In the current global landscape, the Turkish games industry is a success story. In 2021, the Turkish gaming market was worth $1.2 billion. By 2025, it’s expected to reach $2.2 billion.

Several factors contribute to this on-going growth. One is the increasing popularity of mobile gaming, as most Turkish gaming revenue comes from hyper-casual and casual mobile games. The other is a change in distribution, as some mid to big size studios with the know-how, experience, talent pool and in-house tools have started the shift to self-publishing.

If you’re a Turkey-based game developer, keep reading to discover how you can use alternative payment methods and self-publishing tools to generate sustainable, long-term revenue for your games.

Go global with your video game

The games industry has challenges, like the high cost of UA and operations, inflation, and changing consumer habits. Game developers naturally seek ways to generate extra revenue, and a great way to do that is to expand into foreign markets. But starting to sell a game globally can take time and effort. Developers must learn about each market’s different payment methods, regulations, and marketing strategies. Still, the revenue opportunities far outweigh the cost of the challenges.

Opportunities

- Global revenue. In 2021, the global gaming market was worth $196 billion and is expected to grow to $295 billion by 2025. Turkish game developers can tap into this large and growing market now.

- Diverse audiences and payment methods. The global gaming audience is very eclectic. People from all over the world play games and have different interests and preferences. Turkish game developers already create games that appeal to a wide variety of players. Accepting alternative payment methods popular and widely used in specific regions will draw even more players to their games.

- Supportive government policies. In 2021, the Turkish government announced many measures to support the gaming industry, including tax breaks and subsidies. These measures make it easier for Turkish game developers to start and grow their businesses.

Challenges

- Diverse payment methods. Every country has different popular payment methods, often due to availability and customer preference. For example, in the United States, credit cards are the most popular payment method, while in China, mobile payments are the most popular. Developers must offer and accept payment methods widely used in the regions where they want to sell their games for maximum benefit.

- Regional regulations. Governments around the world have different rules for video games. For example, in some countries, there are restrictions on the types of games that can be sold, and in others, there are restrictions on the amount of money that can be spent on in-game purchases. Regardless of where the game originates, its developers must comply with the regulations in the countries where they want to sell their games.

- Competition with established publishers. Another challenge Turkish game developers face is competition with big international game publishers. These publishers have a lot of resources and experience, which gives them a significant advantage over smaller developers. As a result, smaller studios often turn to major foreign publishers for support.

Understand and use regional payment methods to your advantage

To succeed in a new market, you must create an experience that makes it easy for local players to get excited about your game. How? By localizing checkout and payments and optimizing them for the regional audience. For example, you can increase conversion rates by up to 3x when you accept local currency.

Below, we examine a few regions, highlighting their preferred payment methods to help you define your business strategy. You can establish individual relationships with each local payment solution and then implement them individually, or you can partner with a merchant of record that can handle these relationships and implementations for you.

United States

Essentially, most US local payment methods are the same as the popular global options, such as credit and debit cards( Mastercard, Visa, Discover, others) digital wallets like PayPal and Venmo, and mobile payment services like Apple Pay and Google Pay.

One of the main challenges present in the US and the entire North American region is the increasing demand for faster and more secure payments. Consumers want options that are both convenient and offer comprehensive security measures. In this area especially, developers should focus on payment seamlessness, security, and scalability for growth – though we recommend they do so for every region worldwide.

For example, ApplePay enables multiple layers of security, including biometric authentication and tokenization, to protect consumers’ payment information and prevent fraud. And Venmo has become quite the popular payment method for millennials and younger generations looking for a fast, easy, and social way to send and receive money. Venmo also offers strong security measures, such as encryption and multi-factor authentication, to protect users’ payment information.

Brazil

Brazilians prefer local retailers, so enabling local payment methods, like Pix and Boleto Flash, is essential if you plan to bring your game to this region. Pix is an instant payment method offered by the Central Bank of Brazil only in Brazil. It’s available 24/7, even on weekends and holidays, and Pix transactions occur in less than 10 seconds. And Boleto Flash can be paid via mobile or online banking, at an ATM, at the counter of an associated bank, or at any of the 13,000+ lottery agencies throughout the country – and the merchant gets a payment confirmation within the hour.

Another popular payment app is PicPay. It is Latin America’s largest digital wallet, with over 70 million registered users across Brazil. The app allows consumers to send money to friends and make online purchases, with funds that can be added to the account by payment card, bank transfer, or cash.

And a great way to draw in players is to offer installments because it is a popular payment method in Brazil that accounts for 90% of credit card transactions in the country. Installments can increase your average transaction value and revenue-per-player for your game: Xsolla transaction data showed a 20% revenue jump for games that enabled credit card payments via installments. Installments are popular because they offer more purchasing power, empowering individuals to pay for a purchase over several months without paying interest. With the Brazilian economy unstable, people there are less likely to have savings, so installments allow them to buy things they might not be able to afford otherwise.

India

Over 10% of the world’s gamers reside in India. While the average revenue per paying user (ARPPU) in the Indian gaming market is low compared to more established markets, much of its growth potential lies in the region’s sheer volume of gamers. As more of India’s growing population of 1.42 billion citizens take up gaming, it will only boost the potential for the market’s overall value.

Several popular payment methods exist in India, but online banking remains the most widely used. All major banks, like Axis Bank, Citi Bank, and State Bank of India, offer online services allowing customers to transfer funds, pay bills, apply for loans, shop, and much more.

