Merge-2 is the genre that never seems to have a bad year. While other categories rise and fall, this one just keeps climbing.

In October 2025, Gossip Harbor by Microfun hit roughly $62M in monthly IAP revenue—the highest historical figure the Merge-2 genre has ever recorded so far.

But why did Gossip Harbor outperform where most other Merge games didn’t?

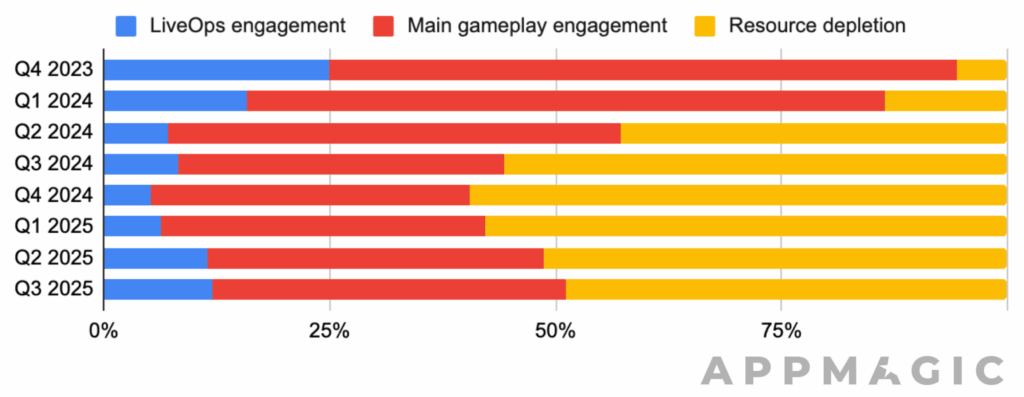

A big part of the answer comes from the game’s LiveOps evolution.

Let’s look at the timeline:

Prior to Q2 2024

In its early days, the game featured around 20 events per month, most lasting from 1 to 10 days. These events focused on retention and followed the genre’s usual rhythm.

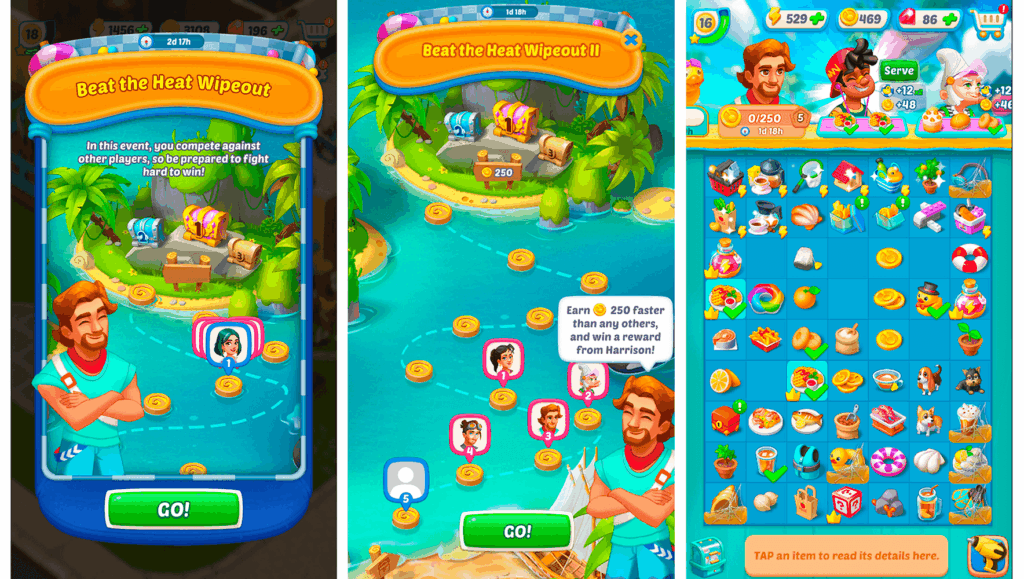

“Race” was one of the first formats to join the regular rotation in 2023, and Gossip Harbor was among the pioneers that adopted it early and kept it in steady rotation ever since. Even today, it remains one of the game’s strongest performers.

