. Venture-led early-stage rounds (pre-seed and seed) contracted sharply, reaching just $0.5 billion across 125 deals, while Series A funding dropped to $0.3 billion.

The slowdown was most pronounced in North America and Western Europe, while Türkiye and Asia-Pacific remained hotspots for AI-driven gaming tools, VR startups, and mobile studios.

Conclusion

Aream & Co.’s analysis paints a picture of a maturing, selective market: while consumer engagement and top-line revenues continue to rise across all platforms, early-stage capital is tightening, and strategic acquisitions dominate dealmaking.

Growth regions like Asia and Türkiye are increasingly pivotal, both as creative hubs and as testing grounds for global expansion strategies.

The full report is available to read here.