Headquartered in Montreal and launched in 2016, Mistplay is a media source for game publishers, most recently achieving Top 10 for ROI and Retention on the 2024 Singular ROI Index.

The Mistplay team has run a survey and has categorized respondents by genre engagement and segmented them into five groups based on the genres of games they played in the last 30 days:

- Casual Candace (Match, Puzzle, Simulation )

- Midcore Mike (Strategy, Action, Shooter, RPG)

- Lucky Lucy (Social Casino)

- Sporty Steve (Sports, Racing)

- Party Patty (Hypercasual, Party, Tabletop)

Mistplay asked industry experts what awaits the market in 2025

These new insights empower marketing, product, and monetization teams to prioritize player-centric innovation and unlock new growth opportunities in 2025, with a focus on optimizing the early stages of the mobile growth funnel – from first ad impression through D7 of the user journey – to ensure that initial user stickiness paves the way to long-term retention and heightened LTV.

Predictions for mobile gaming growth in 2025, supported with insights from industry experts:

Publishers will hyper-personalize the user journey to maximize LTV

User acquisition and monetization need more segmentation than ever. Marketing in 2024 is all about segmentation of the audiences and not having a one-size-fits-all approach.

You need to understand your audience. You need to segment it. But I believe it is a necessity in this day and age to really speak deeply to a specific audience and adapt your message to something that they want to hear and not what you want to say.

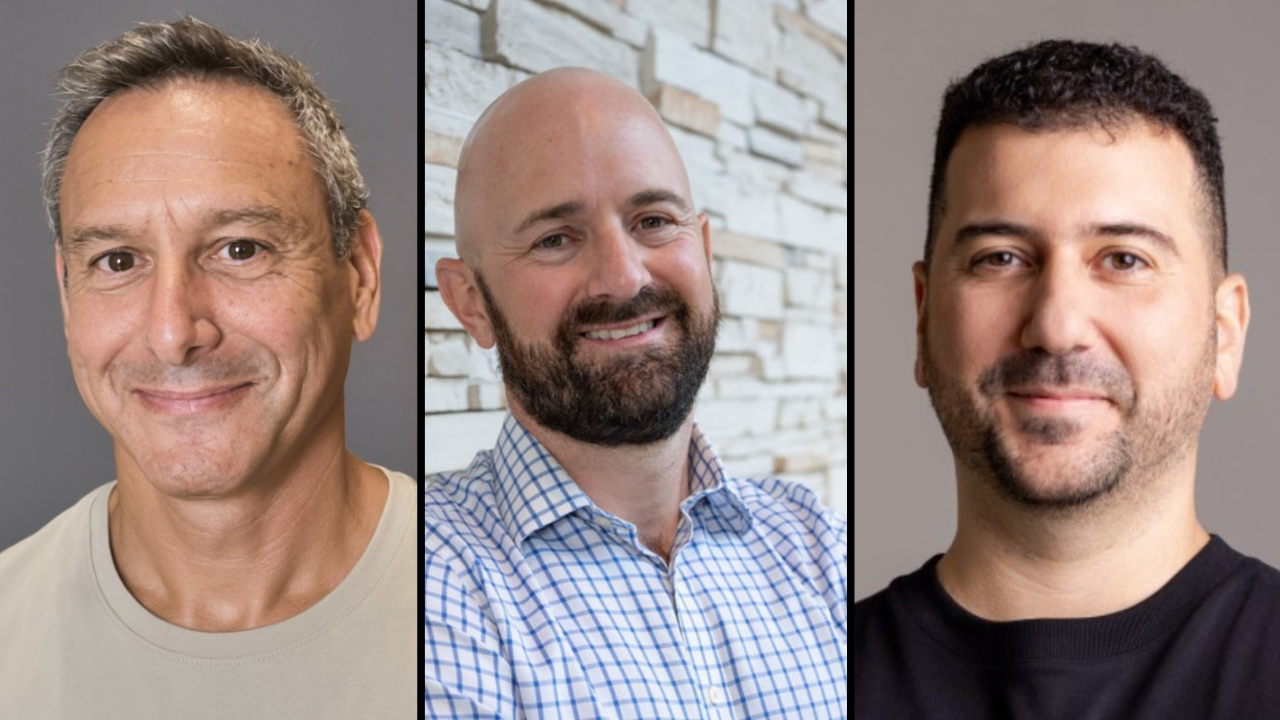

GUS VIEGAS, Vice President of Marketing at Cosmic Lounge

Brand marketing initiatives will enrich paid acquisition to reduce overall CAC.

“If you want to strengthen your overall paid UA CAC, brand awareness strategies work really well. Investing in yourself, in your brand, and who you are, is always paying off. For games, social proofing works really well.

Whether it’s testimonials or awards like Game of the Year, people want to understand that you are not a scam because there is more and more competition. Creative tailored to your audience that is socially proofed and user-first is what works best.

CLAIRE ROZAIN, Founder of RZAIN Consulting

New monetization models will further grow in popularity to scale revenue.

“Right now, many publishers are trying to introduce different streams of revenue to reduce dependence on Apple and Google. The main thing I see on the market right now is promising emerging alternatives, like an increasing interest in DTC web shops that will continue to rise.

OXANA FOMINA, Founder of Gradient Universe Games Analytics Consultancy

Publishers will lean more into IP and brand collaborations for increased retention and spend.

“IP and brand collaborations are a sweet spot for everyone to get more organic installs, drive awareness, and get people passionate about your game. If you bring the story from an IP into your game, you increase your perceived value.”

CLAIRE ROZAIN, Founder of RZAIN Consulting

More full-funnel reward programs will be integrated to increase acquisition and stickiness.

“There will be an even greater rise in rewarded apps—they’re growing rapidly, and they’re here to stay. With increased competition, everyone is searching for answers, and the usual solutions just aren’t cutting it anymore.

We’ll see more innovative rewarded approaches, with rewards evolving to be more sophisticated and exciting.”

MICHAL PROKOP GRNO, CMO of Pixel Federation

Mistplay’s 2024 Mobile Gaming Growth Report provides holistic insights through a segmented analysis, spanning spenders, non-spenders, and core personas based on top mobile game genres.

Key findings include:

- Brand collaborations fuel increased IAP spending: 54% of spenders who engage with an in-game IP or brand collaboration have made a related in-app purchase. Additionally, 18% of spenders say these collaborations positively impact their desire to install a new mobile game.

- Early churn is largely driven by misaligned expectations: 77% of gamers state their leading reason to churn from a mobile game is a poor balance between gameplay and monetization while 66% also state misalignment between ads and gameplay is another top reason.

- Game discovery is impeded by oversaturation of ads: When searching for a new game, nearly 50% of players claim they are overwhelmed by the amount of games advertised. Over 25% are also seeking clarity on offline availability and are apprehensive about pay-to-win mechanics.

- A majority of players conduct extra research before installing: 75% of players take extra steps after ad impression and before game install, including 49% looking up reviews and 16% also researching online for more information about the game.

- DTC webshops are a win-win for players and publishers: 26% of players are open to visiting a publisher’s DTC web shop to explore exclusive IAP deals and special events, and 8% of spenders have already made a purchase.