SocialPeta has partnered with Reforged Labs to release the report “2025 Global Mobile Game Marketing Insights & Creative Breakdown”, offering an in-depth look into the latest creative and marketing trends across the mobile gaming industry.

By analyzing over 1.7 billion ad creatives and tracking millions of daily updates, the report uncovers the evolving strategies that top advertisers use to capture user attention and maximize ROI.

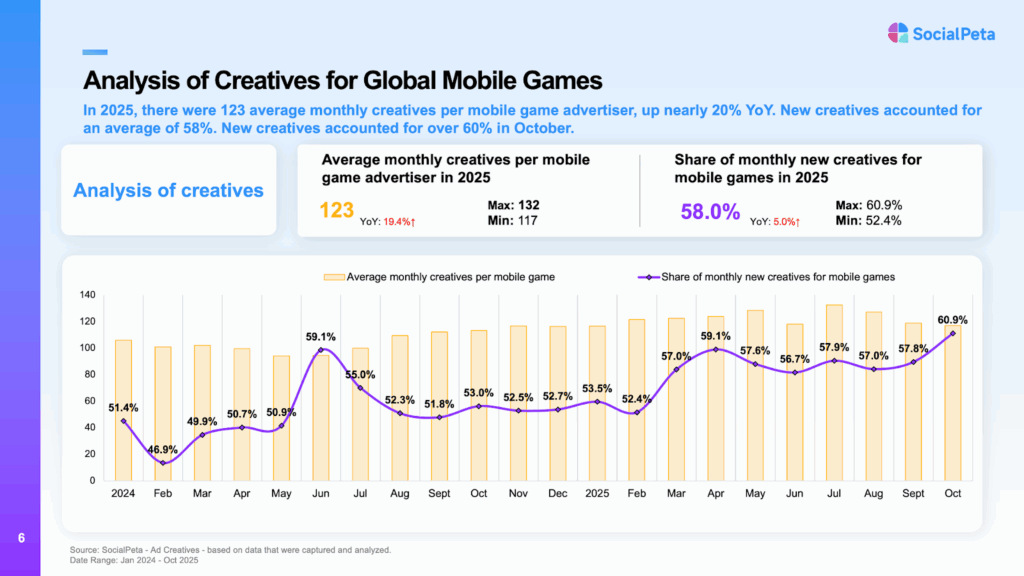

1. Global Creative Landscape: Volume and Speed Are Key

The 2025 mobile gaming market is more competitive than ever. On average, advertisers globally deploy 123 creatives per month, up 19.4% year-on-year, with peaks reaching 132. More importantly, 58% of monthly creatives are new, reflecting the fast-changing preferences of users. High-frequency iteration is no longer optional—developers who can quickly optimize and refresh creatives will gain a significant edge.

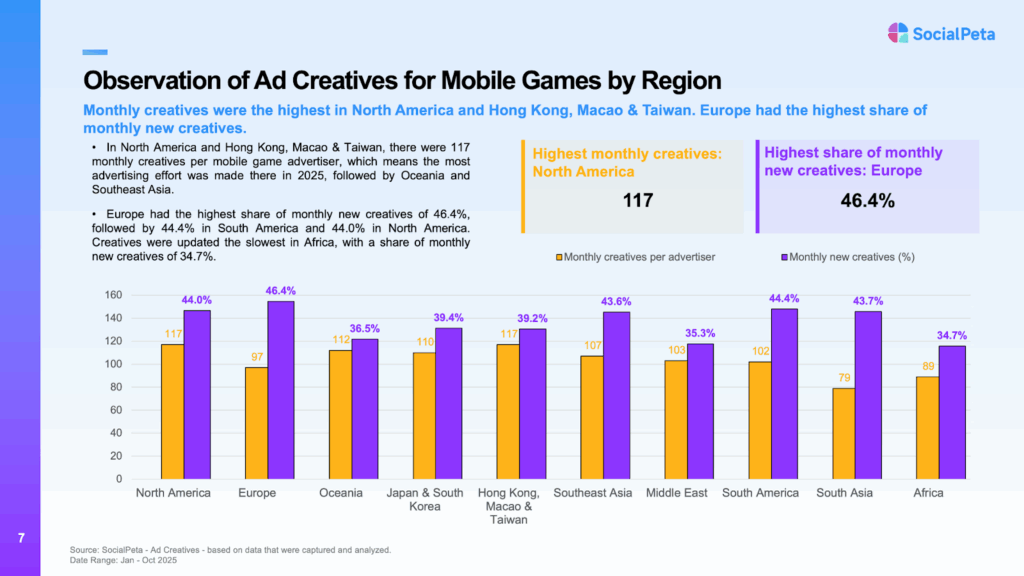

2. Regional Deployment Strategies

Creative strategies differ sharply across regions, highlighting the importance of localized marketing:

