SocialPeta has released the 2024 Global Mobile Games Marketing Trends & Insights White Paper, providing a data-driven analysis to explore new growth opportunities globally, featuring insights from industry leaders at Google, AdQuantum, App Masters, Gamelight, AppSamurai, Gamee Studio, Gamesforum, Geeklab, UGC Ninja, Mobidictum, Appcharge, Odeeo, Leke Games, Cost Center, Tenjin, and experts Daniel Camilo and Gokhan Uzmez.

The global mobile gaming market in 2024 is experiencing continued growth, driven by increasing smartphone penetration, particularly in emerging markets where a wave of new users is entering the mobile gaming space.

In established markets like North America and Europe, players’ strong willingness to make in-game purchases provides a solid foundation for growth.

While the market presents both opportunities and challenges, expanding into international markets has become a key strategy for both large and small companies. The demand for mobile games from global users will continue to rise, and the potential for growth in international markets remains significant.

Key Takeaways:

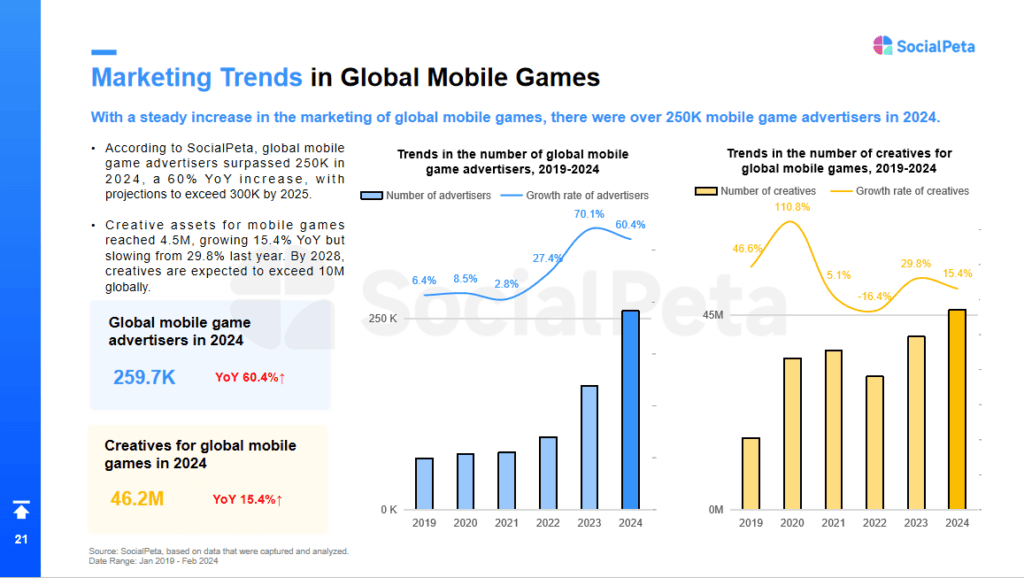

- Global Mobile Game Market Recovery: Over 250,000 advertisers participated in global mobile game ad campaigns in 2024.

