Building and scaling a mobile game requires fast, accurate decisions. However, critical choices regarding UA budgets, update schedules, or investor communications often hinge on one major unknown: the future.

At Mobidictum, we observe a clear shift in how successful studios operate. Forecasting is no longer just a metric; it has become the central “operating system” for growth.

We recently met with the team at Leus to analyze the mechanics behind their forecasting engine. Our review of their data highlights how high-precision predictive modeling is shifting studio operations from reactive chaos to proactive strategy.

Moving from Historical Data to Predictive Modeling

Traditional forecasting often relies on fragmented historical data. The architecture behind Leus’s Weekly Forecasting Model (Lumina) offers a compelling alternative. By using just one week of data (Retention Week 0), the system generates a 52-week projection.

The model filters out volatile or low-signal cohorts to ensure predictions rely on consistent monetization patterns rather than noise. Forecasts are updated daily and focus specifically on the two KPIs that drive business health: ROAS and LTV.

Precision as the Core Metric

In forecasting, accuracy is the only currency that matters. Leus reports a 98% Forecast Accuracy, with predictions deviating by an average of just 2% from actual results (MAPE).

To ensure this isn’t just a fluke, accuracy is rigorously validated using a 4-week rolling holdout method, continuously comparing forecasts against actuals. Additionally, the model provides confidence intervals to keep data dynamic and decision-ready. For a studio, this level of precision offers a near real-time view of a game’s future economy.

Why Prediction is the Ultimate Competitive Advantage

Accurate forecasting does more than answer “what will happen.” It fundamentally restructures how a studio allocates its resources:

- Smarter UA: Teams can scale winners or stop losing campaigns in week one instead of waiting for months.

- Better Roadmaps: Studios can confidently invest in games with long-term upside and cut weak ones fast.

- Liquidity Planning: Founders can anticipate cash needs early and secure financing at the right time.

- Early Risk Alerts: It allows teams to catch monetization drops before revenue suffers.

- Portfolio Management: It creates a fair, consistent basis to compare titles and spot top performers.

The Big Advantage for UA & Growth Teams

When a UA manager can forecast not just the amount of revenue, but where it will come from, management shifts from reactive to proactive. Instead of chasing lagging indicators on yesterday’s dashboards, growth teams can:

- Scale winners fast and cut losers early.

- Shift budget to the strongest geos and networks immediately.

- Plan payback and cash needs with clarity.

- Compare campaigns on a fair, consistent basis.

- Catch monetization issues early and reduce waste.

Leus describes this capability as “turning uncertainty into clarity.” In an industry where uncertainty is expensive, clarity is the ultimate growth hack.