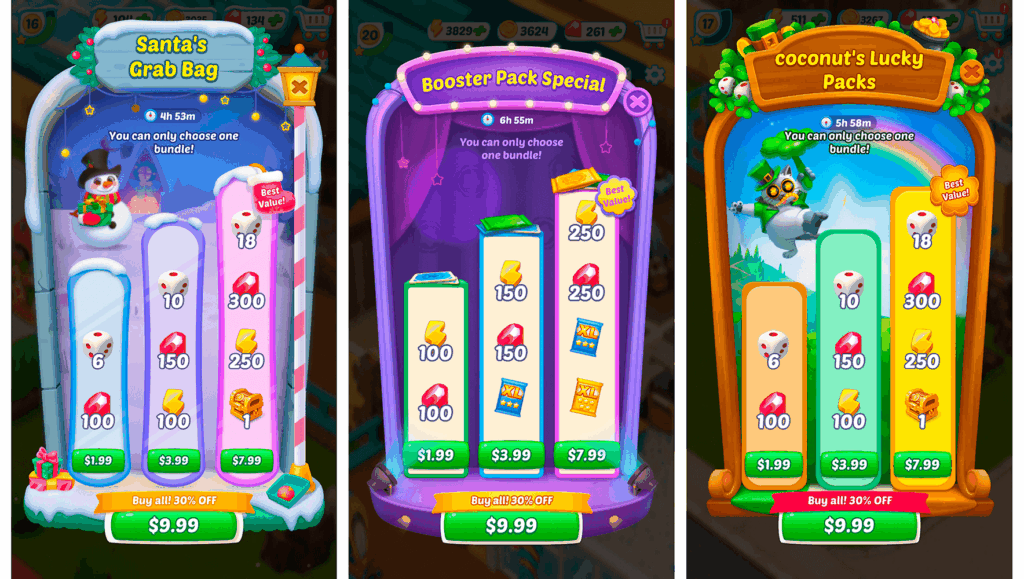

The team also removed some outdated offers, added short-term bundles, and introduced early versions of what is known today as “pick one” deals, including the Buy All option in this period.

The Buy All formats typically raise the average check because they push players toward a higher-priced option, since buying all is a much better deal.

Overall, the pre-Q2 2024 period captures the game before any major changes. While LiveOps was there in a limited capacity, the groundwork for what’s to come has been built.

The First Spike: Q2–Q3 2024

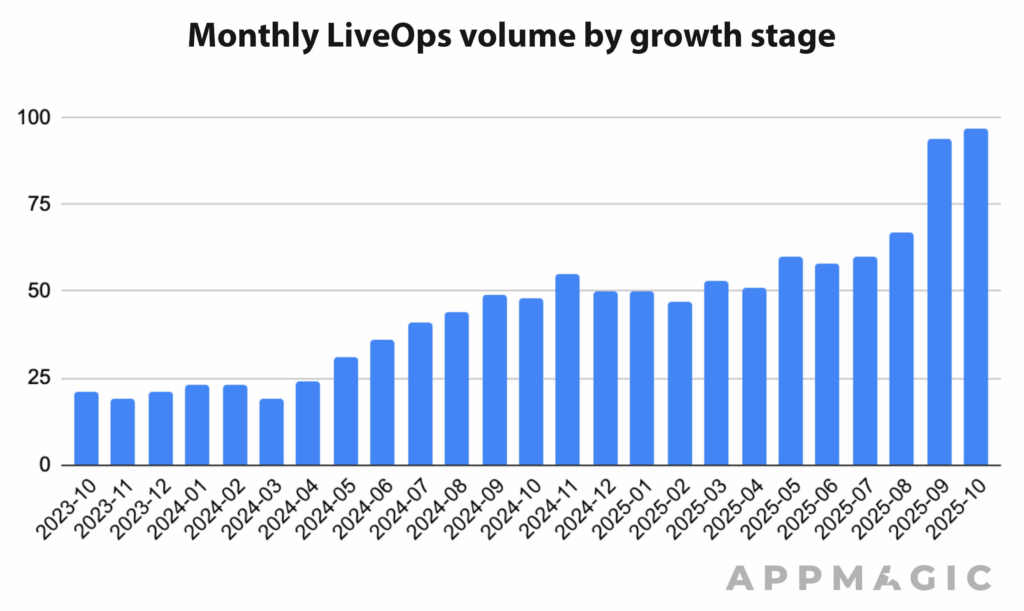

The first spike didn’t come from just one big feature. It happened when Gossip Harbor moved from a simple retention setup to a faster, more connected LiveOps structure. In Q2 2024, the team expanded the grid, added new formats, and tightened the schedule.

Short events played a key role in that shift. Many lasted less than a day and worked as quick loops that pulled players back in.

