Year-end recap posts are a useful snapshot of what game and app companies want to emphasize after a busy year—new launches, major updates, growth moments, and priorities for the year ahead.

In this roundup, we have collected 2025 recaps from Turkiye’s game and app ecosystem and pulled out the most relevant highlights, including milestones, available numbers, and early signals for 2026.

Rollic

In its 2025 recap, Rollic put the spotlight on Color Block Jam.

- The game reached 60 million players, including 3 million daily players, and was played across all seven continents for a combined 39.6 billion minutes.

- Rollic also highlighted the game’s top charts performance, noting it hit #1 in Top Free Games on Feb 3, 2025, and later climbed to #15 in Top Grossing on Apr 17, 2025.

- We covered the success story of Color Block Jam with insights from Gybe Games and Rollic on how the title came together.

- We also covered how Take-Two secured full rights to Color Block Jam through Rollic and Zynga, following the Turkish Competition Authority’s approval of the transfer.

- In 2026, Rollic will push stronger into the Action RPG genre, with a senior hire signal and an increased emphasis on in-house tech.

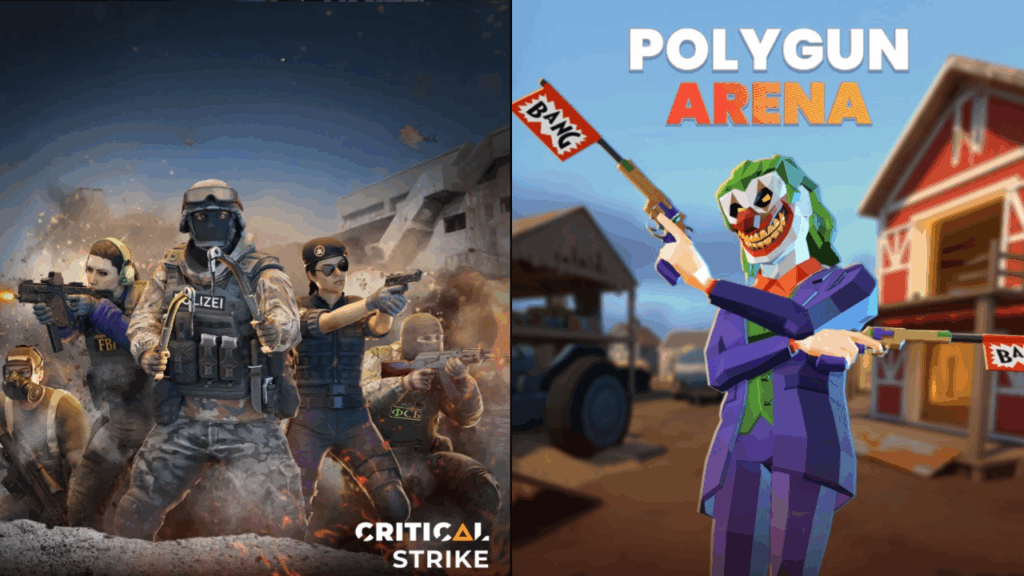

Vertigo Games

In its 2025 recap, Vertigo Games shared a 2026 Hiring Wishlist, saying it’s growing the teams behind its games and inviting candidates to check its open roles.

- The studio listed openings across art, engineering, data, product, and growth, including 2D Art Lead, UI Designer, 3D Environment Artist, Senior 3D Animator, Technical Artist, Game Developer, Data Analyst, Data Engineer, and Lead Data Scientist, alongside Growth (New Grad) and Product Specialist (New Grad) roles.

- We covered Critical Strike surpassing 153.5 million total installs.

- Vertigo’s DTC partnership with Aghanim helped triple off-app revenue for Critical Strike in the first month and increased average check size by 19%.

- We also published a deeper look at how Vertigo scaled up on midcore in Turkiye with Critical Strike and Polygun Arena and what’s next for the company.

Unico Studio

In its 2025 recap, Unico Studio shared a product recap and 2026 vision centered on the Brain Test series.

- The studio highlighted its 2025 content output across multiple titles, including 49 new episodes for Brain Test 1, new story additions for Brain Test 2, 19 new levels (and story completion) for Brain Test 3, 100 new levels for Brain Test 4, and 100 new levels for Brain Test 5 (bringing the experience to ~400 total levels).

