The global gaming market has slightly declined in 2022 after enjoying growth in the previous year. This fluctuation can be attributed to the worldwide pandemic. People being locked down in their homes, and the following global economic recession lead people throughout the world to find free ways to have fun or socialize at home.

While games are among the first pastimes to spring to mind under the circumstances, mobile games specifically have been more attractive because of their playing dynamics, psychological effects on the players, and business models. In simpler terms, they enjoyed popularity since they are easy to play, let the players chill out, and are mostly free or freemium.

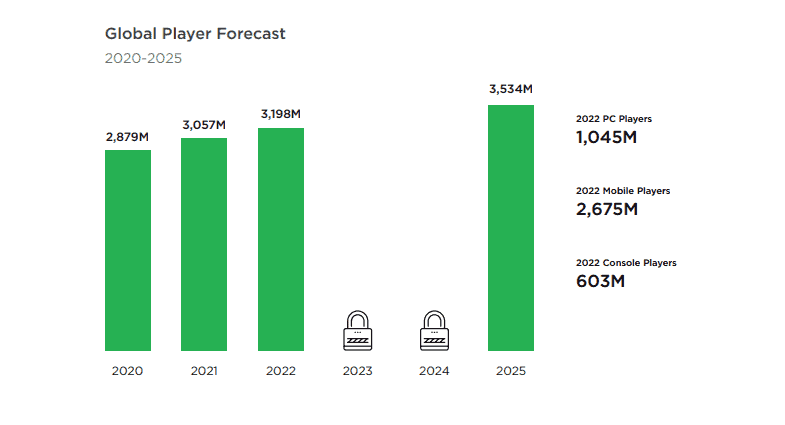

According to Newzoo’s 2022 global gaming market report, approximately 2.6 billion of 3.2 billion gamers worldwide were mobile game players.

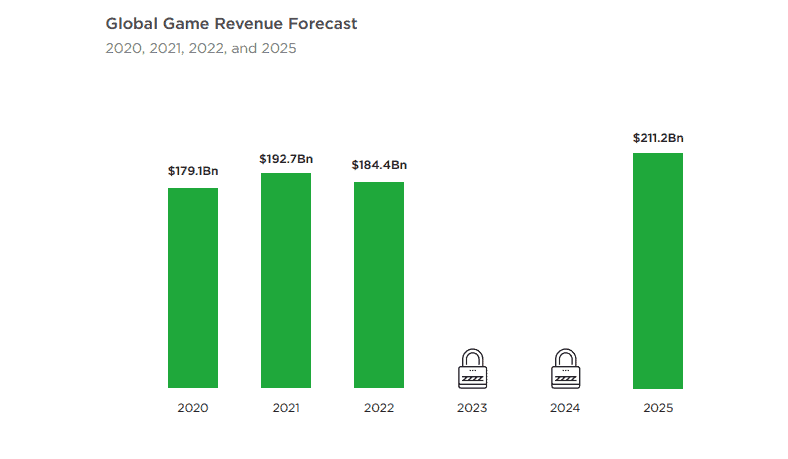

In the same report, Newzoo estimates that the global gaming market will reach $184.4 billion in 2022 with an approximate 4.3% year-on-year decline.

The global pandemic has offered the game industry an opportunity to grow rapidly, but with the pandemic and lockdowns gone, factors fueling this fast growth have disappeared. Considering the circumstances, it’s natural for the game industry to experience slight stagnation and even recession. Nevertheless, it will regain its natural growth rate as the life, and global financial dynamics recover from the pandemic.

Newzoo forecasts that the global game market will achieve around 14% growth and reach $211.2 billion in 2025. The fluctuation in the game market has revealed some rare opportunities and shifted the scale slightly in favor of the mobile game industry. If the mobile game industry can maintain this momentum, it has the opportunity to benefit the most from the forecasted growth.

Türkiye’s game industry has drawn much attention during the global pandemic, which was abundant in crises and opportunities. 2022 has been an active period for Türkiye’s game industry, but where does it stand in the bigger picture? What kind of opportunities does it have, and what made it attract the attention it had recently?