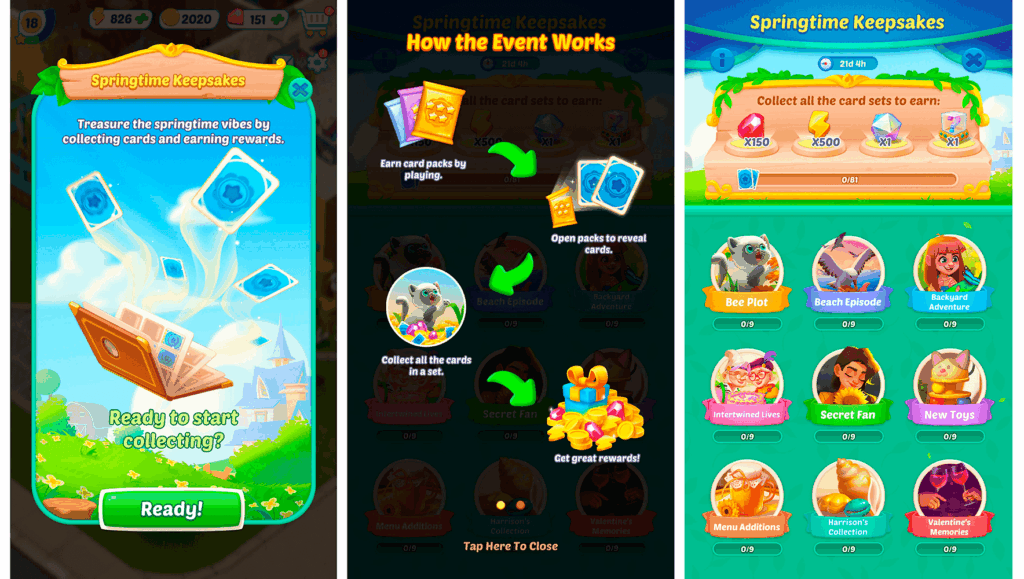

This period also brought in two important mechanics. The first was the album system, and the second was Lava Quest, an idea that had already been popularized by Royal Match, and Microfun adapted it for Merge-2 as a timed chain of tasks.

During this period, monetization evolved alongside the LiveOps grid. Offers became closely linked to event activity. This period introduced the first 1+1 bundles (“buy one, get one free”), and players wasted no time picking them up.

Together, these changes created a more flexible and event-driven monetization system. By the end of this period, the revenue split looked like this:

- Special Offers & Temporary Bundles: ~62% of total revenue

- Seasonal Passes: ~10% of total revenue

- Hard Currency (Gems): ~18% of total revenue

The Second Spike: Q3–Q4 2025

By Q3 2025, Gossip Harbor wasn’t adapting to the genre anymore—the genre was adapting to it.

Microfun didn’t just add more formats; it refined how they worked together. Events began forming chains, with one loop feeding into the next. Stepping out of one activity often meant stepping straight into another, sometimes with a reward, sometimes with a new goal. It changed how players moved through the game: less stop, more go.

The volume of events grew, too. Monthly launches jumped from roughly 60–70 to around 95–100. But the number wasn’t the whole story; the lineup’s content mattered. The grid blended long progress systems, short competitive bursts, co-op formats, and recurring streaks.

Instead of relying on one “big driver,” the game created several smaller ones that ran at the same time.

Two mechanics stood out during this period. The first was Win Streak, a format that rewarded consistency and made the whole LiveOps schedule feel connected.

And the second was Lucky Wheel, a light, social, and steady event that tied 1+1 offers, making it easy for active users to keep the momentum going.

Monetization moved in step with the LiveOps rhythm. new type of offer emerged: escalating daily bundles, where a new option would unlock each day and the final reward would arrive only after purchasing all the parts.

Gossip Harbor also added another segmentation tool: event-specific progression passes. This created a second layer of progression on top of the seasonal pass and made monetization inside individual events more meaningful.

At this point, Gossip Harbor’s offer system had become a full stack:

- Event-specific bundles

- End-of-event catch-up offers

- 1+1

- Buy All formats

- Escalating daily bundles

- Multiple passes tied to different loops

Each layer served a purpose. None of them tried to replace the others. Together, they covered the spent moments created by the busier LiveOps setup without overwhelming players.

Key Takeaways

Microfun didn’t chase every trending mechanic and built its LiveOps with patience. They experimented, filtered, adjusted, and shipped only what made sense for Gossip Harbor’s economy.

Here are the main takeaways:

- Don’t bet on one mechanic. You need a full grid: long loops, fast loops, streaks, co-op, pressure beats.

- Layer your monetization. Passes, bundles, 1+1 deals, dynamic offers—each hits a different moment of intent.

- Short events lift LTV. Fast loops bring players back more often and make spending feel natural.

- Iterate, don’t rebuild. One good test unlocks the next. That’s how systems scale without cracking.

- Watch Gossip Harbor closely! The game turns successful tests into permanent loops, and that’s why it’s worth watching.

If you want to learn more about Gossip Harbor’s LiveOps Journey, check out the full report on AppMagic.