Nvidia has become a stalwart of the NASDAQ, after initially launching stock at the height of the dotcom bubble in 1999. Long-term investors will know all about this tech stock and gamers will know the brand well, but how will it fare in the current bear market?

If you’ve ever bought a quality gaming PC or even built your own rig, you’ll also know what Nvidia is. Considering investing in the stock of the company you probably already use, listed as NVDA, especially in the current market, is a tough decision.

To help you understand all about Nvidia and its stock, we’re going to dive into:

- What Nvidia is all about.

- What’s going on in the current market.

- Nvidia’s current performance in the market.

- The outlook for Nvidia in the short to medium term.

What is Nvidia?

Nvidia was founded in 1993 and is a chip maker for a range of tech companies. It achieved OEM acceptance in the 1990s before inventing the graphics processing unit (GPU) which makes modern computer gaming the immersive experience it is.

As a gamer, you’ll know that probably one of the best-value GPUs you can get is the Nvidia GeForce RTX 3060 Ti. Pretty much any PC game will look and feel amazing with this as part of your kit.

It’s not a brand that’ll be familiar to modern console gamers – standalone GPUs aren’t how Microsoft or Sony build their machines. Nvidia was part of the first Microsoft Xbox architecture and this solidified Nvidia as the leading chip manufacturer we know today.

In 1999, the same year it created the GPU, Nvidia went public on the NASDAQ exchange, trading at $19.69 per share. At the time, it was already a leading semi-conductor supplier and well placed to ride out the dotcom bubble bursting.

It’s been on a steady incline since, outperforming the market year after year. In fact, if you’d bought 100 shares back in 1999 for $1,969, by November 2018 you’d have had nearly $292,000, assuming you reinvested dividends. You could have spent the same money on 10 Sega Dreamcasts – or not…

The stock reached its all-time high on November 29, 2021, trading at $333.76. It has since dropped dramatically, so is it worth putting your money into Nvidia in the current bear market? Let’s see what that market looks like.

What is driving the current bear market?

The word recession is coming up more and more in financial news. While the US and other global economies are technically there yet, indicators are looking that way. Bankers are definitely nervous about the outlook, talking about “storms”.

Jamie Dimon, CEO of JPMorgan, said in a statement to an investor conference on June 1, 2022:

“We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself. JPMorgan is bracing ourselves, and we’re going to be very conservative with our balance sheet.”

The trend in the NASDAQ backs up the talks of storms to brace for. It’s been volatile since December 2021 and on the decline since April this year.

This clearly fits the definition of a bear market, which is when stocks are on a sustained, long-term decline.

A range of factors is causing cash to be pulled out of securities. These include:

- Increased gas prices causing inflation to hit 8% in Q1 2022.

- Higher wheat and other commodity prices, caused by a squeeze in supply from the Russian invasion of Ukraine.

- The Federal Reserve increasing interest rates three times since March 2022, currently at 1.75%.

How is the bear market affecting Nvidia?

We’ve seen that Nvidia has historically been a good place to put your money, but it doesn’t make it immune to market trends. Here, you can see the trend of Nvidia’s stock price roughly mirrors the NASDAQ at large.

You can see the same December peak, April rally, and subsequent fall we just saw on a macro scale. At the time of writing, you’ll pay $171.26 for an Nvidia stock – just shy of a 50% drop from its November top out.

Are these warning signs to avoid the tech stock? Is it the perfect time to get involved?

What’s the outlook for Nvidia stock in the current market?

Nvidia has been victim to vagaries of the normal economic cycle. We’re used to seeing stocks rise and fall, yet history has shown that stock tends to do better than putting your cash in the bank.

The company has paid dividends to shareholders every quarter since 2012. Compare this to other tech giants like Meta, Alphabet, and Amazon – they are yet to pay a dividend on their shares, ever.

Profits are also looking solid. In its most recent reports, for Q1 2022, revenue was up 46% year on year and 8% on the last quarter. Its data centers and gaming profits have been key to the recent growth. Data centers in particular should be resilient to market changes since they are now vital infrastructure.

Nvidia is also set to be the supplier of chips and other technology for the Metaverse. It is still at the forefront of computer technology, standing it in a solid position for long-term growth.

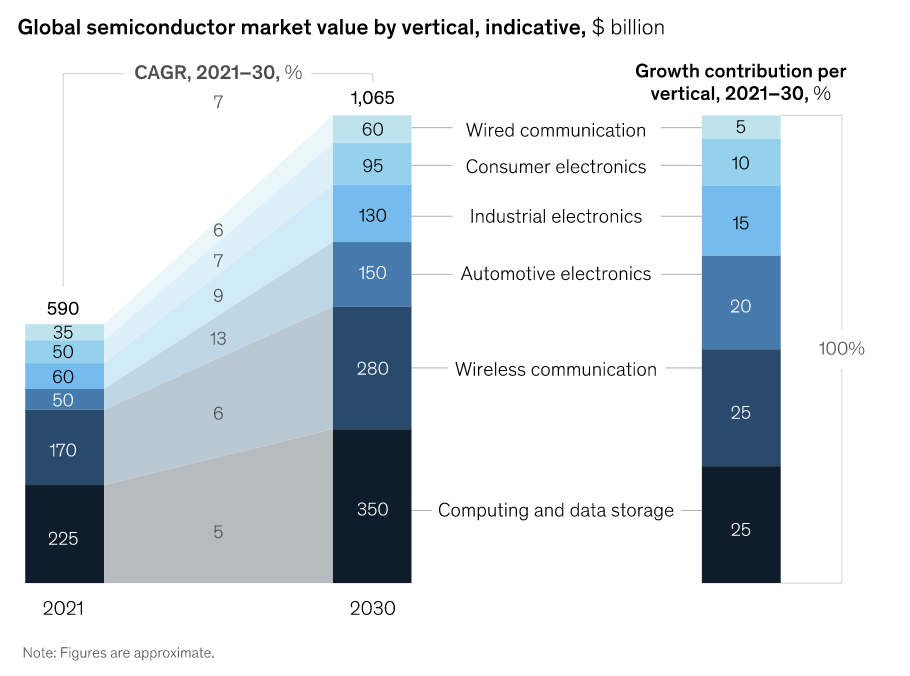

On a broader level, the semiconductor market is on an upward trend. According to data from McKinsey, by 2030 the market will be worth $1 trillion, and being so ingrained in the industry, Nvidia is set to be integral to that growth.

How to invest in Nvidia

Investing in Nvidia is a personal choice – seek professional financial advice before making a decision. There are steps you need to take to buy stocks and the process and rules can be different depending on where you are.

A general guideline to invest in Nvidia would look something like this:

- Install a VPN for PC or laptop, depending on your device so that your financial information and trading accounts are kept securely online.

- Open a brokerage account with a trusted platform that is regulated in your jurisdiction, this will make sure you’re trading compliantly and have recourse if there are problems.

- Decide how much you can afford to invest – never invest money that you need for living expenses since the money you invest in stocks can go up as well as down.

- Don’t try to “time” the market; invest when you have the cash ready and be ready for a long-term investment to get solid returns.

Disclaimer: Past performance is not a guarantee of future returns. This article does not constitute investment advice. Seek advice from a qualified financial advisor before making investment decisions.

Guest Author: Leo Corado