Türkiye has a unique geographical position between the East and the West. This position also makes it sociologically and culturally unique. Turkish companies can adapt to the working cultures of both Eastern and Western companies, which offer advantages in mergers and acquisitions. The government highly encouraged and popularized a work-from-home culture in the early times of the pandemic. It is also popular and preferred among the young population.

SciPlay Chief Revenue Officer (CRO) Noga Halperin said this on SciPlay’s acquisition of Alictus:

“I was shocked that the corporate culture is similar to ours. They started working remotely before the pandemic started, so it was easy for them to continue, but their approach allows employees to create and be innovative. It’s a management that trusts employees. On the other hand, they also have company meetings, which aim to bond, help employees make connections, and work together remotely. They are very bold; it’s beautiful to see. It’s very similar to our world.”

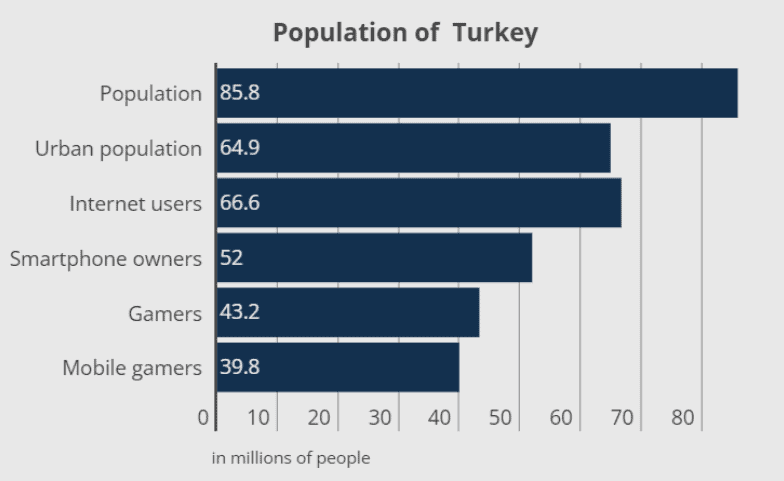

The country has a population exceeding 85 million with a major young population. Among 45 million Turkish gamers, almost 40 million are mobile gamers. In addition, the popularity and penetration of smart mobile devices are very high among the population. All these factors make the country an attractive market for the mobile game industry.

The following graph is taken from Allcorrectgames and breaks down the population according to gamers, mobile gamers, and smartphone owners:

The currency crisis the country has offered opportunities along with all the financial ordeal that comes with it. Since the game industry doesn’t involve the logistics of raw materials or final products, a decreased currency value increases the competitive price ability of Turkish companies. It also makes Turkish game companies profitable and appealing options for foreign companies looking to expand via mergers and acquisitions.

The Government of the Republic of Türkiye is also enthusiastic about R&D efforts and supportive of progress in most areas of technology. Various government agencies, institutions, and even ministries publish reports to provide data for investors and entrepreneurs. Events focusing on R&D and technology are organized and even attended at the government level. The country’s president personally attends many events focusing on technology and innovation. The Global Esports Federation, an affiliate of the metropolitan municipality of İstanbul, the largest city and financial capital of Türkiye, organized a more recent of these events. This event was also supported and attended by the mayor.

According to a report published by the Republic of Türkiye Investment Office, Türkiye has 522 startups, ten gaming incubators, 13 accelerators, and a gaming cluster.

The same report emphasizes that:

“As of mid-2022, the Turkish Gaming Ecosystem has already seen the birth of two unicorns. The first one received a billion-dollar valuation on acquisition; the second earned its unicorn classification only 23 months after its establishment. These are clear indicators of the vibrancy and dynamism of the gaming ecosystem.”

The gaming market in Türkiye has surpassed the billion-dollar threshold by the end of 2021. Since then, it has retained its exponential growth despite the financial difficulties overwhelming the country. Today its largest game company alone, Peak Games, surpasses this mark. Peak Games is also a nesting ground for new developers. Thanks to the company’s supportive culture, eight successful companies were founded by its former employees. Cartoonz, Bigger, Spyke, Gleam, Dream, and Loop Games are some of them.

The young population of Türkiye not only provides an advantage in terms of market opportunities and the workforce. The country’s young people are keen and have an aptitude for technical and technological professions, including multiple branches of engineering and many newly emerged innovative jobs.

