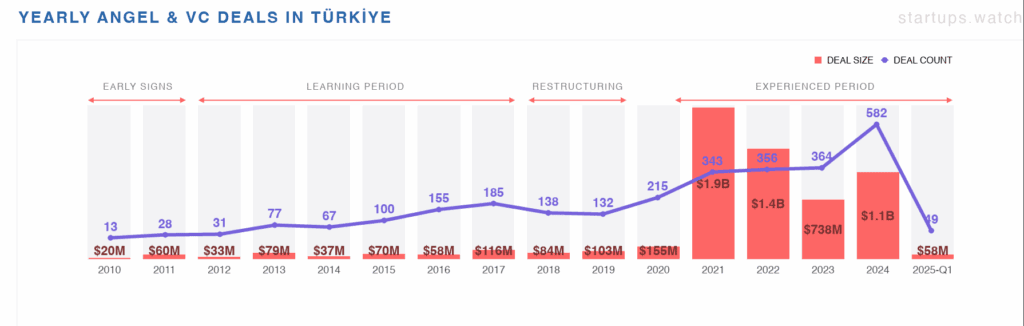

Despite a notable slowdown in overall startup activity, gaming startups emerged as a bright spot in Turkiye’s startup ecosystem during the first quarter of 2025. According to the Turkish Startup Ecosystem – 2025 Q1 Report by startups.watch, a total of $58 million was invested across 49 funding rounds.

This figure includes 12 early-stage startups supported by TÜBİTAK’s BiGG (Bireysel Genç Girişimci) program, a government-backed initiative aimed at funding and accelerating technology-driven ventures founded by young entrepreneurs, recent graduates, and academics.

Q1 2025 marked the slowest quarter for deal volume since early 2023, and the second-lowest in total funding, trailing only Q4 2023. The ongoing difficulty of moving from seed stage to Series A and beyond remains a major barrier to growth.

Later-stage deals are still rare, and many founders end up relocating after Series B to access follow-on funding. On average, seed investments in Turkiye are less than half the size of those in Europe, highlighting a fundamental funding gap at the early stages.

Gaming Sector Maintains Its Momentum

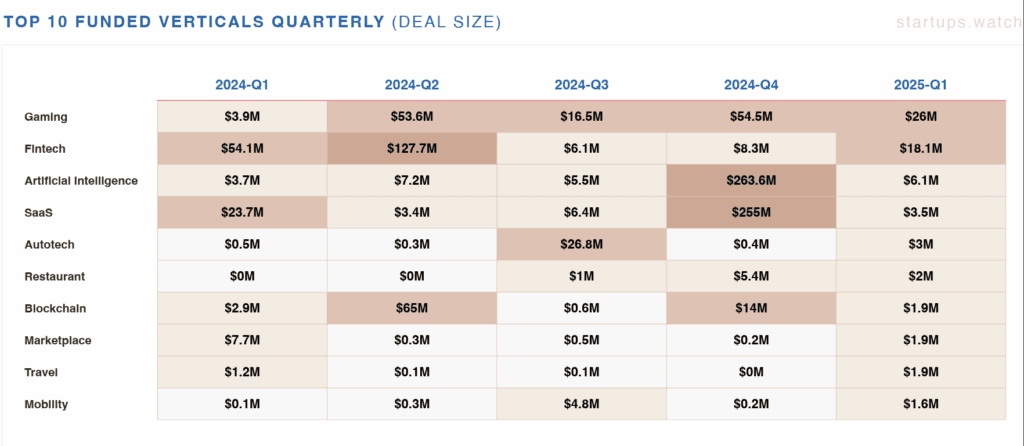

Gaming and fintech were the standout verticals in Q1, leading in both investment volume and attention from foreign investors. Good Job Games was a key driver in maintaining gaming’s strong showing, echoing the high levels of capital interest the sector enjoyed throughout 2024.

Foreign interest in gaming startups grew notably. Despite an overall decline in deal numbers, foreign investor participation nearly doubled quarter-over-quarter, thanks in part to the lower baseline of total deals. Among the international backers showing confidence in Turkiye’s gaming and fintech startups were Play Ventures, Arcadia Gaming Partners, Menlo Ventures, DN Capital, Qatar Development Bank, and Startup Wise Guys, among others.

Early-Stage Struggles Continue

The Series A crunch remains the ecosystem’s core issue. While the number of seed-stage rounds was relatively stable, transitioning beyond that stage is still a major hurdle. If these obstacles can be addressed by increasing average seed funding and providing more follow-on capital, there’s potential for a healthier pipeline leading into Series B, C, and later-stage investments.

CVC Activity and AI Trends

On the corporate side, no new corporate venture capital (CVC) funds were launched in Q1, keeping the total static at 92. CVC and corporate investor participation also fell to 27%, a quarter-over-quarter decline.

Although AI startups drew less funding overall, their presence was noticeable. These early-stage AI investments are seen as seeds for future growth, and may play a bigger role in coming quarters.

Methodology & Data

The data in this report is sourced from startups.watch and includes only verified funding rounds. Verification was conducted through the Chamber of Commerce, direct startup/investor confirmation, or public press releases.

- Fundings listed in the Chamber of Commerce data are counted, regardless of a startup’s current registration location.

- Buyouts, M&A, and secondary transactions are excluded as they are treated as exits.

- For tranched investments, only the disclosed amount is included.

- Tags/categories used are not mutually exclusive.

- Included: Private company fundings, angel rounds, seed rounds, Series A–C.

- Excluded: Public company rounds, debt/loans, secondary transactions, grants, ICOs, and non-equity rounds.

You can access the full report here.