SocialPeta and AMO Pictures jointly conducted an in-depth analysis of the global micro-drama ecosystem. By combining advertising intelligence with production-side insights, the report Insight into Global Micro Drama App Marketing for 2026 explores how micro-drama app marketing is evolving—and what will ultimately define sustainable growth in the industry’s next stage.

The report also incorporates first-hand industry perspectives from experts across the short drama ecosystem, including contributors from the Short Drama Alliance, Sooper, and AMO Pictures, offering a more comprehensive view of both market dynamics and execution strategies.

1. Advertising Momentum: Creative Scale Becomes the New Baseline

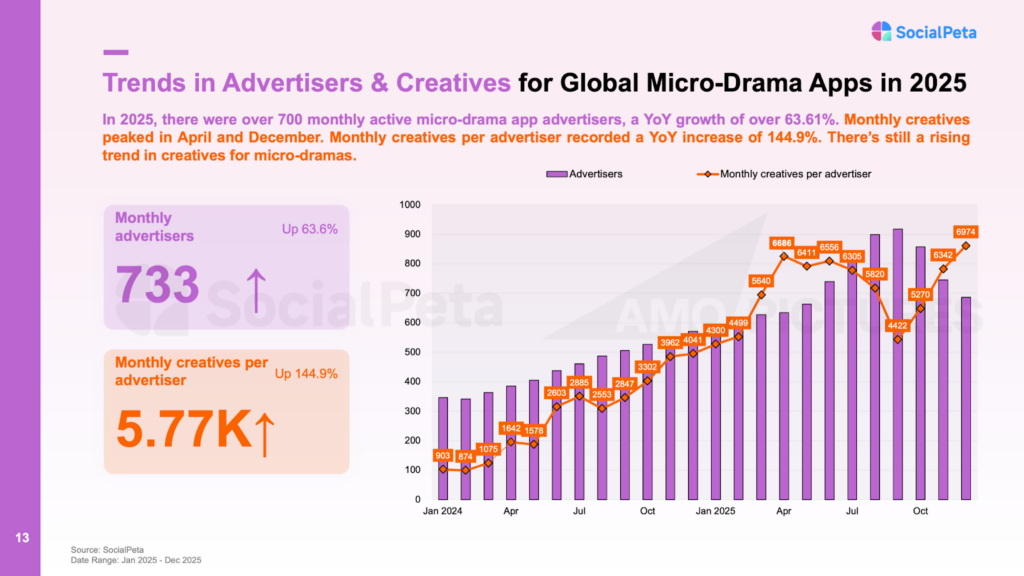

By the end of 2025, short-drama app marketing had reached a new level of intensity:

- Over 700 monthly active micro-drama app advertisers, with 63.61% year-over-year growth

- Monthly creatives per advertiser increased by 144.9% YoY

- Clear seasonal peaks in creative output, indicating standardized and repeatable launch cycles

These signals suggest that heading into 2026, creative scale is no longer a competitive advantage—it is a minimum requirement. The key differentiator is shifting toward how efficiently advertisers can test, iterate, and localize creatives across markets.

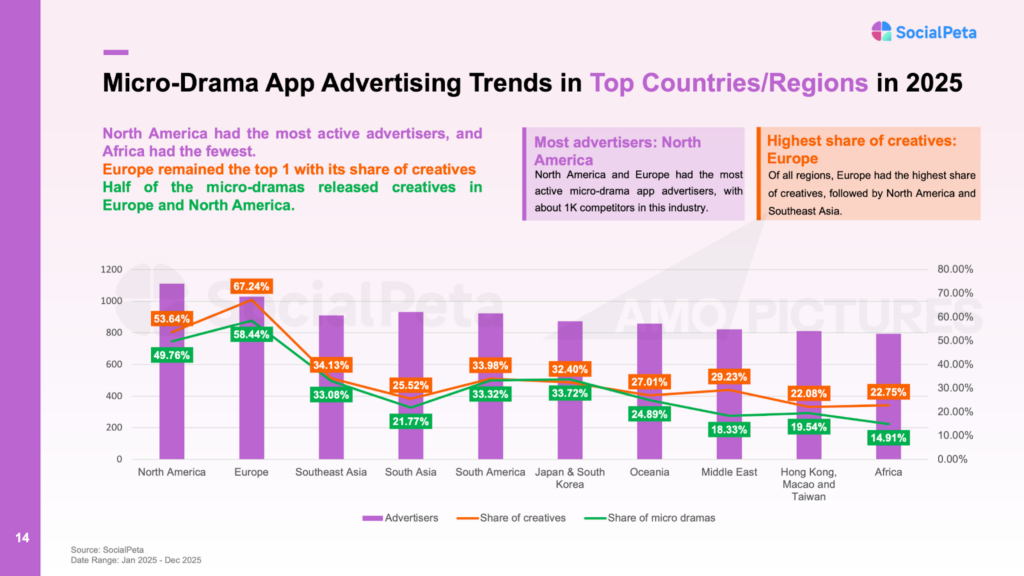

2. Regional Concentration: Core Markets Still Define Performance

Advertising activity remains highly concentrated:

- North America leads in advertiser participation

- Europe ranks first globally in total creative volume

- Nearly half of all micro-drama creatives are released in Europe and North America

For 2026, these regions continue to function as revenue anchors and creative testing hubs, where advertising feedback loops are fastest and monetization efficiency is highest. Emerging markets offer growth potential, but mature regions remain critical for validating genres, creatives, and pricing strategies before broader expansion.