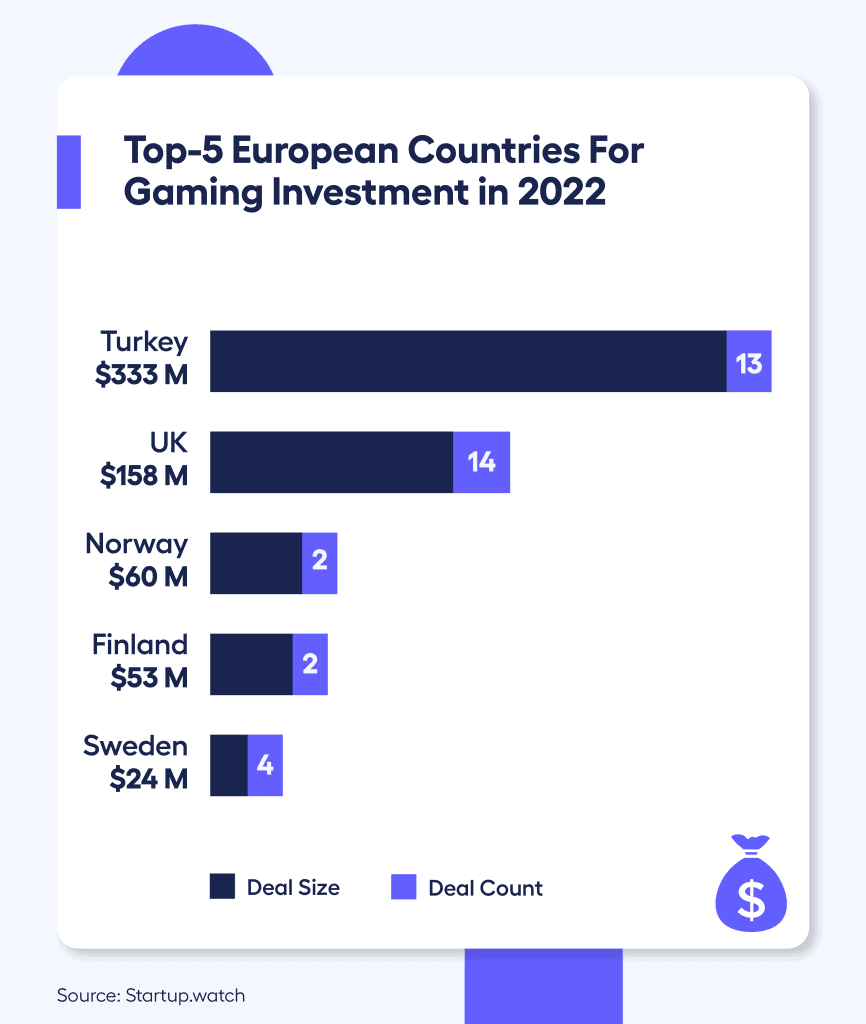

According to a report published in Adjoe, Turkey holds the top position by far among European countries regarding investments.

According to a report published in September 2022 by Game Factory, an online game developer and incubator based in Türkiye, the country has overtaken Italy to become the fifth-largest mobile game maker in Europe by total revenue.

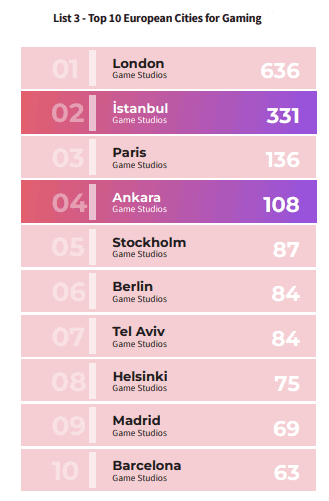

İstanbul follows London as the second in rank regarding the number of game studios in the city. Türkiye finds itself two slots in the list with 108 studios in Ankara. Considering that there are game studios in other major cities, it’s safe to assume that the total number is higher.

Türkiye has been going through some financial and social ordeals like the rest of the world throughout the pandemic and after. Despite the country struggling to thrive during this challenging period, the game industry has achieved more than enough to stay optimistic. Time will tell whether it can retain its growth rate, profitability, and productivity, but industry leaders appear mostly keen to push forward.