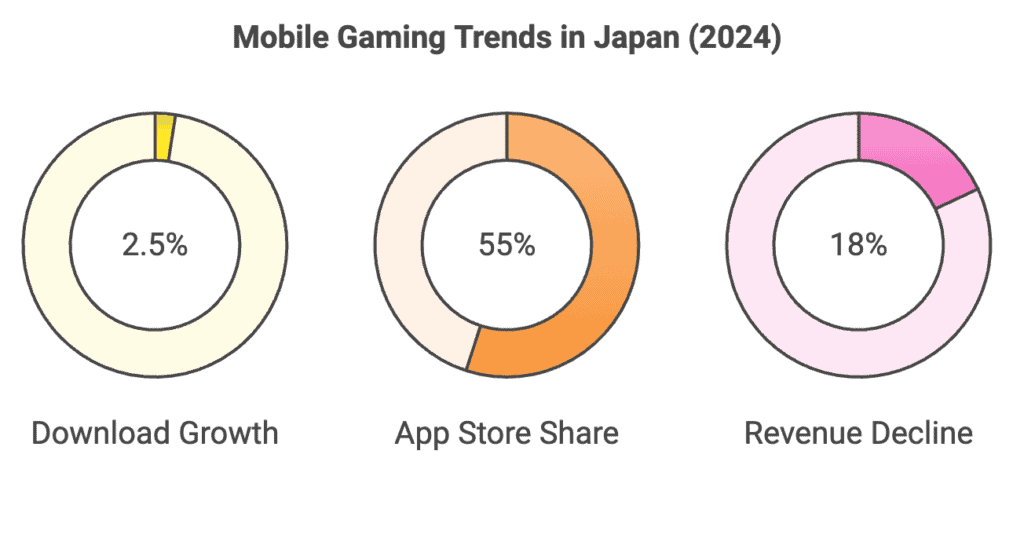

The first half of 2024 brought both opportunities and challenges for the Japanese mobile games market. While download numbers continued to climb, a significant drop in revenue highlighted the impact of external factors and shifting player preferences.

This report examines the key trends shaping the market, examining the performance of leading games and publishers, and identifying potential areas for growth and adaptation.

More Downloads, Less Money

Download Growth:

The Japanese appetite for mobile games remained strong. Downloads grew by 2.5% year-on-year, reaching 320 million. The App Store accounted for a majority share (55%), indicating a preference for iOS devices among Japanese gamers.

Revenue Decline:

Despite healthy download numbers, overall market revenue declined. dropping by 17% year-on-year to $5.3 billion USD. This downturn is due to the weakening yen against the US dollar, making in-app purchases more expensive for players.

Top Games and Publishers: Established Dominance and Rising Stars

Leading Games:

Japanese-developed games dominated the top spots in the revenue charts.

- Monster Strike: Mixi’s veteran title retained its leading position, generating over $290 million. This long-standing hit is approaching its 11th anniversary and boasts over 50 million users in Japan.

- Legend of Mushroom: A notable newcomer, Joy Net Games’ Legend of Mushroom, achieved remarkable success following its February 2024 launch. It quickly surpassed $100 million in revenue, becoming the only new title to break into the top 10 revenue rankings by July 2024.

- Dragon Ball Z Dokkan Battle: Strategic events and collaborations, like the DOKKAN Fest × Legendary Summon Festival, drove significant revenue growth for this title, resulting in a 28% year-on-year increase.

Publisher Performance:

Bandai Namco Entertainment emerged as a top performer, driven by the successful debut of Gakuen Idolmaster and the continued strength of titles like Dragon Ball Z Dokkan Battle.

- Gakuen Idolmaster: This new anime game based on a fresh IP quickly topped revenue growth charts and secured the leading position for IP-based mobile game revenue.

- Overall Success: Bandai Namco Entertainment’s revenue in Japan reached $390 million, a 3.5% quarter-on-quarter increase.

- Global Reach: The company also demonstrated its ability to attract international audiences, generating $270 million from overseas markets, representing 40% of its total global revenue.

IP Performance: The Power of Familiar Faces

Top Grossing IPs:

Established intellectual properties (IPs) continued to demonstrate their strong appeal.

- Dragon Quest: Mobile games based on this beloved franchise generated $170 million in revenue, led by titles like Dragon Quest Walk and DRAGON QUEST TACT.

- Uma Musume Pretty Derby: This title maintained its dominance as the highest-grossing IP-based mobile game, generating over $160 million in revenue. Its third-anniversary celebrations significantly boosted revenue, leading to a remarkable 64% month-on-month increase in March.

Anime-Style Mobile Games: Japan’s Global Influence

Japan’s Authority:

Japan remains the world’s largest and most lucrative market for anime-style mobile games, accounting for 49% of global revenue generated by the top 50 titles.

Leading Titles:

- Domestic Strength: Established Japanese titles like Monster Strike, Uma Musume Pretty Derby, and Puzzle & Dragons continued to dominate the top revenue spots.

- International Success: miHoYo’s Honkai: Star Rail and Genshin Impact secured positions within the top 8, demonstrating the potential for overseas developers in this market.

- New Releases: Several new anime-style games entered the top 8 on the growth chart, including Gakuen Idolmaster, Saint Seiya: Legend of Justice, Love and Deepspace, Zenless Zone Zero, Wuthering Waves, and Solo Leveling: Arise. Notably, five of these are from overseas publishers.

Otome Games: A Genre on the Rise

Japan’s Leading Position: Japan remained the primary market for otome games, accounting for 70% of global revenue in 2023.

Changing Dynamics: The launch and rapid growth of Love and Deepspace, a Chinese-developed otome game, increased China’s share of global revenue to 45%.

Love and Deepspace’s Success:

- Rapid Growth: This title gained traction in Japan, generating over $21 million in revenue and becoming the fastest-growing otome game.

- Global Performance: Love and Deepspace achieved $200 million in global revenue, with Japan emerging as the highest-revenue market outside of China.

Note: The data and insights presented in this report are primarily sourced from Sensor Tower.

Zenless Zone Zero: A Case Study in Successful Launch

Launch and Growth:

miHoYo’s Zenless Zone Zero, a stylish action RPG, experienced a highly successful launch in the Japanese market.

Popularity: The game’s unique blend of urban fantasy setting, fast-paced combat, and engaging characters resonated strongly with players.

Contributing Factors: miHoYo’s strong reputation, pre-registration campaigns, and effective marketing efforts contributed to the game’s success.

Performance Metrics: Zenless Zone Zero achieved high rankings on download charts and maintained a strong presence in top-grossing charts, demonstrating its ability to attract and retain players.