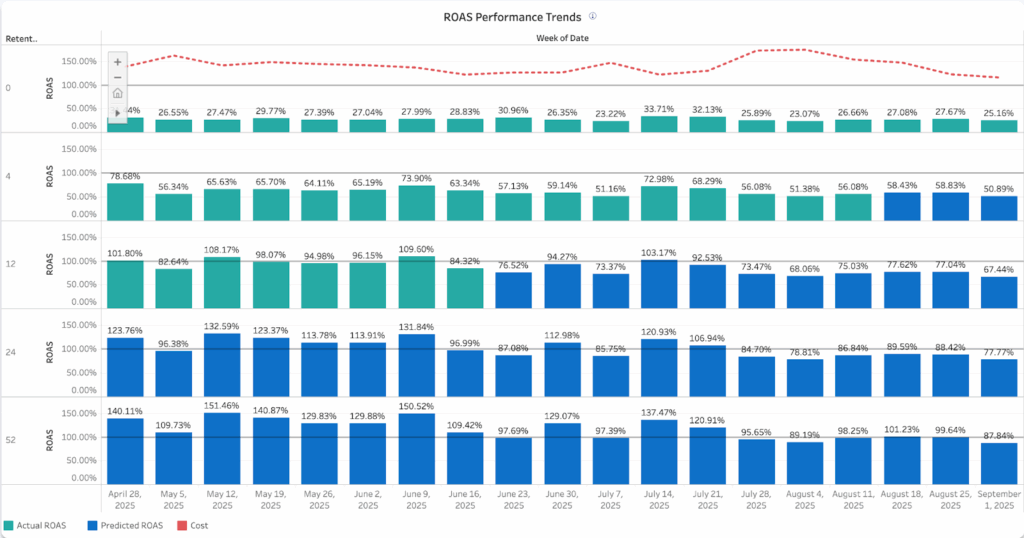

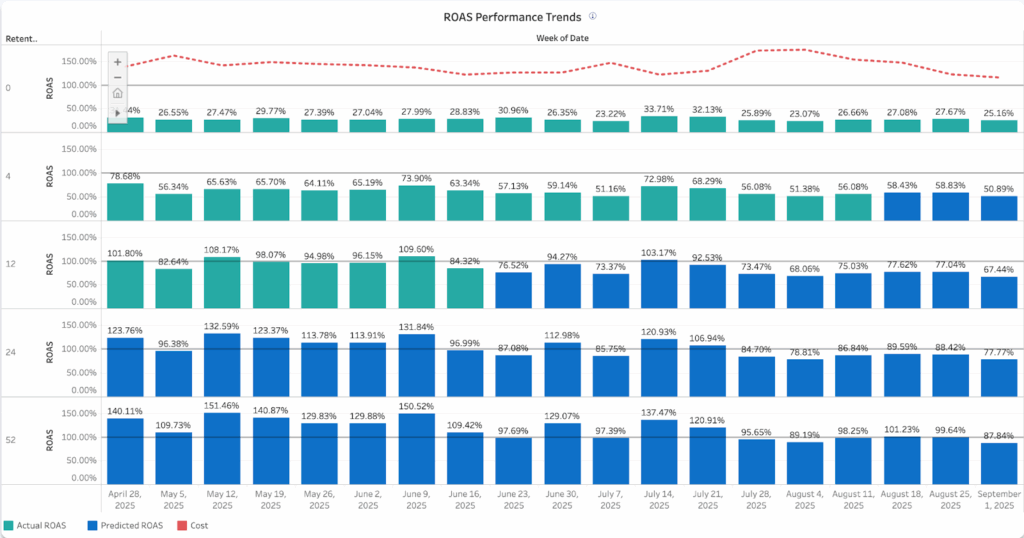

CASE STUDY 1: The Compounding Effect of Small Inefficiencies

Data from Leus reveals a critical insight: minor signals today often compound into massive outcomes over a 52-week period.

In the chart above (Green = Actual ROAS, Blue = Forecast), the difference in Week 0 appears trivial. There is a slight dip in ROAS while spend remains steady, which many teams might dismiss as noise.

However, the projection tells a different story. By Week 52, that minor inefficiency compounds into a 40% drop in ROAS. The Diagnosis: Creative Saturation. The ads driving early momentum lost efficiency and silently dragged down lifetime performance. Without predictive modeling, this trend is often detected too late.

CASE STUDY 2: The “Strong Start” Fallacy

Early metrics can be deceptive without long-term foresight. An analysis of cohorts from May 26 to June 23 illustrates this perfectly.

The Week 0 Trap: Four distinct cohorts show nearly identical Week 0 ROAS values (~27–30%). On the surface, they look equally healthy, and a standard analysis would suggest maintaining spend on all four.

The Week 52 Reality: The trajectories diverge drastically. While the May and June 9 cohorts mature into healthy profitability, the June 23 cohort stalls. Despite having the highest Week 0 start, it ends at 97.7% and fails to break even.

The Insight: This is a classic trap. Judging by initial performance, June 23 appeared to be the winner. In reality, it was the worst performer. Lumina flags this immediately by identifying the root causes:

- Audience Overlap & Saturation: Campaigns hit diminishing returns despite an initially strong response.

- Creative Fatigue: Early clickers converted, but retention collapsed, dragging down lifetime ROAS.

- Spend Allocation Blind Spots: Cost levels looked steady, but the efficiency behind them shifted quietly.

The Forecasting Advantage

Inefficiencies in mobile gaming rarely announce themselves with sudden drops. They creep in quietly, cohort by cohort. The value proposition of platforms like Leus lies in flagging these inefficiencies the moment they appear.

This allows teams to rotate creatives upon seeing a small dip, stress-test overperforming cohorts, and optimize spend before it compounds into losses.

Perhaps most notably, Leus is democratizing access to this high-level analysis. Studios can access these forecasts ,with up to 98% accuracy ,without financing commitments.

You can see many technologies aiming to set new industry standards. However, seeing a predictive engine of this caliber offered as a free tool is a rarity.

Generate your free forecast now.

For decision-makers, the takeaway is clear: In an environment where UA costs are rising and competition is fierce, the winners will be the ones who see tomorrow’s ROAS today.