- Unico also shared download totals as of Dec 15, 2025, reporting 164M total downloads across the series (BT-1: 93M, BT-2: 14M, BT-3: 10M, BT-4: 12M, and BTAS: 35M).

- In 2026, Unico plans to grow Brain Test 1 to 250 total episodes, add two new stories to Brain Test 2, and release 200 additional episodes for Brain Test 4.

- Unico Studio surpassed 1.6 billion total downloads worldwide (alongside 750 million web game plays), and the company is pushing to expand its work with external IP partners.

HyperMonk

In its 2025 recap, HyperMonk looked back on a full year of building, learning, and team growth—ending with a clear message: “2026, we’re ready.”

- HyperMonk’s games have passed 100,000,000 downloads worldwide.

- The company noted the team grew by 100% over the year.

- HyperMonk also shared that the team moved into a new HQ.

- The studio ranked among Deloitte Technology Fast 50 Turkiye 2025, alongside two other game companies from Turkiye.

Yamy Studio

In its 2025 recap, Yamy Studio highlighted a major milestone: ranking 5th on Deloitte Technology Fast 50 Turkiye 2025.

- Yamy Studio was recognized as the 5th-fastest-growing technology company in Turkiye and credited its team, investor UP Capital Management, and partner Leus.

- Deloitte’s list coverage places Yamy Studio in the top five, with a reported 2,696% growth rate.

- Yamy Studio was selected for the London Market Expansion Programme, aimed at supporting Turkish startups entering the UK market.

Laton Ventures

In its 2025 recap, Laton Ventures looked back on its second year and framed the momentum as “just getting started.”

- Laton closed its first fund at $50M, completed 8 new investments across Turkiye, the US, and Europe (bringing it to 13 deals in 2 years), and reported an 80% next-round graduation rate among its first-year investments.

- The firm also highlighted portfolio and ecosystem activity, noting Grand Games “topped the charts” following its $30M Series A, ranking #3 most active gaming VCs globally, and organizing 6 events across 4 countries while attending industry events in 10 countries.

- In 2026, Laton signals continued pace on investing and ecosystem-building, emphasizing that it’s “just getting started.

Boğaziçi Ventures

In its 2025 recap, Boğaziçi Ventures focused on fund performance, asset growth, and the launch of a new AI-focused vehicle, while positioning 2026 as a year to accelerate growth and sustain differentiated, tech-driven returns.

- Boğaziçi Ventures said several of its funds outperformed their benchmarks in 2025, and that it strengthened its position in fully technology-managed statistical arbitrage funds, closing the year with assets under management exceeding TRY 10 billion ($232.8M).

- The firm also highlighted the launch of BV Growth II, a fund investing in early-stage and growth-stage AI startups in Turkiye and Korea, noting it started quickly and made its first investment before year-end.

- Boğaziçi Ventures stated it made direct investments totaling TRY 471 million ($11.0M) into 19 startups across AI, HR Tech, Ed Tech, Gaming, Fintech, and other verticals, and invested TRY 30 million ($0.70M) into three VC funds to support the broader ecosystem.

- Portfolio highlights included Gulliver’s Games reaching scalable growth and profitable game metrics with Word Tiles GO (with 70%+ of its user base coming from Tier-1 markets), Joygame Publishing progressing toward an IPO (including approval to move into the registered capital system and entry into a Q3 2026 IPO timeline) while reporting 8M MAU and 50M+ mobile downloads, and Lucid11 Interactive’s Party Club reaching ~4M library adds and 800K+ unique users on Steam.

Codeway

In its 2025 recap, Codeway framed the year around portfolio scale, cross-category focus, and apps that “raised the standard” across markets.

- Codeway’s portfolio matured across categories, highlighting user scale by vertical: Utility & Productivity (200M+ users), AI Creativity (130M+ users), Education (100M+ users), Wellness (15M+ users), and Media (10M+ users).

- The post also spotlighted individual category wins, including CleanUp as the world’s top-grossing cleaning app (65M+ downloads),

- Retake as the #1 most downloaded face editor app in the US (28M+ downloads),

- Learna AI as the #1 fastest-growing language learning app (30M+ downloads),

- IQ Masters as the #1 most downloaded brain training app (22M+ downloads),

- and HeartIn as the #1 most downloaded heart rate tracker app worldwide (6M+ downloads).

Moving into 2026, Codeway positioned the year ahead as continuing “at full speed,” with an emphasis on compounding portfolio growth and building the “next generation of flagships.”