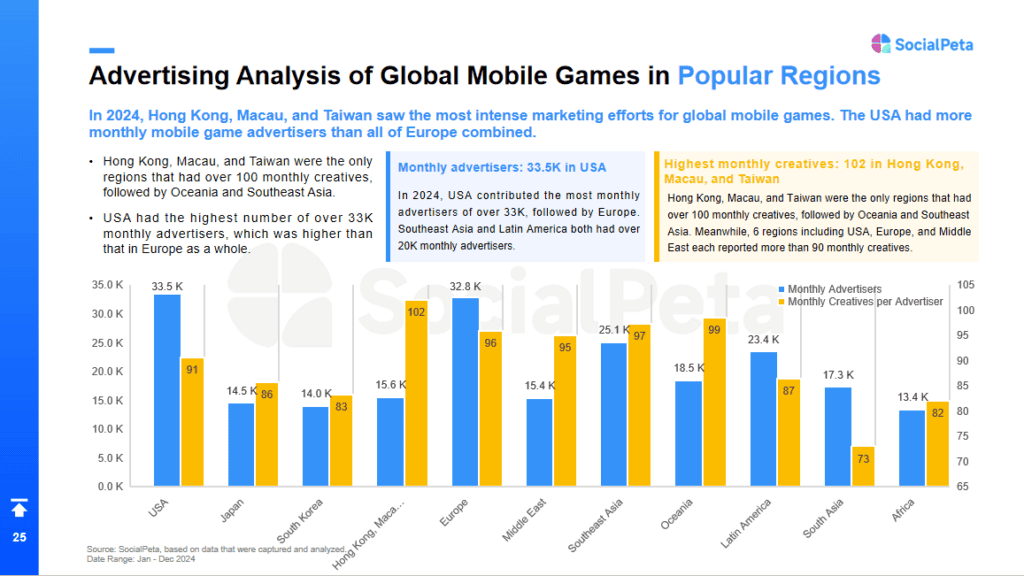

- Hong Kong, Macau, and Taiwan Lead in Competitiveness: These regions are the only ones where the average number of creatives exceeds 100. The U.S. leads in the number of advertisers, surpassing Europe.

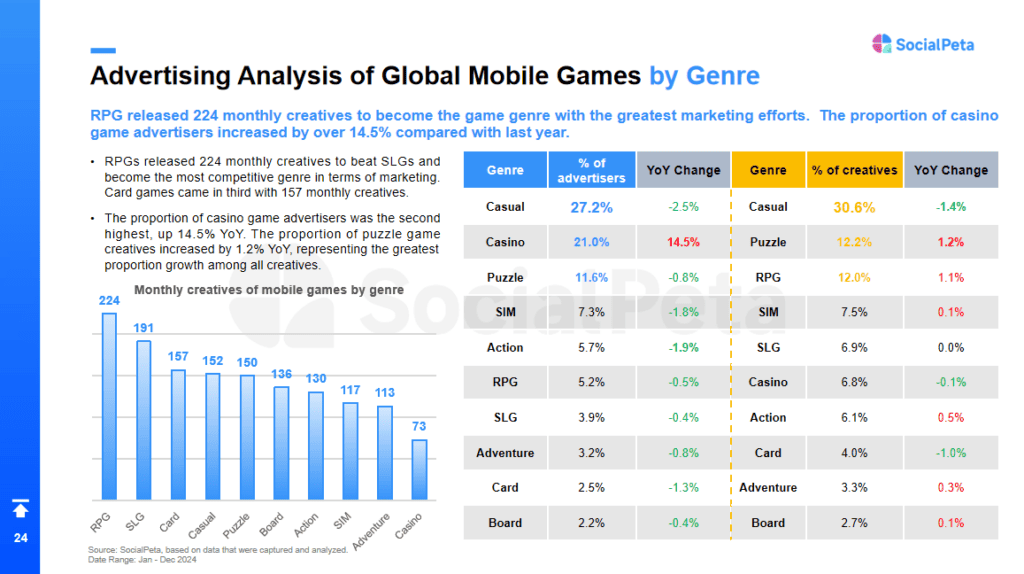

- RPG Games Dominate Creatives: RPG games have the highest average number of creatives, exceeding 220, surpassing strategy games.

- iOS Creatives Decline: The share of iOS creatives has dropped below 30%, with new creatives now almost evenly split between iOS and Android.

250,000+ Advertisers in Global Mobile Gaming: The market continues its recovery with strong advertiser participation.

Despite global economic fluctuations, the mobile gaming market has shown strong growth. In 2024, the number of advertisers exceeded 250,000, a 60.4% increase from the previous year, while mobile game creatives grew by 15.4%, surpassing 4.5 million. This growth underscores the increasing reliance on advertising for mobile game success.