- North America & HK/TW: The highest creative volume at 117 per month. Success requires broad coverage and attention to multiple audience segments to avoid fatigue.

- Europe: Fastest iteration at 46.4% new creatives monthly. Users demand novelty, so rapid iteration and innovative concepts are essential.

- Other regions: Oceania and Southeast Asia rank third and fourth for creative volume, while Africa has slower updates, suggesting targeted, lower-frequency strategies for emerging markets.

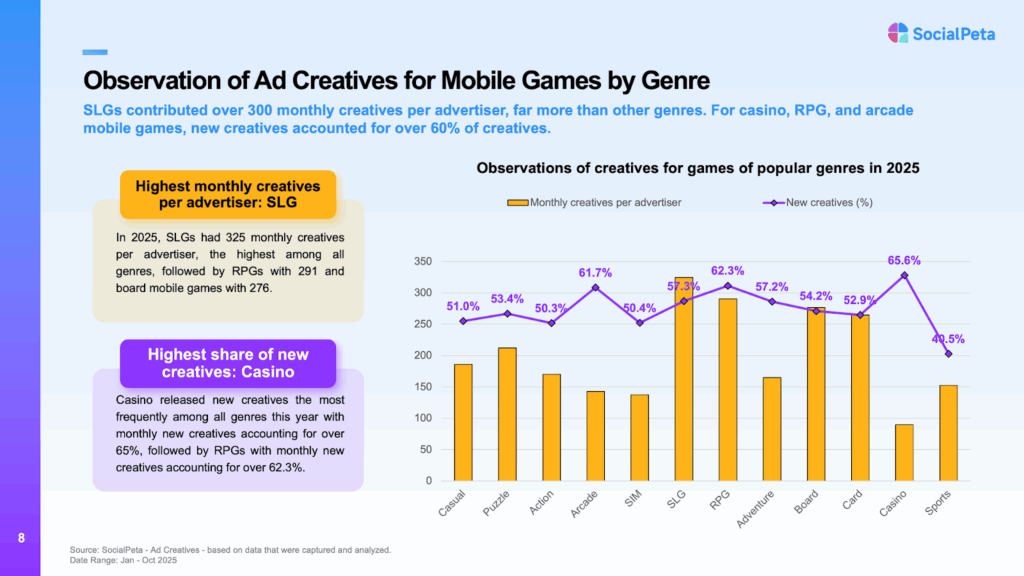

3. Category Insights

Creative deployment also varies by game genre:

- Strategy games: Lead with 325 creatives per month, reflecting the need to showcase gameplay depth, world-building, and social systems.

- RPGs and board games: Moderate creative needs, relying on frequent updates to maintain user engagement.

- Casual or sports games: Lower creative iteration is sufficient, given simpler gameplay and stable user engagement.

