BITKRAFT Ventures announced the release of a report powered by Redseer Strategy Consultants, forecasting high growth in India’s gaming and interactive media sector, despite the ban on real money gaming.

The study reveals that the segment, already a key engine in India’s digital media & entertainment space, is projected to triple in size, reaching $7.7 billion by FY2030

The report, “The Gaming and Interactive Media Opportunity in India,” highlights that these segments are growing approximately 1.5 times faster than the overall digital media and entertainment market, fueled by India’s massive, young user base, nano-transactions, high smartphone engagement, and shifting consumer behavior toward interactive and personalized content.

Key Market Projections: A Structural Shift Towards Casual and Interactive Content

Gaming Market Resilience: Despite regulatory intervention concerning online money gaming (RMG), the digital gaming sector is set to thrive. This market alone is projected to nearly double, reaching approximately $4.5 billion by FY2030, and esports is expected to triple at $120 million by 2030.

- Hybrid Casual, the new format with similar Mid-core game-like progression and deeper meta systems is emerging as a key segment

- The Battle Royale genre continues to enable most monetisation.

- While the market is nearly equally split between ads and IAPs (In-App Purchases), the balance is expected to heavily tip towards IAPs in the next 5 years with ~6X growth.

Interactive Media Surge: Disruptor segments within interactive media are poised for exponential growth, expanding from an estimated $440 million in FY2025 to $3.2 billion by FY2030. Fastest-growing sectors include:

- Astro & Devotional Tech: Projected to grow 8x to $1.3 Billion by FY2030, digitizing a massive offline market through 1:1 consultations.

- Micro Drama: A nascent but high-potential segment mirroring successful models in China, expected to reach $1.1 Billion by FY2030 by capitalizing on short, serialized mobile-first video content.

- Audio Streaming: Expected to quadruple to $300 Million by FY2030, driven by high user engagement and localized content strategies.

The India Opportunity: Vernacularization and Social Connection

The report emphasizes that growth is increasingly driven by the ‘Bharat’ audience (Tier 2+ segments), who seek vernacular content, social identity through gaming communities, and new avenues for social connection. AI is also emerging as a key enabler, significantly lowering content creation costs and accelerating local game development.

“India represents perhaps the most compelling greenfield opportunity globally. The confluence of a digitally native youth demographic, established mobile infrastructure, and massive scale is creating what we believe to be a hyper-growth environment. In our view, this is an inflection point, positioning India as a true global powerhouse for interactive entertainment.”

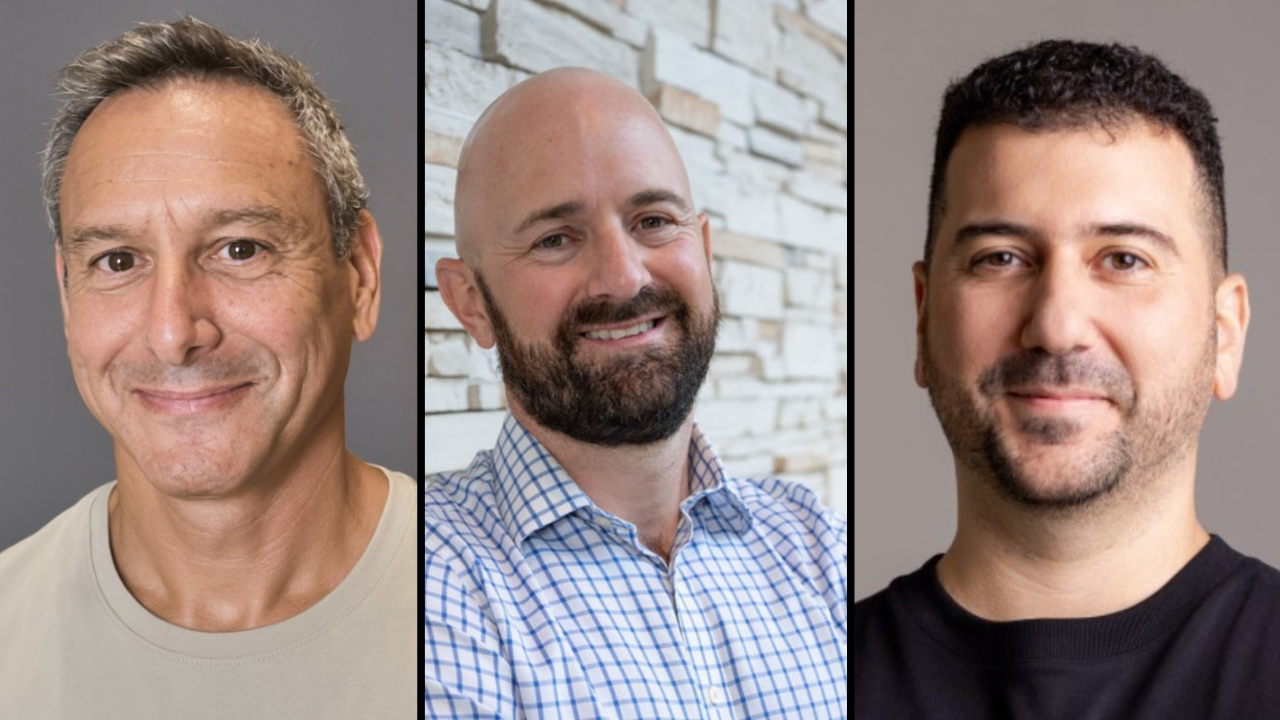

Jens Hilgers, Founding General Partner at BITKRAFT Ventures

“It’s exciting to see India’s gaming sector entering a phase of durable growth, with local developers creating innovative and monetizable experiences that are beginning to resonate globally. We’re witnessing strong momentum across casual and hybrid-core titles, fueled by rising player engagement, new IP creation, and increasingly accessible payment ecosystems. Together, these factors are helping define the next chapter of India’s gaming and interactive media industry.”

Anuj Tandon, Partner, India & UAE at BITKRAFT Ventures