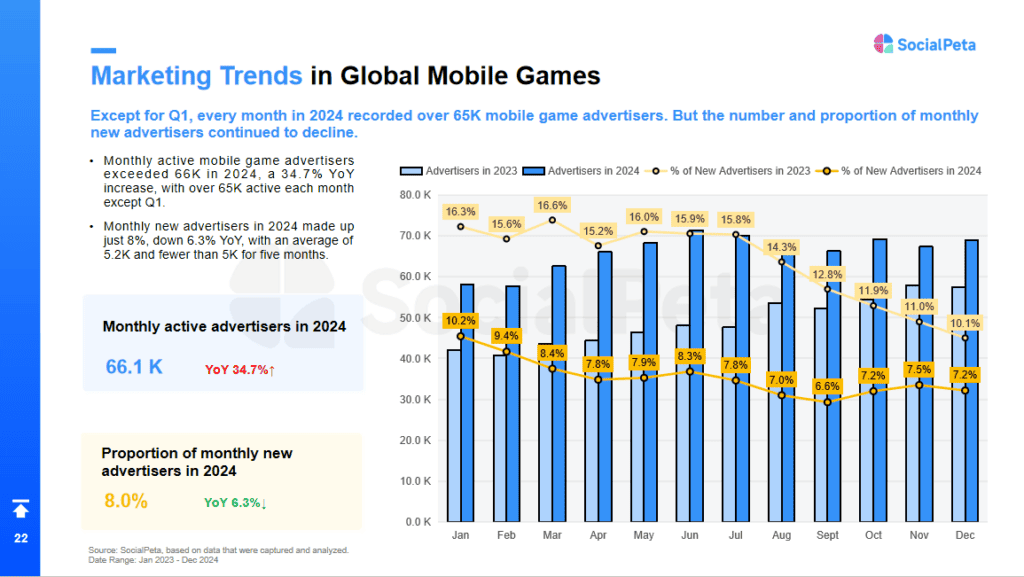

In 2024, monthly mobile game advertisers consistently exceeded 65,000, except in Q1. However, the proportion of new advertisers declined, suggesting market maturation and fewer opportunities for newcomers. This also highlights the stability of existing advertisers and increasing competition.

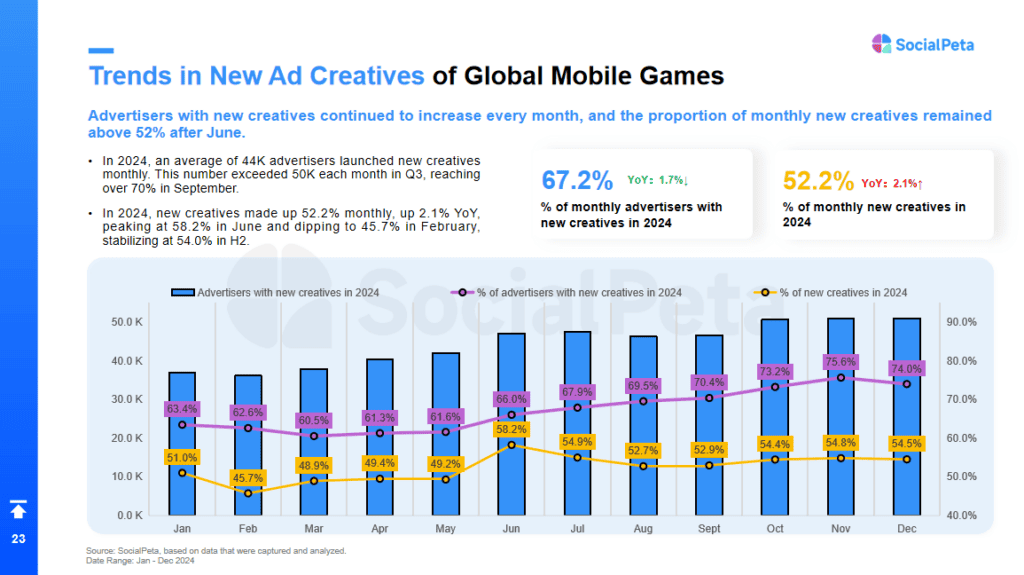

The number of new advertisers and creatives has steadily increased, with new creatives consistently making up over 52% since June. In June, the share peaked at 58.2%, showing a 2.1% year-on-year growth. This reflects the growing demand for innovative content in the mobile gaming market.

Hong Kong, Macau, and Taiwan are the most competitive markets, with the U.S. surpassing Europe in monthly advertisers

In 2024, Hong Kong, Macau, and Taiwan lead as the most competitive mobile gaming markets, with over 100 creatives per month. Oceania and Southeast Asia follow, while the U.S. surpasses Europe with over 33,000 advertisers per month.

