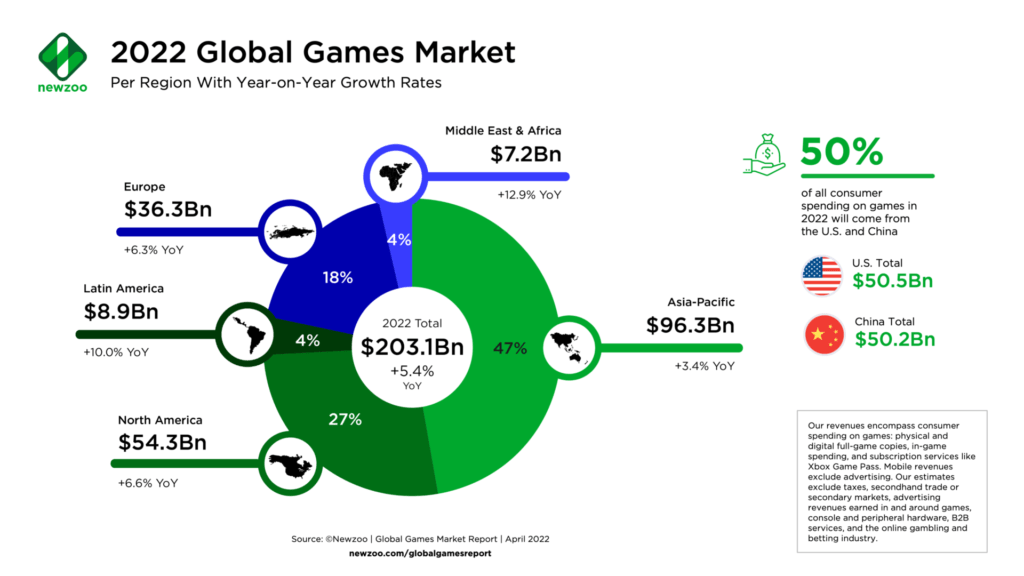

Since the pandemic is easing down and the world is starting to go back to normal, the gaming market has proven that its strength does not depend on it. Revenues are still growing in 2022. Revenues through consumer spending are expected to reach $203.1 billion (+5.4% YoY).

According to the data published by Newzoo, the number of global players will also make a breakthrough this year and will reach 3.09 billion players by the end of the year and exceed the three billion threshold.

Game revenues by region

Before we review the 2022 gaming market forecasts for mobile, PC, and console, we wanted to highlight some notable regional developments.

In terms of gaming revenues from consumer spending, the US ($50.5 billion) is expected to generate more revenue than China ($50.2 billion) in 2022.

This shouldn’t come as a surprise, as the Chinese government has cracked down on the game industry in China, limiting new games and young people’s playtime in the country.

However, Asia-Pacific remains by far the largest region by income:

As seen in the report, emerging regions are places with double-digit growth. However, the more mature regions of Europe and North America are also showing strong growth thanks to PC and console performance. Mobile will continue to generate more revenue than the sum of these two segments in 2022.

Mobile game revenues to reach a significant milestone

Annual mobile gaming revenues are expected to surpass $100 billion for the first time in 2022, increasing 5.1% year on year to $103.5 billion.

While mobile will still grow, 2022 will not be able to sustain the pandemic-driven growth of previous years, and its annual growth is significantly lower than the 2020 and 2021 growth figures. This means mobile’s market share will drop by one point this year (from 52% in 2021 to 51% this year).

The most mature mobile markets will show only minimal annual growth in 2022 – for example, +2.8% in China and +1.1% in Japan. These mature markets rely on new game releases and improved monetization strategies to increase revenues as player growth is minimal.

Games in China are limited due to government regulations. While new releases such as Apex Legends Mobile (especially in Japan) and Diablo Immortal will contribute to revenue growth globally, user acquisition will remain a significant challenge.

Privacy changes like the removal of IDFA make it more difficult for mobile games to win and target players effectively. While Apple’s engagement changes are more than Google’s, most publishers provide a combined UA budget (not a separate one for iOS and Android), so user acquisition is impacted.

Asia-Pacific remains the most significant gaming region in total income (by a large margin). Still, China, Japan, and Korea show low, single-digit growth numbers year over year. So, where does the growth of mobile come from?

Emerging markets in Latin America and Southeast Asia will be the most significant contributors to mobile’s 2022 growth, thanks to:

- Increasing access to games and (smartphone) devices.

- Infrastructure and mobile internet improvements.

- More seamless and accessible payment options.

The console market will continue to grow in 2022

From the advent of mobile to the birth of cloud gaming, experts and analysts have long predicted that the console market will end. But contrary to popular belief, the console continues to grow.

Despite ongoing supply chain constraints, console games are expected to generate $58.6 billion in 2022, up 8.4% annually. This growth will be driven by:

- Massive titles like Horizon Forbidden West, Pokémon Legends Arceus, and Gran Turismo; to be released titles such as God of War Ragnarok, and Xbox’s H2 series will also be announced.

- Highly anticipated titles like Call of Duty Modern Warfare 2 (perhaps the most expected Call of Duty game in years), Elden Ring, and sports titles debut every year.

- There is ongoing console performance and passion for live service games like Fortnite, GTA Online, and Call of Duty Warzone.

No significant growth is foreseen on the PC side

PC gaming revenue will grow slightly slower than console but will increase +1.9% to reach $41.0 billion in 2022.

Like the console, revenue from built-in live service games and new games like Elden Ring and Modern Warfare 2 will contribute the most to growth.

However, PC’s growth is still lower than console’s because PC has:

- Less high-profile first-party releases (games like Horizon Forbidden West and Pokémon Arceus Legends mean hundreds of millions of dollars in revenue that the PC can’t catch).

- Lack of subscriptions such as PlayStation Plus, Xbox Game Pass (PC has Game Pass, but not so connected to the ecosystem), and Nintendo Switch Online.

We attribute most of Europe’s gaming market growth (+6.3%) to the stronger-than-average PC market; however, the region’s growth potential has been limited by the ongoing conflicts in Eastern Europe.

Specifically, China’s PC market will decline slightly year on year, with this decline accelerating towards 2024, a direct result of government pressure on gaming. This gives us an idea of what the future state of the gaming market will be.

What awaits the global gaming market revenues in the future?

The game market will continue to grow in the coming years. With a CAGR of +5.6%, it will reach $222.6 billion in 2024 (2020 to 2024).

The future is similarly bright on mobile, PC, and console. On the mobile front, talented studios will continue to adapt to new privacy norms, all of which will support the market by:

- Ongoing live services and hybrid monetization innovation (between basic and casual genres).

- Console and PC priority companies are moving their big titles to mobile this year to support their growth and revenue streams, including Apex Legends Mobile and Diablo Immortal.

- Increasingly complex and immersive mobile games attract core players and increase revenues.

On the console PC and mobile front, expanding subscription services alongside full-priced versions will give players more ways to play and pay. Of course, massive ongoing and upcoming live service titles like Call of Duty Warzone 2 announced in 2023 will also keep players engaged and spending.