Unified Payments Interface (UPI) aggregates multiple bank accounts of any participating bank into a single mobile app. Launched in 2016 by the National Payments Corporations of India (NPCI), the UPI instant payment system now supports more than 370 banks. It also incorporates many preferred payment apps, like PhonePe, Google Pay, and Paytm Wallet.

Paytm, one of the more popular local digital wallets, was introduced in 2010. In January 2023, Paytm had more than 330 million registered users and 89 million monthly transacting users.

Japan

It’s no secret that video games are a big part of Japanese culture. Besides being the third largest video game market globally, Japanese gamers spend more on purchases too. According to the Global Games

Market Report, Japan’s average spend per player is 1.5 times higher than in North America and 2.5 times higher than in Western Europe.

People in Japan use credit cards, digital wallets, and direct carrier billing (payments charged to the user’s mobile account) to make purchases. But approximately 20 million people, accounting for about 20% of the Japanese ecommerce market, use Konbini.

Konbini is a cash-based payment system that allows shoppers to make online purchases using cash at ATMs or convenience stores (also called konbini). Konbini boasts a 0% fraud rate, and compared to other Japanese cash-based payment methods, it has a markedly lower rate for its transaction fees. Konbini is deeply integrated into everyday Japanese life; it’s available at over 50,000 locations, including major convenience store chains on nearly every block in major cities. Although Konbini has a smaller market share than credit cards, Xsolla data shows that the average Konbini purchase is twice as big as a credit card one.

Other preferred local payment methods are mobile apps that link to a bank account or credit card for funds, like PayPay, LinePay, and Rakuten Pay. PayPay is a QR-code-based payment method accepted at retailers across Japan, including convenience stores and supermarkets. Backed by SoftBank, PayPay currently has more than 55 million registered users. And LINE Pay, offered by the Japanese messaging service LINE, is used by at least half of LINE’s 90 million active users. Launched in 2016, Rakuten Pay recently replaced their traditional payment methods with a simple QR code scan, likely following PayPay’s lead.

Partner with a global payments and compliance powerhouse

One of the best steps Turkish developers can take when they begin selling their games internationally is to accept alternative payment methods. In certain regions where ‘traditional’ payment methods like bank cards or credit cards are not widely used, that will automatically help to increase the paying user base. And overall, letting players pay how they want, in the way that is most convenient to them, will eventually generate extra revenue.

The next best step is to partner with a payment solution provider like Xsolla. That takes the pressure off devs to know all the intricacies of payments and regulations for every local region because Xsolla handles all of that complexity. And Xsolla offers more than just payment processing to help developers enter the global market, with additional services such as localization, marketing, distribution, and 24/7 customer support.

Here are three Xsolla solutions that can benefit any Turkey-based developers starting today:

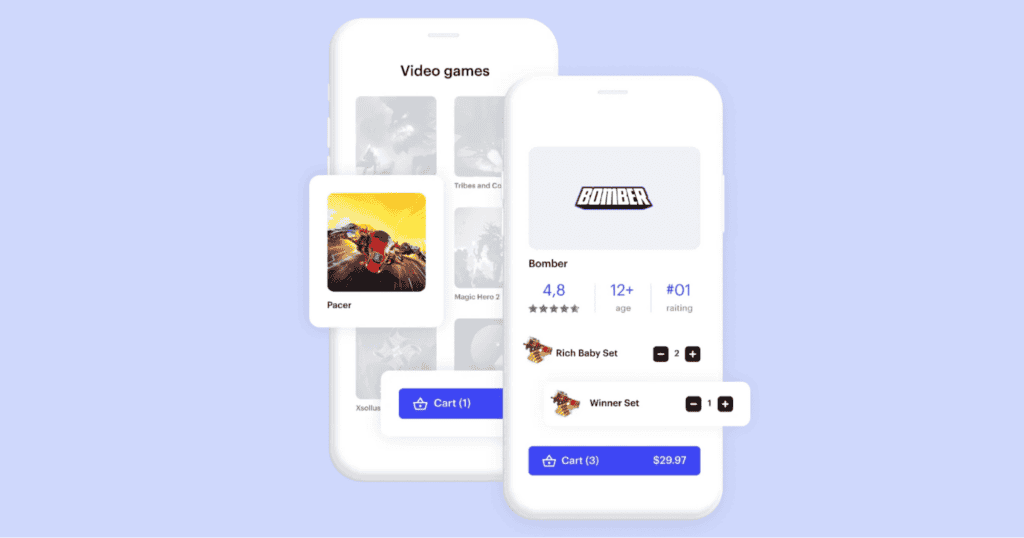

- Xsolla Payments is the flagship ecommerce solution for the gaming industry. Developers can reach more players worldwide and securely accept global payments. It elevates the entire checkout experience with a streamlined user experience across multiple platforms. Xsolla partners, which encompass all sizes of game developers, have successfully expanded their audience reach and increased their revenue by offering more local payment methods in more regions around the globe.

Pay with Points introduces a new way for players to pay by redeeming loyalty points at checkout. Pay with Points leverages Mastercard’s expertise, scale, and trusted connections to reduce payment drop-offs and boost player purchases. It allows shoppers to use loyalty points from participating partners to make purchases without leaving the platform.

- The Xsolla Digital Distribution Hub (DDH) solution can connect your game to new platforms and markets. DDH allowed Gaijin Entertainment to place their existing games, like War Thunder, in cash kiosks, ATMs, super apps, and online banking apps. The studio can now seamlessly add new titles across the entire distribution network.

Xsolla can support Turkish game developers with a variety of payment tools and other services that can ensure compliance with regional regulations as they expand into global markets. Contact Xsolla to learn how their solutions can help you reach a wider audience and achieve long-term business success.