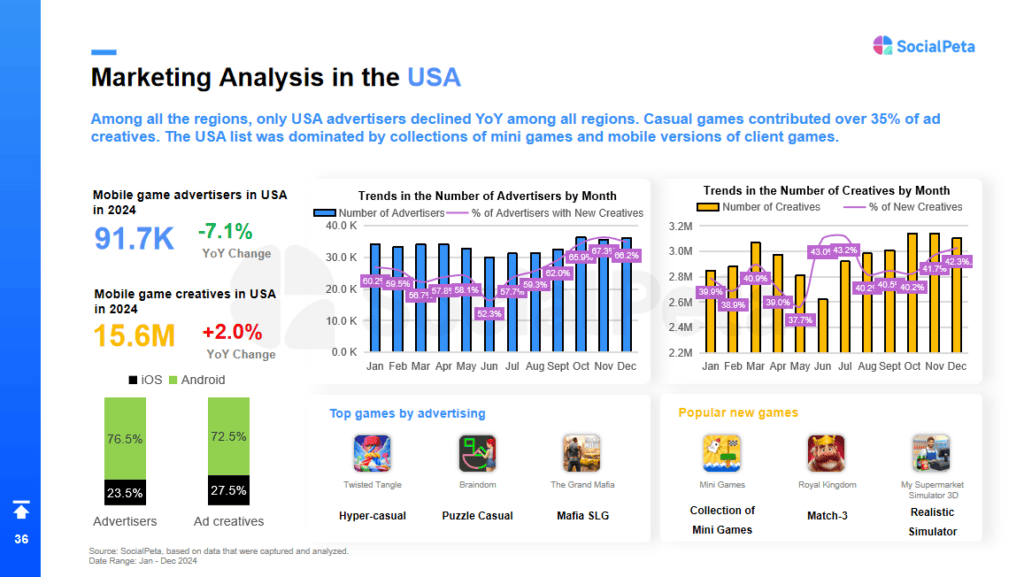

The U.S. mobile gaming market remains stable in 2024, with high acceptance and willingness to pay for IP-based games. Creative ads and local cultural integration are key to attracting U.S. users.

The U.S. is the only global mobile gaming market to see a year-on-year decline in advertisers, with 91.7K in 2024—a 7.1% drop. Despite this, the demand for high-quality creatives remains strong, as the number of mobile game creatives grew by 2.0% to 15.6 million.

Casual games, especially mini-game collections and mobile ported products, make up over 35% of advertising and continue to perform well on U.S. charts.

AIGC Boosts RPG Creatives: RPG games now have the highest number of creatives

In 2024, advertising strategies in the global mobile gaming market have become more diversified. RPG mobile games, with an average of 224 creatives per month, now lead the market in marketing efforts, surpassing strategy games to become one of the most competitive categories.

Additionally, the share of advertisers in the entertainment sector has increased by over 14.5%, and the proportion of puzzle and puzzle-solving creatives has risen by 1.2% compared to last year, highlighting the growing potential and player interest in these categories.