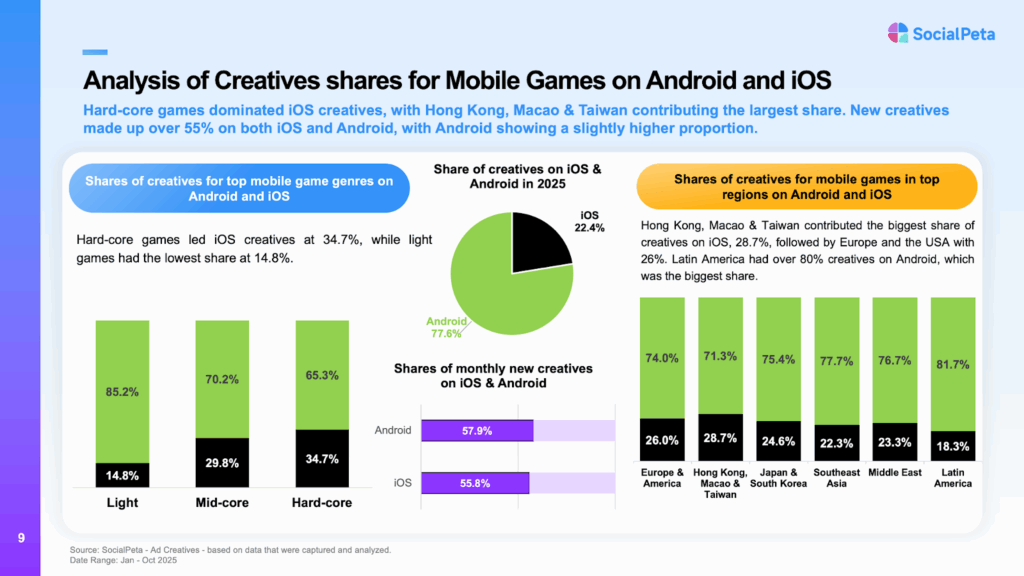

4. Platforms and Creative Types

- Android dominates (77.6% of creatives), with iOS favored in heavy games and mature markets like HK/TW and Europe.

- Video creatives lead the market, particularly for puzzle and fast-paced games. High-impact visuals and short demonstrations capture attention effectively.

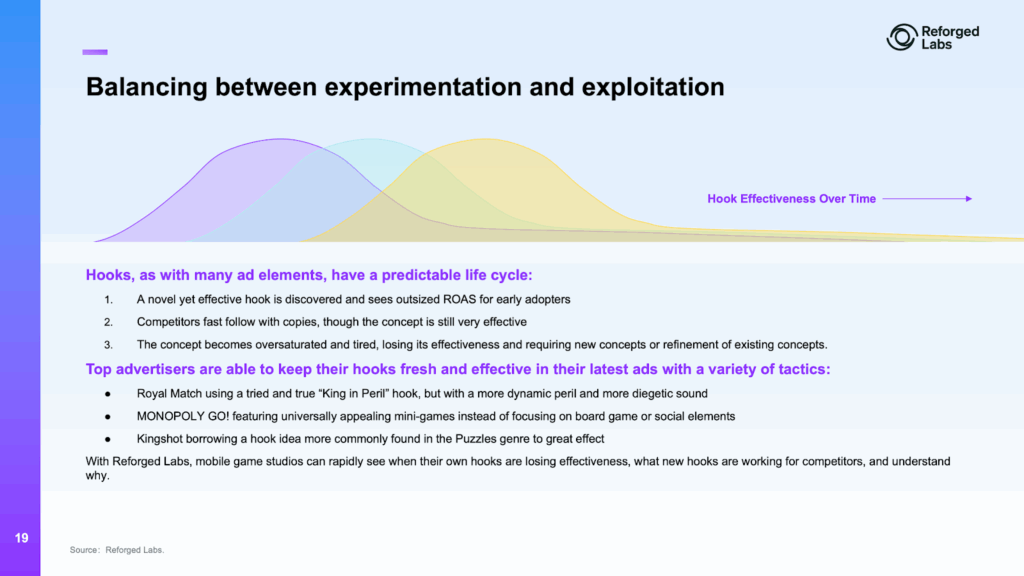

5. The Life Cycle of a Hook: Balancing Experimentation and Exploitation

One of the report’s most valuable insights is how top advertisers manage creative hooks—balancing experimentation (discovering new hooks) with exploitation (leveraging proven hooks).

Every hook follows a predictable life cycle:

- Discovery: New hooks deliver exceptional results for early adopters.

- Fast-Follow Duplication: Competitors copy the hook, performance normalizes but remains effective.

- Oversaturation: Hook effectiveness declines, requiring iteration or new concepts.

Examples from leading advertisers:

- Royal Match: Refreshes the classic “King in Peril” hook with dynamic danger and immersive sound.

- MONOPOLY GO!: Moves beyond board game visuals to universally appealing mini-games.

- Kingshot: Adapts puzzle game hooks to other genres with strong results.

Understanding and managing hook lifecycles allows advertisers to maintain a competitive edge by continually innovating while maximizing proven strategies.

The 28-page report provides detailed insights on global creative trends, formulas for top-performing ads, and hook analysis—essential for any developer looking to break creative homogenization and maximize ROI.

Download the full report here.