Aream & Co., the largest independent investment bank focused exclusively on interactive entertainment and working with Founders, CEOs, and Boards, has shared its Q2 2025 report on the games industry.

The summary for the Q1 Report is available on our site.

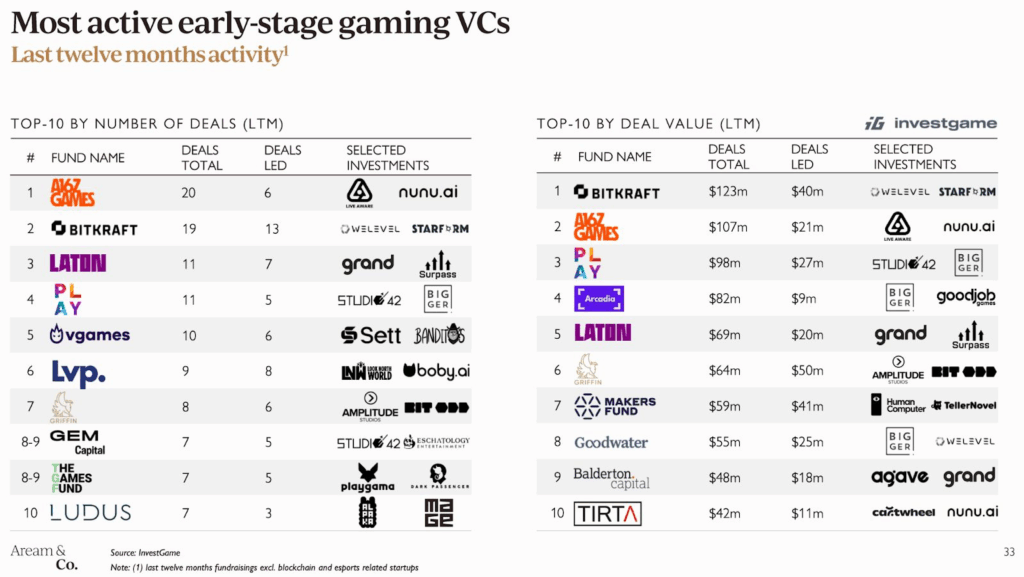

Turkiye now successfully puts itself on the global gaming investor map after years of building legacy gaming companies. Q2 2025 Aream & Co. report shows that Laton Ventures was the top #3 gaming VC in the world in terms of activity, driven by their intensive operational partnership model and being a key connector between Turkish and global ecosystems.

Turks made a strong showing across the chart. Arcadia Gaming Partners was listed as #4 in terms of the total round value of the participated rounds, and Ludus Ventures was listed as #10 in terms of activity.

