UA funding has become a central topic for game and app teams looking to scale profitably without giving up ownership.

In this interview, Halil İbrahim Özdemir, Managing Director and Founder of Leus Capital, breaks down the unit-economics logic behind UA funding, why he sees it as a founder-first alternative to equity, and what “scale-ready” means beyond top-line ROAS—from data readiness and team capabilities to product fit.

Why has UA funding become such a central topic in the industry, and what is the real gap it fills for studios in today’s market?

The math is simple. If you have a 110% D60 ROAS and the cash cost is a 3% fee on top of the principal, you effectively keep 107% of your revenue and 100% of your equity.

It solves the cash flow gap where you pay for ads today but wait 60 days for store payouts.

Since repayment plans are structured to match your ROAS and revenue cycle, it feels more like a profit-sharing partnership than a typical financial arrangement.

What is the fundamental strategic difference between selling equity and using UA funding to scale, especially from a founder’s perspective?

Equity investment puts a new person at your table who might push for a specific exit timeline or the next funding round. You end up sharing your voice and your vision.

UA funding is a surgical tool for growth that keeps you in full control. Even if you eventually want to take equity investment, it is smarter to use UA funding first.

By scaling your game with our capital, you can reach a much higher valuation before you ever sit down with a VC. It is about selling a smaller piece of a much bigger pie.

Can you walk us through what the experience of working with Leus Capital looks like? Do you only provide UA funding, or are there other ways you support a studio’s growth?

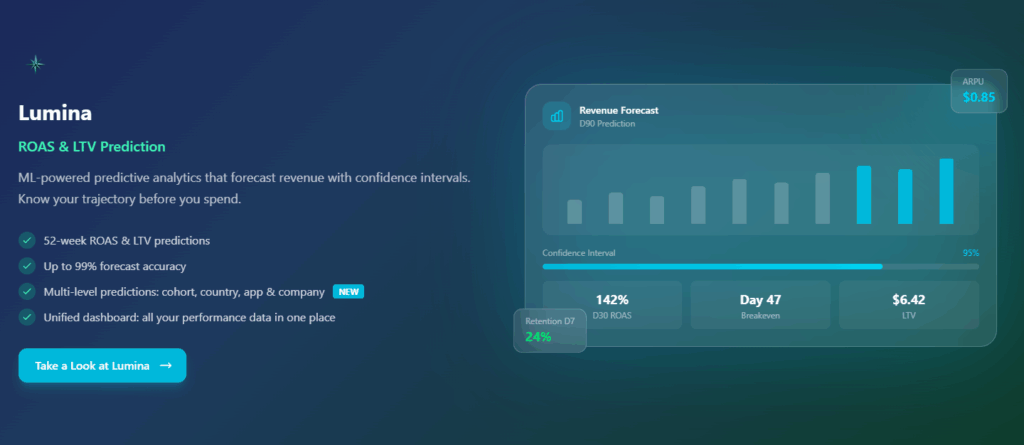

We often work with studios to get them scale-ready before we even deploy capital. We provide a tech layer that includes Visua for creative insights and Lumina for predicting LTV and ROAS.

Most teams struggle with data modeling, so we provide the infrastructure they need to see their future profitability clearly.

We are not just a capital source; we act as a growth partner that helps every dollar spent drive sustainable scale.

Since Türkiye is your core market, what are the biggest pain points you see, and how is the founder mindset evolving?

We see three main pain points: data hesitation, the debt misconception, and profitability anxiety.

In Türkiye, founders are often guarded with their data due to local habits, but for us, data access is a mandatory requirement for our prediction engines. We ensure our data pipelines are fully secure and that privacy is never compromised.

On the funding side, many see this as a liability, but equity is actually a much more permanent cost.

Regarding profitability fears, Türkiye offers significant government incentives for the gaming sector that founders can leverage.

When you combine these incentives with UA funding, it becomes much easier to manage cash flow and keep a larger share of the profits for reinvestment. We use our own tech to remove the guesswork and help founders scale safely.

Beyond the basic metrics, what unique signals tell you that a studio is ready to scale, and where do teams usually need the most guidance?

It starts with a simple question: Are you profitable? If you are, you are eligible.

We also look closely at the team to see who is managing the growth and if they understand the unit economics.

We also check if the product fits current market trends; for instance, highly competitive niches like astrology apps are a red flag for us.

Most importantly, we play every game and use every AI app we fund. If the experience does not feel right, no amount of capital will make it a hit.

Looking at the growth of Leus Capital itself, what are the next major steps for you, and how do you see your role expanding in the global gaming community?

We are currently launching our expansion into London and the European market with our London office.

As the sector grows, many pure finance firms are trying to enter this space, but they lack the specific experience needed for gaming and apps.

Our advantage is our gaming DNA. We understand the creatives, the data, and the founder’s journey.

Our goal is to be the global partner that helps talented creators scale to millions of users while remaining completely independent.

Managing Director & Founder at Leus