According to the Drake Star Partners report, 844 business and partnership deals were made in the gaming industry in 2021. The value of the deals made has more than doubled in 2020, reaching 71 billion dollars.

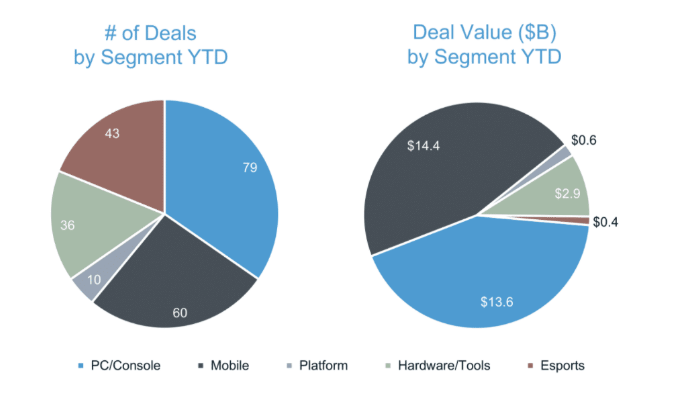

228 of the agreements made were in the form of mergers and acquisitions. While the M&A transaction volume is around $32 billion for the first 9 months of 2021, the chart includes the PC and console industry with 79 deals and the mobile game industry with 60 deals. $13.6 billion of the deal is traded in the PC and console industries, while the rest is scattered across other gaming platforms. The mobile game industry accounts for approximately 26% of the volume.

Netmarble, ByteDance, and Tencent became the main buyers in the third quarter of 2021, with transactions totaling USD 4.96 billion.

The key M&A deals for the third quarter of 2021 are as follows:

- Voodoo announced that it has acquired Israeli game studio Beach Bum.

- In August 2021, Netmarble announced that it had acquired Hong Kong-based SpinX Games for $2.19 billion.

- Zynga announced that it had acquired mobile advertising and monetization platform Chartboost for $250 million.

- Stillfront announced that it had acquired Jordan-based mobile card games maker Jawaker for $205 million.

- In September 2021, Playtika announced that it had acquired home design app maker Reworks for $400 million.

- MTG bought word games developer PlaySimple for $360 million.

Investments increased significantly compared to last year

According to the report, investment activity in the first 9 months of 2021 increased significantly with $9 billion in a total of 493 deals. While increasing investments encouraged companies to develop new projects, well-known companies such as Roblox, AppLovin, Playtika, Huuuge, PlayStudios, Krafton, Unity aimed to reach more resources by offering themselves to the public. One of these companies, South Korea-based Krafton, traded for $3.7 billion shortly after its public offering.

In addition, Tilting Point raised $235 million from investments, while Mobile Premier League received $150 million at a valuation of $2.3 billion.

Increasing investments and increasing industry graphics seem to open the door to new investments and partnerships, especially in the mobile game industry, in the following years. Companies accelerate their new plans and investments after the effects of the global pandemic.