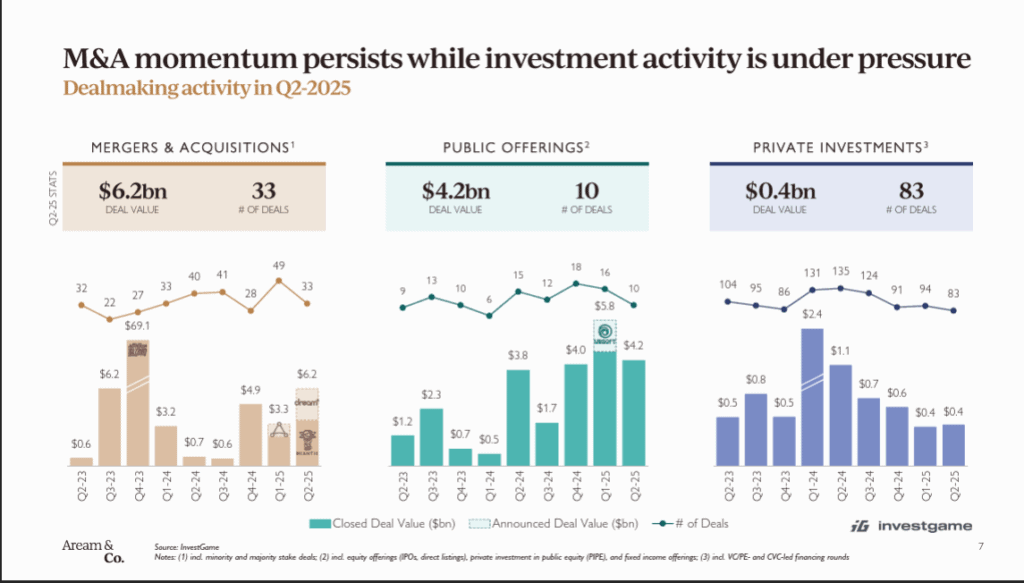

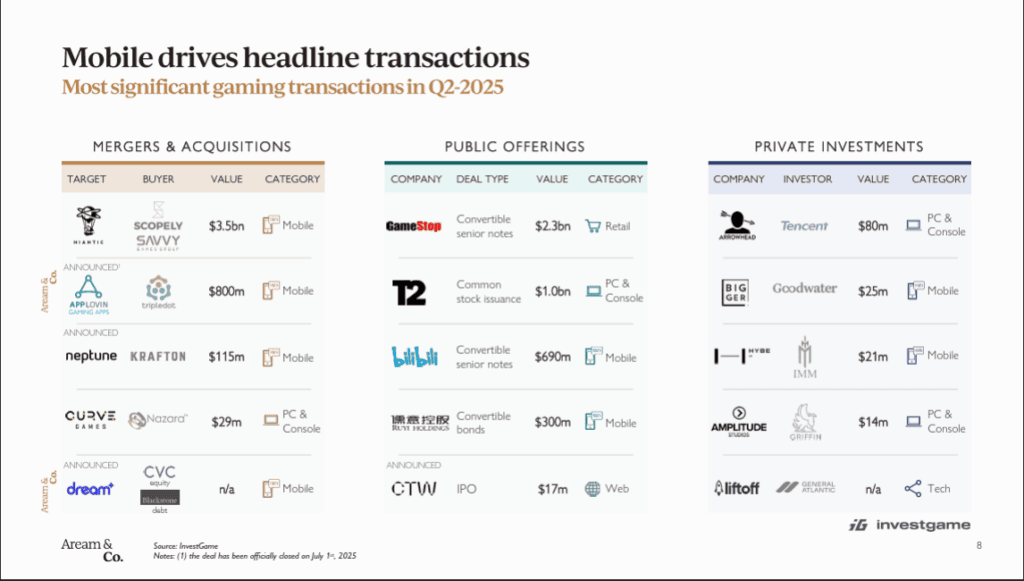

The report also reveals that M&A activity reached $6.2 billion in Q2, driven by the sale of Niantic and a PE-led strategic round in Dream Games.

The Q1 report saw a similar number and revealed that M&A hit $6.6bn in Q1—the highest in 2 years—and exceeds pre-pandemic levels, with mobile continuing to dominate headline activity.

Deal activity remains concentrated in mobile, as PC/Console dealmaking lags. Mobile gaming has stabilized at $20bn in quarterly consumer spend, though downloads continue to trend down.

Related: Turkish gaming companies that received investment (2025)

Private gaming investments dip to a five-year quarterly low of $0.4bn, as late-stage VC appetite weakens.

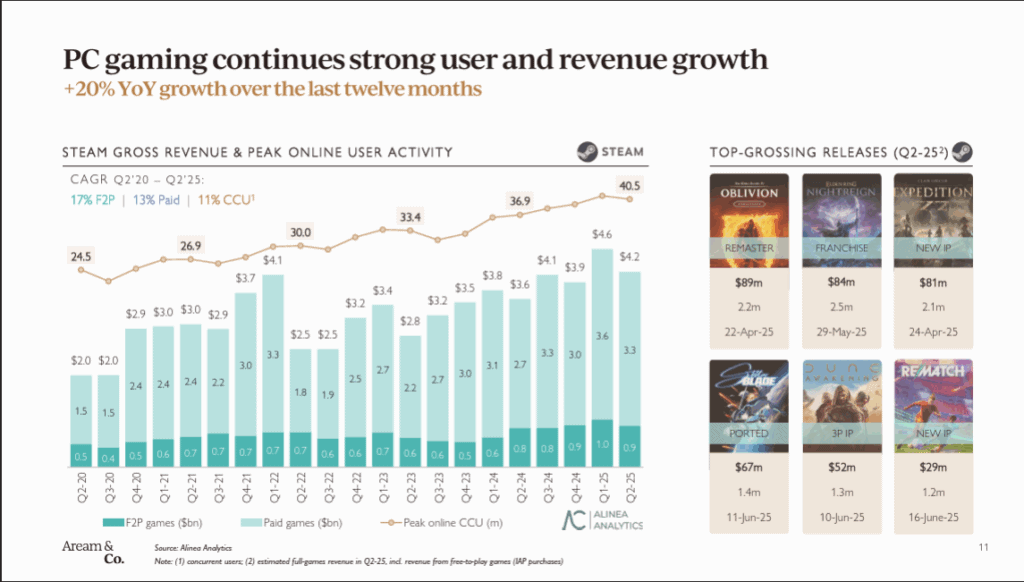

PC gaming contniues to grow, with Steam revenue up +20& YoY, powered by several standout indie launches.

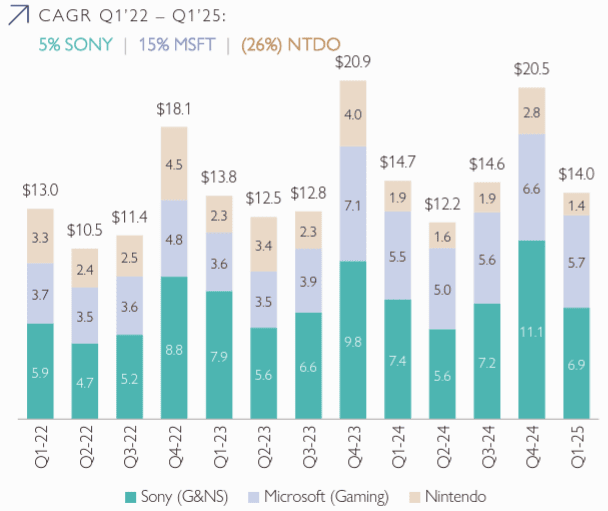

Console momentum builds up as Nintendo Switch 2 becomes the fastest-selling console, while PlayStation hits 120m+ MAUs in its most profitable hardware cycle.

Major Console Platforms: Quarterly Gaming Division Revenue ($BN)

Summary of Capital Markets

Public offerings raise $4.2 bn in Q2, with healthy demand across debt and equity issuance.

Gaming equities deliver robust YTD performance despite macro pressure, with many names trading close to their 52-week highs.

Valuation spread widens: PC/Console and diversified comps trade at 15x+EBITDA, while mobile peers lag at historic lows.

The full report offers much more detail and can be accessed here.