3. Creative Performance: Three Structures That Consistently Convert

SocialPeta’s analysis of high-performing short-drama ads reveals three creative formulas that continue to dominate global campaigns and are expected to remain effective in 2026:

Formula 1: Intense Conflict + Highlight Clips + Cliffhanger Ending

Optimized for the first three seconds, this structure maximizes completion rates and aligns with short-video platform algorithms that prioritize engagement.

Formula 2: Local Scenes + Universal Emotions + Clear Calls to Action

By reducing cultural friction and clarifying emotional stakes, this formula improves both retention and conversion—particularly in region-specific campaigns.

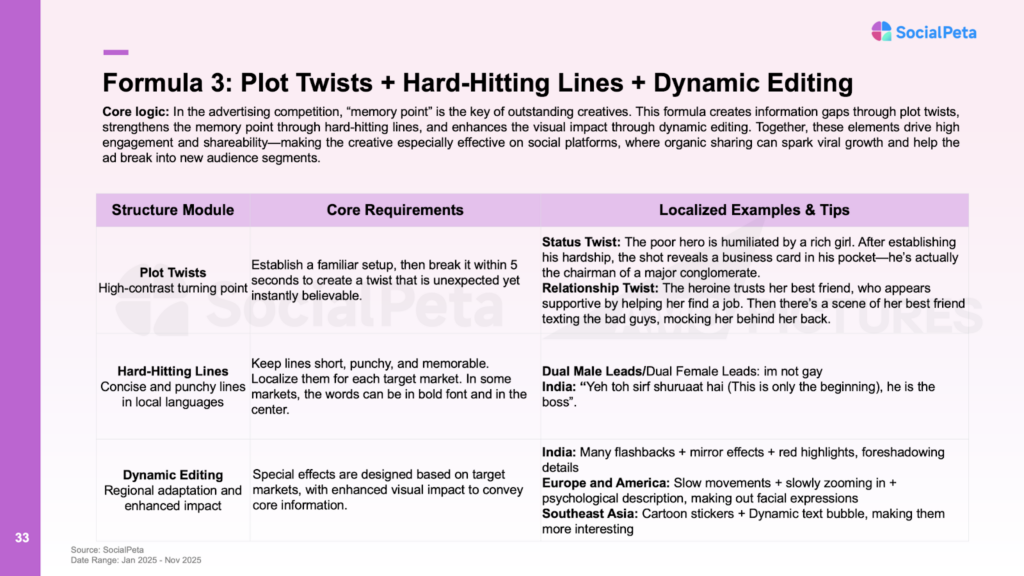

Formula 3: Plot Twists + Hard-Hitting Lines + Dynamic Editing

Strong “memory points” increase shareability and organic distribution, helping ads break beyond paid traffic into broader audience segments.

Across all three structures, one pattern is consistent: emotional clarity outperforms narrative complexity in driving acquisition performance.

4. AMO Pictures: Audience-First, Data-Driven IP at Scale

As marketing systems mature, production studios are also redefining their position in the short-drama value chain. AMO Pictures illustrates how vertical drama studios are transitioning from execution partners to IP-driven media companies.

Operating across 55+ countries and generating over 3 billion monthly views, AMO has built scale through standardized production pipelines and performance-oriented storytelling. In 2025 alone, the studio produced 55 vertical dramas and launched 24 proprietary IP titles.

At the core of this strategy is audience-first development. Continuous analysis of short-form performance data highlights consistent behavioral patterns:

- the first seconds determine success or failure;

- emotion consistently outperforms exposition;

- injustice, empathy, and suspense drive retention;

- sustained momentum is critical in vertical viewing environments.

Data informs decisions across scripting, pacing, casting, and editing, creating a feedback loop between audience behavior and creative execution. Each IP is developed with multi-platform deployment in mind, allowing flexible editing and broader monetization across ecosystems.

For AMO, owning IP is not about isolated hits, but about building scalable, long-term content assets that compound in value as the market matures.

The full report spans over 30 pages, providing detailed analyses of top-performing short drama apps, trends in advertising creatives, and exposure strategies for micro-dramas across key global markets.

Download the full report to explore actionable insights for micro-drama app marketing in 2026.