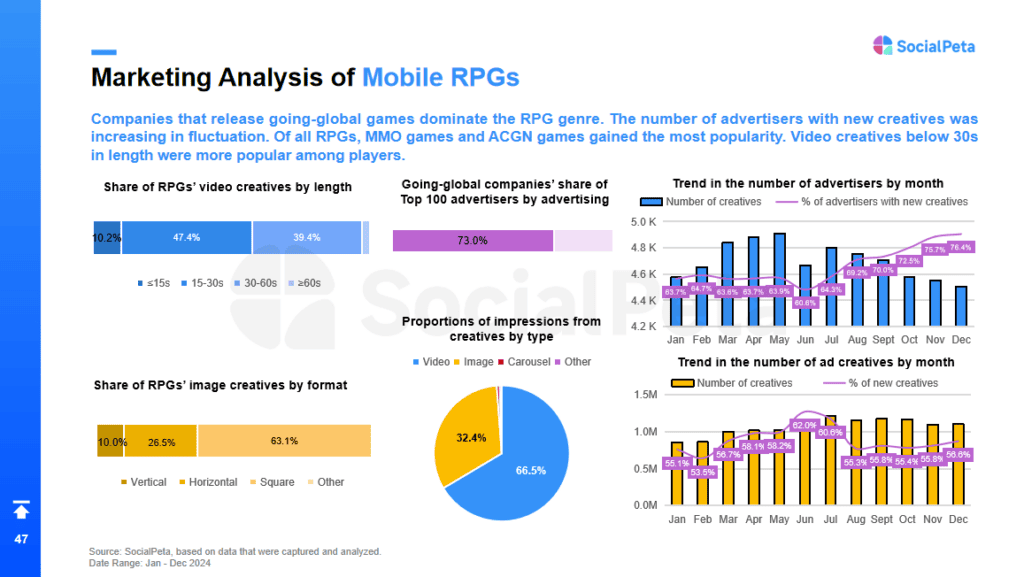

Chinese overseas developers have dominated the RPG mobile game marketing space, with the number of advertisers launching new creatives showing a fluctuating upward trend.

Notably, MMO and anime-style mobile games have gained significant popularity, with short video creatives (30 seconds or less) being especially favored by players. This trend reflects players’ preference for fast-paced, high-efficiency content, offering developers clear guidance for their marketing strategies.

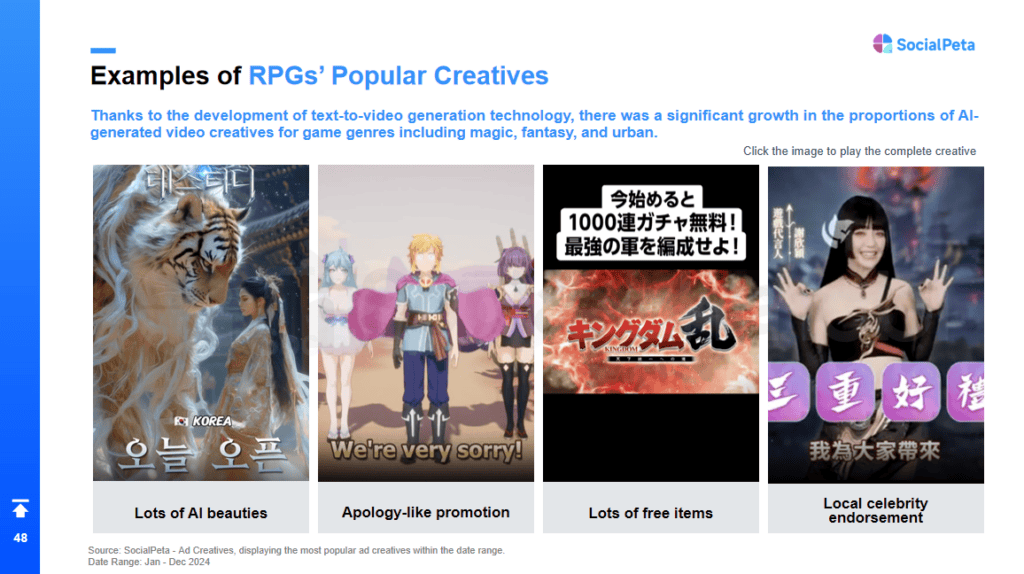

Advancements in text-to-video technology have led to a significant increase in AI-generated video creatives for genres like fantasy, magic, and urban-themed games. These technologies have not only improved the visual effects but also diversified RPG game marketing formats.

For example, promotional videos featuring AI-generated female characters, free item giveaways, and endorsements by local celebrities have successfully captured players’ attention, boosting the game’s appeal.

This white paper also offers a detailed analysis of the marketing cycles for five popular games in 2024: Capybara Go!, Vita Mahjong, Hero Wars: Alliance, Whiteout Survival, and Jujutsu Kaisen Phantom Parade.

Spanning 70 pages, SocialPeta‘s report provides an in-depth look at five major game genres and valuable insights into key overseas markets, including the U.S., Japan, South Korea, Southeast Asia, and more. You can download your free copy here.